Putting Midwest weather worries in context: Analyst insight

Thursday, 8 June 2023

Market commentary

- Markets came under pressure yesterday from improved US weather forecasts (more below) and traders positioning ahead of tomorrow’s USDA report. Tomorrow (5pm) the USDA releases its monthly update of world supply and demand forecasts.

- UK feed wheat futures (Nov-23) fell £2.75/t yesterday to close at £190.25/t.

- Paris rapeseed futures (Nov-23) lost €7.75/t to close at €425.75/t. In sterling this equated to £366.02/t and a daily loss of around £7.24/t.

- Meanwhile, the market is still working to understand the impacts of the ruptured dam in southern Ukraine, including crop potential. An ammonia pipeline was also damaged, which could impact negotiations for extending the grain export corridor (Black Sea Initiative). Russia had been pushing for the pipeline to be re-opened.

Putting Midwest weather worries in context

Worries about dry weather in the US Midwest, the US main maize and soyabean production area, helped prices to rise in the past week.

Monday night’s US crop progress report added the first evidence of a negative impact. The amount of maize rated good/excellent to the week ending 4 June fell five percentage points from the week before to 64%, vs 73% this time last year (USDA). Also, the first assessment of the soyabean crop was poorer than the market expected. This, along with speculative traders repositioning, helped markets to rise. But, for the impact on prices to be sustained, we need to see the worries continue.

What’s at risk?

The market is banking on record US crops this harvest:

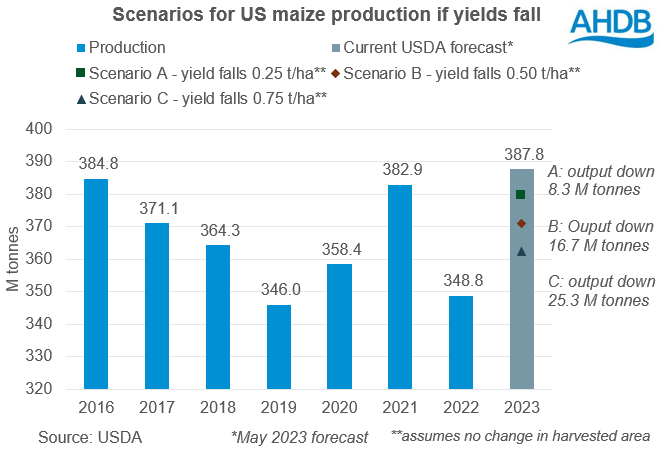

- A maize crop of 387.7 Mt, up 39.0 Mt year on year. This crop equates to 17% of the global grain crop, and the year-on-year rise is over half (56%) of the year-on-year rise in total grain output (USDA).

- A soyabean crop of 122.7 Mt, up 6.4 Mt year on year. This crop equates to 18% of the global oilseed output, but the year-on-year rise is only 15% of the year-on-year rise in total output (USDA).

The current record US crop forecasts contribute to global markets being in surplus and the continuing pressure on prices. But lower output could shift the dynamic, particularly more for maize than soyabeans. Large expected Brazilian crops would likely soften any impact on soyabean markets.

The crops are based on larger planted areas and record yields for both maize and soyabeans. Final planted area stats are due on 30 June, but planting has gone well and most crops are now in the ground. So, yield is now subject to the most uncertainty.

Key watch points

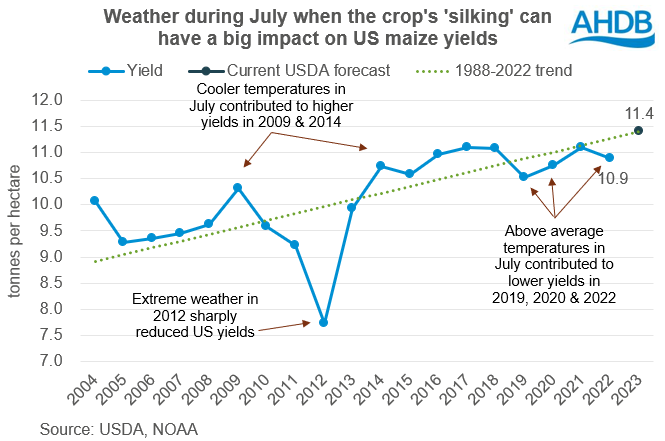

For maize, weather during its reproductive stage, ‘silking’, has more of an impact than at any other. Dry but especially hot weather during silking, which usually takes place in July, can quickly reduce yields, e.g. 2020, with an extreme case in 2012. Cooler (and to a lesser extent wetter) weather in the critical periods can push yields even higher, e.g. 2014.

The chart below shows what impact lower yields could have on US maize production. This assumes the US harvested area stays as currently forecast at just over 34.0 Mha. But bear in mind weather that reduces yields can also reduce the harvested area, as crops get abandoned or silaged. So, the actual impact could be greater.

Recent yields have been generally 0.5 t/ha above or below the 1988-2022 trend. 2014 sits 0.51 t/ha above the 1988-2022 trend, while 2020 sits 0.25t/ha below it. The most extreme scenario (C) shows if the 2023 yield fell 0.75t/ha to around 10.6 t/ha, (and nothing else changed), nearly all the global grain surplus in 2023/24 would evaporate. While this is unlikely and demand would drop as prices rose if it did occur, it helps show the importance of the US maize yield.

It’s worth noting though that the 2012 US maize yield was 2.23 t/ha under the 1988-2022 trend line!

Soyabeans are most sensitive when the crops reach pod-set. So, weather typically has most impact in later July and in August. If we run similar figures to above for US soyabean yields, yields would have to fall 0.7 t/ha below the 1988-2022 trend to remove the global oilseed surplus. Even in the severe drought year of 2012, US soyabean yields were only 0.35 t/ha below the 1988–2022 trend. This points to much more comfortable supply picture.

As both maize and soyabean crops were planted quickly this year, they are likely to reach their critical stages a week or two sooner than usual.

Market upshot

UK crop yields and quality determine our relationship to the global market, especially whether we need to import or export in that season. But the world price is made thousands of miles away. In 2023/24, the US, Black Sea and Brazilian crops will be important parts of setting world prices.

Adverse weather could reduce US crops in 2023/24 and, if it happened, help push up prices. But the extent of the global surpluses mean smaller US crops are unlikely to completely overturn the market outlook on their own. Political events and adverse weather elsewhere would be needed to push the market back to the heights of last year.

What’s next?

- Rain is forecast for the coming weekend and into the early part of next week, along with cooler temperatures. This may come too late to stop condition scores declining in Monday’s progress report. However, it will benefit crops.

- The longer-range forecasts still show hotter than usual temperatures in the Midwest into the second half of June, though potentially normal rainfall. The next month-long forecast, which will cover the start of silking for maize, is due next week.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.