DEFRA provisional areas for England - lower wheat area for 2023: Grain market daily

Thursday, 31 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £188.10/t, gaining £0.65/t on Tuesday’s close. New crop futures (Nov-24) closed at £198.75/t, gaining £1.20/t over the same period.

- Domestic wheat markets gained with both the Chicago and Paris wheat markets. There was support as recent price falls attracted buyers to the market and global demand remains robust. Egypt’s state grain buyer GASC purchased 240 Kt of wheat in an international tender, with the sale comprising of 120 Kt French and 120 Kt Romanian wheat.

- Markets were further supported yesterday by a Canadian crop survey (based on satellite and agroclimatic data) released on Tuesday. It estimated that Canadian wheat production is set to fall by 14.2% year-on-year for 2023, with production now estimated at 29.5 Mt (Statistics Canada).

- In the same report, the Canadian canola crop is now estimated at 17.6 Mt, down 6.1% year-on-year.

- Paris rapeseed futures (Nov-23) closed yesterday at €465.00/t, gaining slightly by €0.25/t on Tuesday’s close. There was also some marginal support in nearby Brent crude oil futures, which gained 0.4% yesterday to close at $85.86/barrel.

- This morning the latest GB animal feed production and UK human and industrial cereal usage figures for July 2023 have been released. They provide the first insight into usage in the 2023/24 marketing year.

DEFRA provisional areas for England - lower wheat area for 2023: Grain market daily

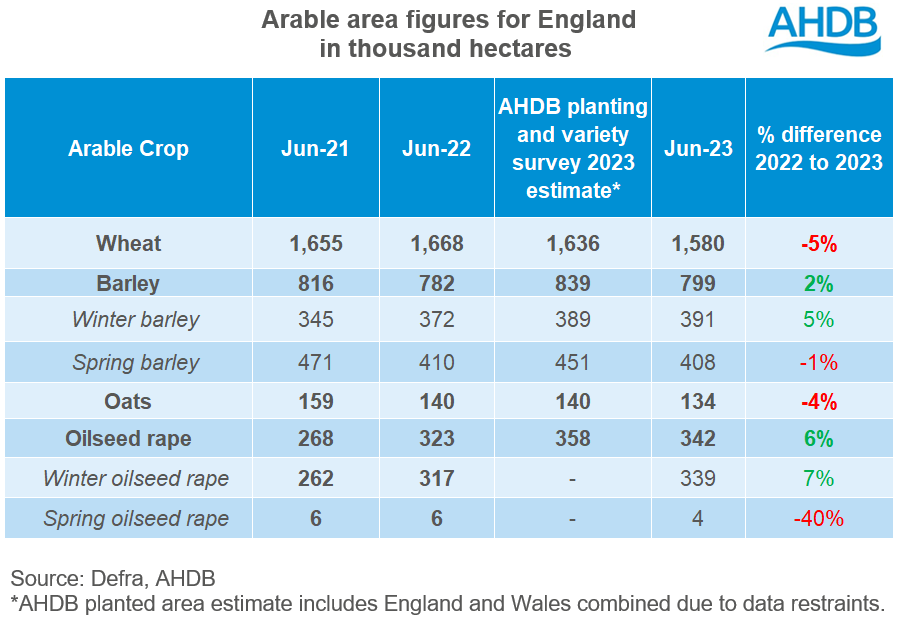

This morning, DEFRA released its arable crop areas for England, as at 1 June 2023.

The stand-out for this data release is the lower-than-expected wheat area for 2023 harvest. Further to that, there is a noticeable change in the area loss of oilseed rape (OSR) from intentions in AHDB’s Early Bird Survey at the end of 2022, to the estimated harvested area for 2023.

The area in England of wheat for harvest 2023 is estimated to be 1,580 Kha by Defra, down 5% year-on-year. Excluding the 2019 Autumn wash out (harvest 2020), this will be the lowest wheat area in England since 2013. To some extent this reduced wheat area is a little surprising. When this 2023 crop was sown towards the end of 2022, wheat prices were historically high from the on-going war between Russia and Ukraine.

