Arable Market Report − 21 August 2023

Monday, 21 August 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

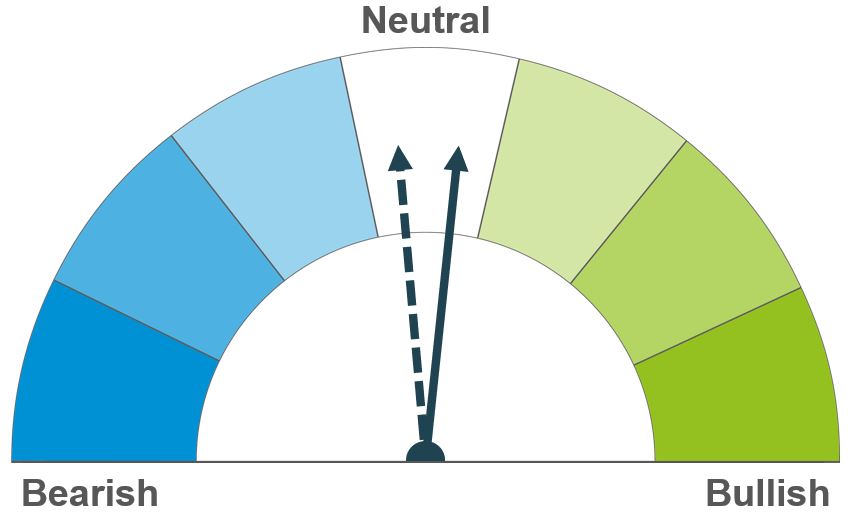

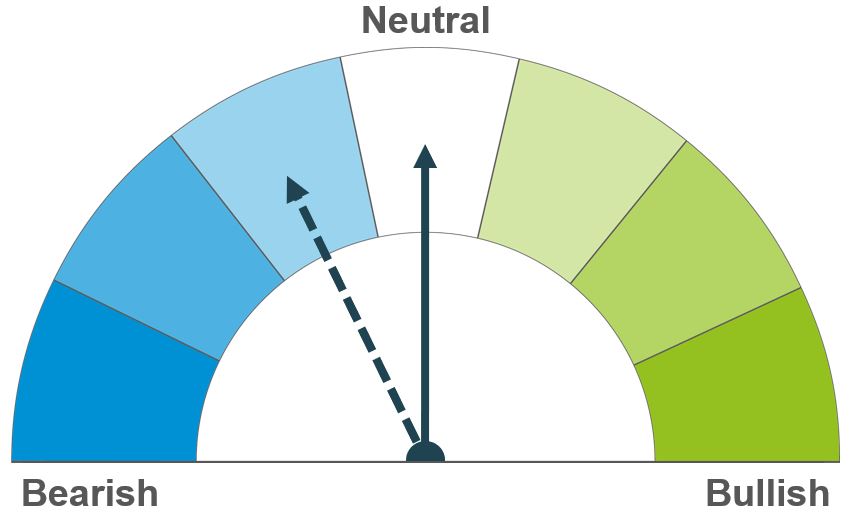

News on any escalations in the Black Sea keeps wheat markets supported but volatile. Global wheat supply and demand remain finely balanced, though plentiful maize supplies will likely limit support.

US weather is a key watchpoint short term, with hot and dry weather forecast over the next week. Longer term, the US is due a bumper crop, which will boost global grain supplies.

