Dry weather and Black Sea talks driving markets: Grain market daily

Friday, 16 June 2023

Market commentary

- Yesterday, grain and oilseed prices recovered part of the falls seen on Wednesday due to ongoing worries about dry weather and tensions in the Black Sea region (more below). UK feed wheat futures (Nov-23) gained £2.55/t yesterday, closing at £199.00 /t. Paris rapeseed futures (Nov-23) gained €7.00/t, closing at €448.50/t.

- UK grass growth slowed again in the past week. AHDB’s Forage for Knowledge shows grass growth at 42.5 kg DM/ha in the week ending 15 June, compared to 58.5 kg DM/ha the week before. Grass growth is now well below the 2017−2021 average for the latest week of 66.0 kg DM/ha. AHDB’s Forage for Knowledge has suggestions of steps livestock farmers can take. If grass growth remains lower, it could have implications for animal feed demand for cereals come winter.

- UK trade data showing imports and exports in April 2023 is available on AHDB’s website.

Dry weather and Black Sea talks driving markets

Continuing worries about rising tensions in the Black Sea and the impact of dry weather in some of the key grain-producing regions pushed prices up yesterday. A bounce in crude oil prices also helped markets to rise.

Meanwhile, the dry weather is still in focus and concerns are rising about the potential impact on yields in several areas:

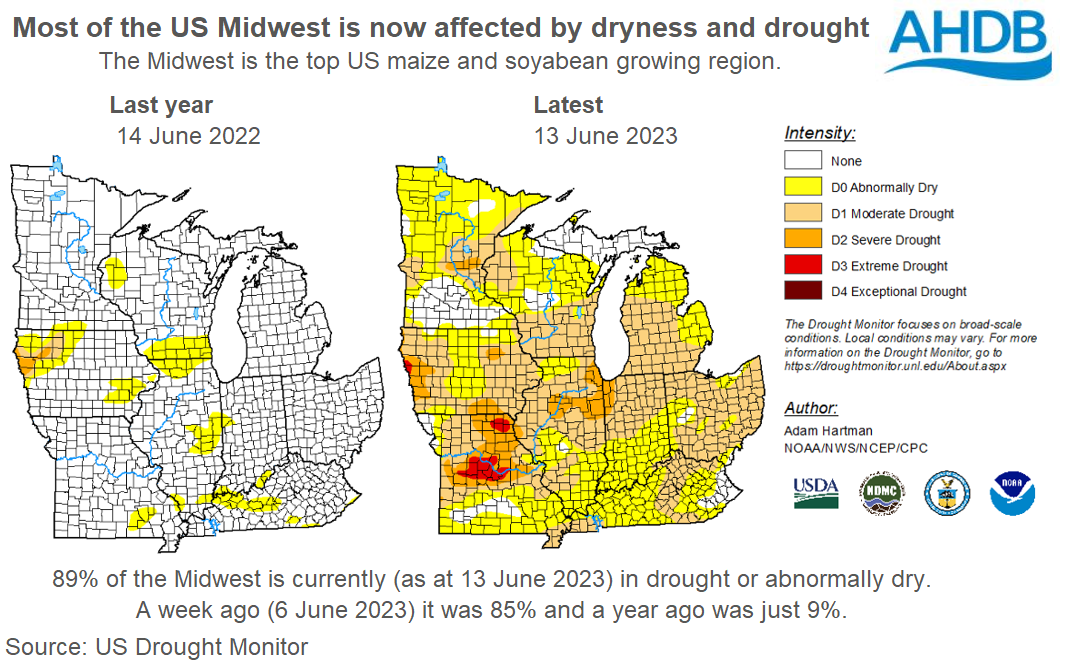

- The US Midwest. Yesterday the US Drought Monitor showed a sharp expansion on abnormally dry conditions and drought across the US Midwest, the main maize and soyabean growing region. The report stated that storms last weekend did “little to halt widespread degradation of conditions” in the region, reporting livestock are already needing additional feed due to reduced forage. Above-average temperatures are also forecast for the end of June and through July by the US Climate Prediction Centre. High temperatures when maize crops are silking (reproductive stage) are strongly linked to lower yields. Read more on what lower US maize yields could mean here.

- Northern Europe. Stratégie Grains trimmed its forecasts for EU-27 wheat, barley and maize crops yesterday due to dry weather in northern Europe and Spain (Refinitiv). Lower maize plantings in Poland and Spain are also a factor. The consultancy still expects wheat and maize output to be above last year, but barley will now be even further below 2022.

French crop ratings fell between 6 and 12 June (FranceAgriMer). Despite the falls, the ratings for winter wheat and barley crops are still the highest in recent years. Plus, winter barley harvesting has just begun. However, spring crops are much more at risk. The proportion of spring barley rated good/very good fell from 89% to 83% between 6 and 12 June. While this is still above last year’s 53%, it is now lower than both 2019 and 2021. Most spring barley crops are flowering. Maize crop conditions also deteriorated, down from 88% good/very good to 86%, slightly below this stage in 2022. Water is really needed to help growing crops and ahead of rapeseed planting in August, though some rain is forecast for next week.

- Malaysia. Water stress is affecting palm oil trees in the biggest palm oil producing state in Malaysia (Refinitiv). Water stress reduces the fruit yields, and so in turn palm oil production. There is currently an El Niño weather event developing, which often means higher temperatures and lower rainfall for palm oil production areas.

Earlier this month the USDA again forecast that global grain and oilseeds will be larger than global demand in 2023/24. They forecast a surplus for all grain of 33 Mt (the largest since 2016/17) and a surplus of 27 Mt for oilseeds (the largest in recent years). This expectation, and relief caused by access to Black Sea supplies despite the war continuing, pushed markets lower.

The issue is that the USDA forecasts are based on high yields. If crops don’t achieve these high yields it could shrink, or for grains even evaporate, the gap between global supply and demand. If confirmed, this would push prices higher.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.