However, it seems that barley and oilseed rape were favoured over wheat. The total barley area in England for 2023 is estimated at 799 Kha, up 2% on the year. This increase comes from a higher winter barley area, which is estimated at 391 Kha, up 5% on the year. While the spring barley area marginally decreased by 1%.

For OSR, the area in England for 2023 is estimated at 342 Kha, gaining 6% on the year. The area of the crop has reduced in recent years from pest pressure. Whilst very attractive prices throughout 2022 led to an uptick in plantings, this is down from plantings in the Early Bird Survey, which initially estimated the area at 369 Kha in England. Pest pressure appears to have led to some losses of OSR, along with inclement weather.

The estimated England oat area in 2023 is 134 Kha, down 4% year-on-year.

Although these DEFRA figures do not exactly match the AHDB Planting and Variety Survey (PVS) released last month, conclusions broadly aligned from the survey. The key message remains that ‘more barley and oilseed rape are sown at the expense of wheat.’

Please note that the PVS figures include Wales too, due to data constraints. The Welsh arable areas make up a small proportion of the total area, so the trend will be largely unaffected. For example, based on 5-year averages Wales accounted for just over 1.0% of the total UK wheat area.

Even less wheat than expected?

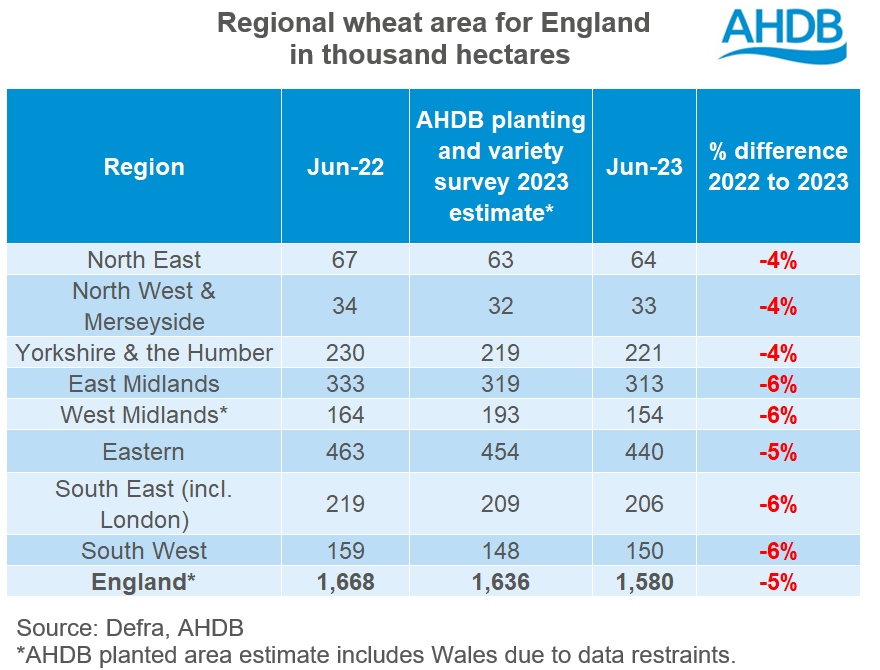

What both these DEFRA figures and the PVS conclude is a smaller wheat area is expected for 2023 than initially anticipated. Leading up to summer there was talk in industry of the UK 2023 wheat crop potentially achieving in the region of 16 Mt. However, with the current estimated area in England, record yields would be needed to achieve that production size.

Every single region in England is expected to reduce its wheat area for 2023. With the largest area drops in the Eastern and East Midlands region, whose combined area accounts for a total decrease of over 40 Kha. In Yorkshire & the Humber, the wheat area is estimated at 221 Kha, excluding 2020 (2019 Autumn wash out); this year will be the lowest area since 2013.

Conclusion

These English area figures suggest that total availability of wheat in the UK at the start of this marketing year may not be as high as initially expected.

Over the coming weeks there will be further analysis and insight from these figures on what domestic availability could be for 2023/24. This analysis will be presented when we get further insight into yield information from the GB harvest progress reports. The next report is provisionally going to be released tomorrow, with data up to 29 August 2023.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.