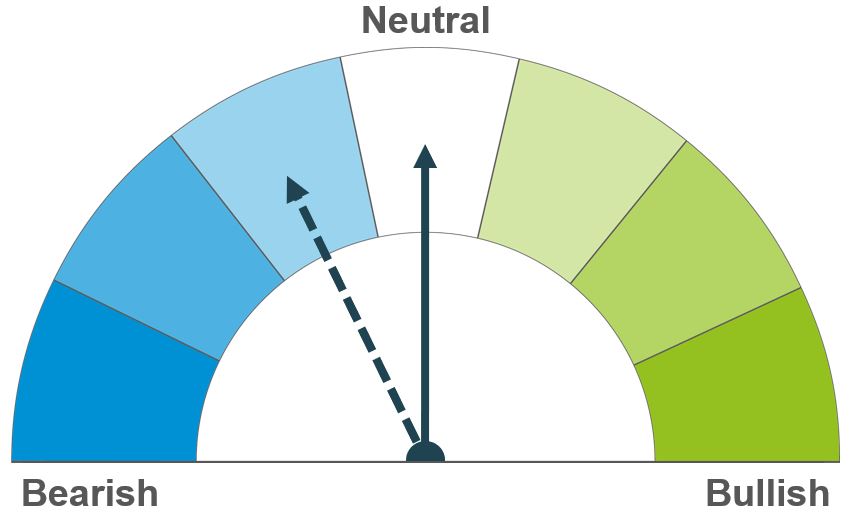

A tight global barley outlook could see some support for prices relative to other grains. Though much like wheat, expectations of a bumper US maize crop could limit any major climbs.

Global grain markets

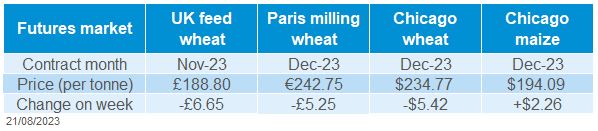

Global grain futures

Global wheat markets fell last week. Chicago wheat futures (Dec-23) and Paris milling wheat futures (Dec-23) were down 2.3% and 2.1% respectively Friday to Friday. Competitive Black Sea supplies continued to weigh on the wheat market, and concern over attacks in Ukraine subsided. On the other hand, Chicago maize futures (Dec-23) were up 1.2% on the week, due to a worsening weather outlook in the US.

Markets remain reactive to news on Ukrainian grain exports. A Ukrainian official said this morning that Ukraine is considering using its newly set up ‘humanitarian corridor’ for grain shipments too. Following the initial invasion in February 2022, some ships have been stuck in Ukraine’s Black Sea ports. This new corridor, which follows the western coastline (near Romania and Bulgaria), is being tested as a way of getting stranded ships out safely (Refinitiv).

According to Ukraine’s Agriculture Ministry this morning, Ukraine’s grain exports have totalled 3.6 Mt so far this season. This is compared to 3.3 Mt as of 25 August last year. Exports have been impacted by the expiration of the UN-backed grain deal last month, though the Ministry did not give a breakdown of exports since the end of the deal.

US weather also remains in focus this week. With less than 20% of the US maize crop denting, adverse weather conditions could still reduce yields. Unseasonably hot weather is expected across parts of the US Midwest over the next seven days with minimal rain forecast. This could lead to some support in US maize markets, though ultimately the US is due a bumper crop. The International Grains Council (IGC) on Thursday pegged US maize production at 383.8 Mt. This is near enough in line with the USDA’s estimate, and if realised would be the second largest US maize crop on record.

UK focus

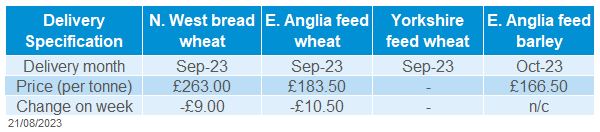

Delivered cereals

UK feed wheat futures (Nov-23) followed global price movement last week and lost £6.65/t, closing on Friday at £188.80/t. The Nov-24 contract closed at £198.40/t on Friday, down £2.80/t over the same period.

Domestic delivered prices followed futures movements (Thurs to Thurs). Feed wheat delivered into East Anglia for September delivery was quoted at £183.50/t on Thursday, down £10.50/t on the week.

Bread wheat delivered into the North West for September was quoted at £263.00/t, down £9.00/t over the week.

Harvest continues to progress slowly across GB, with variable weather continuing to contribute to a stop-start harvest. In data to 15 August, winter barley harvest was near completion. Winter wheat was 37% complete, which is below the five-year average of 56%. Spring barley harvest was 24% complete, also behind the five-year average of 32% complete. While oat harvest was 34% complete, compared to the five-year average of 28%. All the latest information on area harvested, yields and quality is available on the AHDB harvest progress in Great Britain page, which has a full interactive dashboard too.

