US weather supporting your rapeseed price? Grain market daily

Tuesday, 22 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £187.25/t, down £1.55/t on Friday’s close. New crop futures (Nov-24) closed at £195.70/t, down £2.70/t over the same period.

- The UK market followed both the Chicago and Paris wheat market down yesterday. Ukraine is considering using its newly tested wartime Black Sea export corridor for grain shipments, after the first successful passage of a vessel along the route last week (Refinitiv). There were also reports that Ukraine is finalising a plan with global insurers to cover Black Sea grain ships.

- The European Union’s crop monitoring service (MARS) report yesterday reduced their forecast for this year’s average EU soft wheat, maize and rapeseed yields. Abundant and frequent rains have delayed harvest and reportedly led to a drop in wheat quality. Some of the rainfall in Northern Europe has benefitted summer cropping. However, heatwaves and drier-than-usual conditions particularly have impacted summer crops in parts of Eastern Europe.

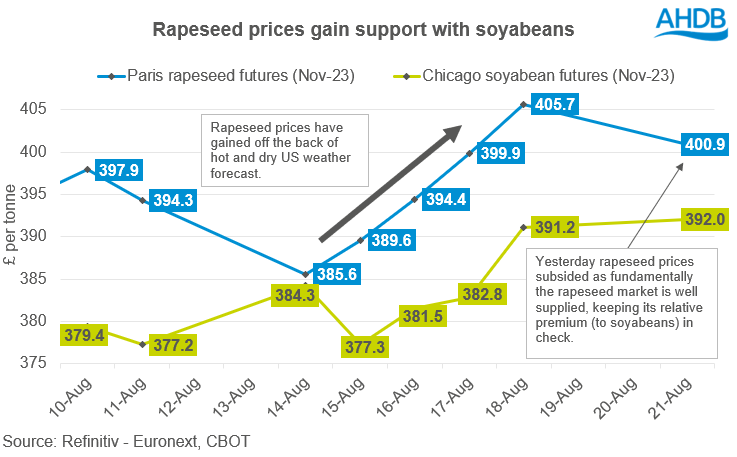

- Paris rapeseed futures (Nov-23) closed yesterday at €469.00/t, down €5.50/t across yesterday’s session. Rapeseed prices until yesterday were strengthening with Chicago soyabean futures, though dropped back from Friday’s high – read more on this below.

US weather supporting your rapeseed price?

Abnormally hot weather currently dominates the US Midwest and oilseed markets have gained over the past week ahead of this, concerned about the impact to the US soyabean crop. On Friday, Paris rapeseed futures (Nov-23) closed at €474.50/t, the highest close seen through August. Though, the contract closed at €469.00/t yesterday, down €5.50/t from Friday’s close as rapeseed markets fundamentally are well supplied (especially Europe) for this marketing year.

As rapeseed doesn’t have a large premium to soyabeans, this means that this bullish weather news (for soyabeans) has pulled rapeseed futures up overall last week. However, yesterday rapeseed markets were unable to gain with soyabeans as global rapeseed markets are still expected to be well supplied this season, with heavy EU beginning rapeseed stocks at the start of this marketing year and a decent EU crop due (2023/24).

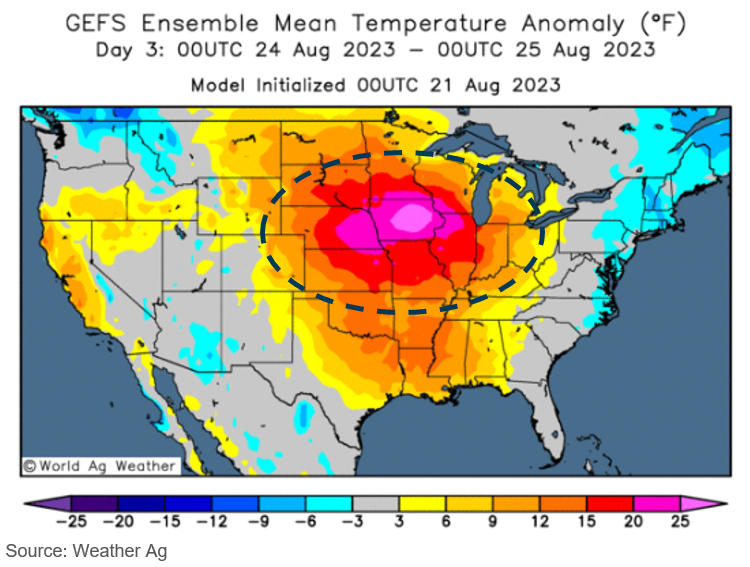

Although it’s seasonally expected to be warm in the US Midwest at this time of the year, there are parts of the US Midwest over the next three days where areas are going to reach abnormally high temperatures. This is especially the case in the state of Iowa (a key soyabean producing state) and the surrounding states, to the point where excessive heat warnings have been issued.

This support for soyabeans has filtered into the oilseed complex over the past week, as 86% of the US soyabean crop is currently in pod setting stages, up from 78% the week before. This is when the crop is most sensitive to heat stress and creates yield impact concerns. In the latest crop progress report released yesterday (up until 20 August) the USDA estimated that 59% of the crop is in good-to-excellent condition, the same as the week before.

Looking further ahead, towards the end of the week temperatures look to subside slightly but for the most part, it is going to remain abnormally warm in parts of the US Midwest with very little rain on the horizon. This could further support prices if realised.

Why is the US important and what does this mean for prices?

Although, for this marketing year the global soyabean market looks to be well supplied, with global ending stocks estimated to grow 16% year-on-year to 119.4 Mt. This US crop is fundamental to balancing this global market. Currently the USDA are estimating this US soyabean crop at 114.5 Mt, currently forecast back just under 2 Mt on the year, but still accounting for 28% of global production. Domestic US demand is expected to stay strong, which is tightening their ending stocks to 6.7 Mt this season, an 8-year low, and that’s without downward (if any) revisions from this recent hot weather.

Although this bullish weather news is providing short-term support, this could be limited by the fact that large South American soyabean crops are expected. Though oilseed markets are pricing in risk that greater reliance might be on these soyabean crops (Brazilian and Argentinian) that are not even sown yet. Fundamentally, both soyabeans and rapeseed for the moment are anticipated to be well-supplied with the price outlook bearish in a longer-term overview.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.