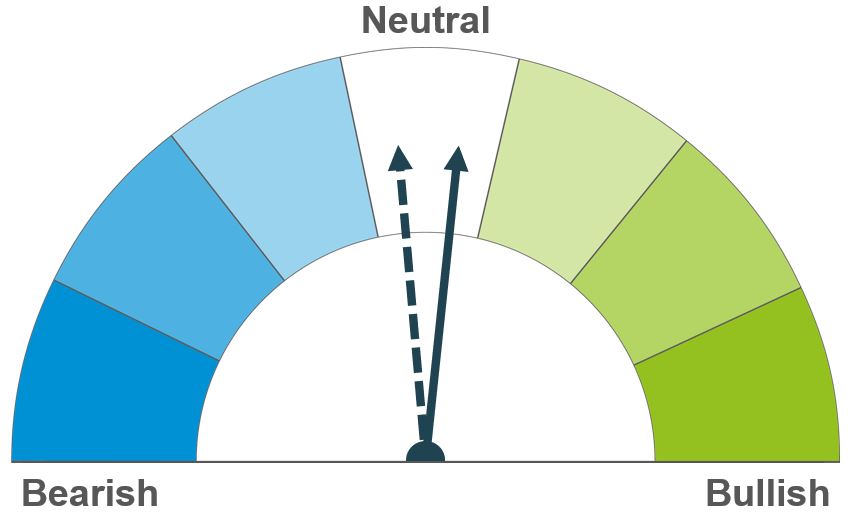

Oilseeds

Rapeseed

Soyabeans

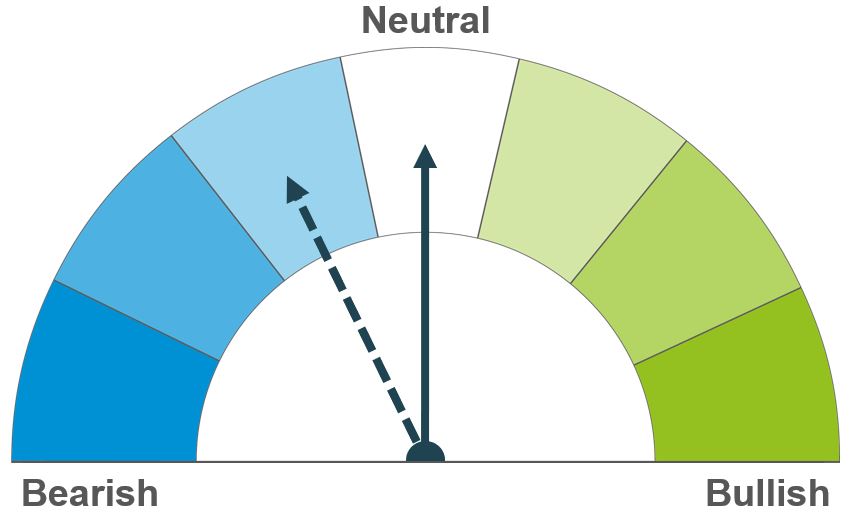

The weather this week and its impact on oilseed crops, especially US soyabeans, could provide short-term support. Longer-term, the global rapeseed market and the EU specifically still look to be well-supplied.

Short-term, the focus remains on the US crop, with a crop tour bringing more insight this week into conditions, which the market may react to. Longer-term, as we head into 2024, large South American crops are still expected to weigh on markets.

Global oilseed markets

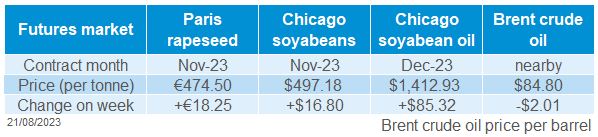

Global oilseed futures

Last week, Chicago soyabean futures (Nov-23) gained on the week, rising 3.5% to close on Friday at $497.18/t. Most gains came towards the end of last week, as the market focused on the hot and dry weather across the Midwest and its impact on the US soyabean crop.

Weather forecasts across the US show little rain and high temperatures this week, with dryness continuing for the remainder of August. With 38% of soyabean crops still in drought conditions (to 15 August) and August a critical crop development month, eyes remain on how big the US crop might be. This week, the annual Pro Farmer crop tour will examine soyabean crops across the Midwest, giving insight into crop potential.

The International Grains Council (IGC), in its latest supply and demand report released last week, trimmed its US soyabean crop forecast for this season. The 2023/24 crop was reduced from 117.3 Mt to 115.5 Mt, now slightly (-800 Kt) down from last year’s crop. The IGC also increased China’s soyabean import forecast for this season (+2.2 Mt) to 100 Mt.

China is in focus in oilseed markets currently. Chinese imports of US soyabeans were down 63% in July from a year earlier to 142.2 Kt, according to the General Administration of Customs (Refinitiv). But shipments from Brazil (China’s top supplier) were up 32% to 9.2 Mt in July, as competitive soyabeans continue to flow. China has suffered from typhoons and flooding in recent months across Northern areas, including some key producing regions. However, the performance of China’s economy remains in focus as their housing market continues to struggle. Lower growth has previously impacted protein demand.

Malaysian palm oil futures felt some support last week. The Nov delivery price was up 4%, on strong exports, a weaker ringgit and production worries due to hot and dry weather forecast.

Rapeseed focus

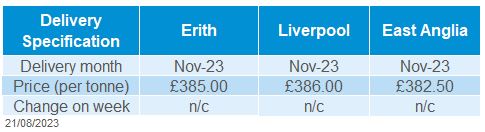

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed on Friday at €474.50/t, up €18.25/t from the previous Friday. The contract found support from the wider soyabean and palm oil markets, with most gains, like soyabeans, on Friday. The Nov-24 contract closed on Friday at €484.00/t, up €18.75/t on the week.

Rapeseed delivered into Erith (November delivery) was quoted on Friday at £385.00/t.

Harvesting of rapeseed in GB has quickly picked up pace recently, with some longer periods of dry weather providing more windows of opportunity. To the week ending 15 August, 98% of rapeseed had been harvested, now ahead of the 5-year average for this point in the season of 93%. Small areas are reportedly still to be harvested in the North East, Yorkshire, South East and Scotland. Yields have seen a large variation, with low yields largely attributed to wet and windy weather, and pest damage. For more information, please follow this link.

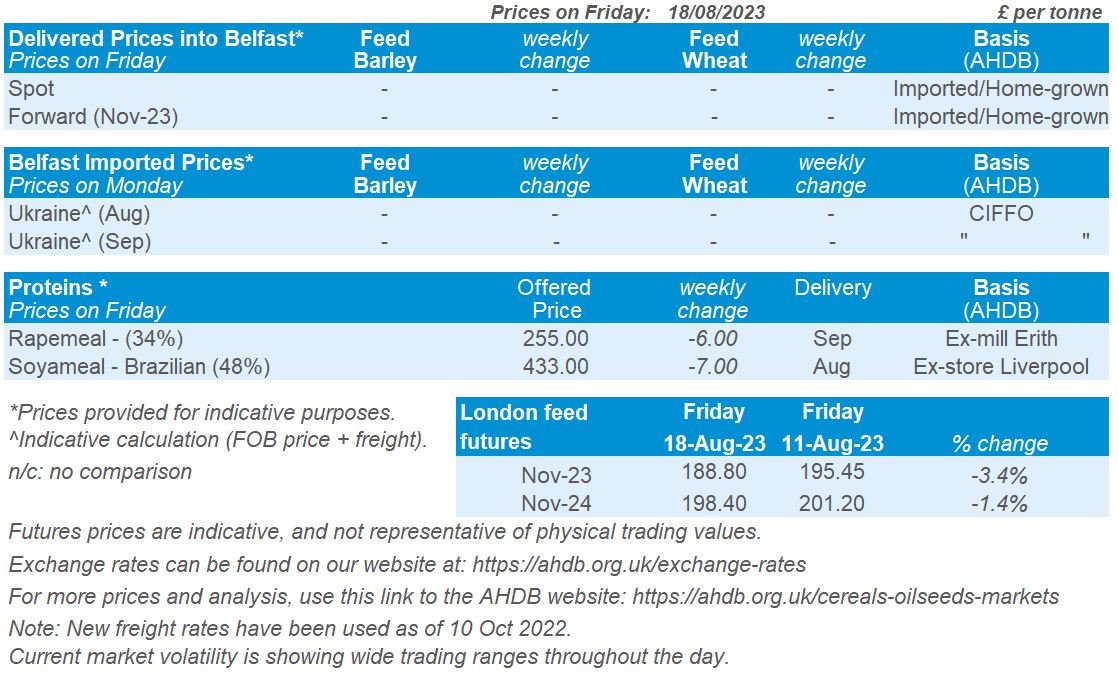

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.