Arable Market Report - 02 October 2023

Monday, 2 October 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

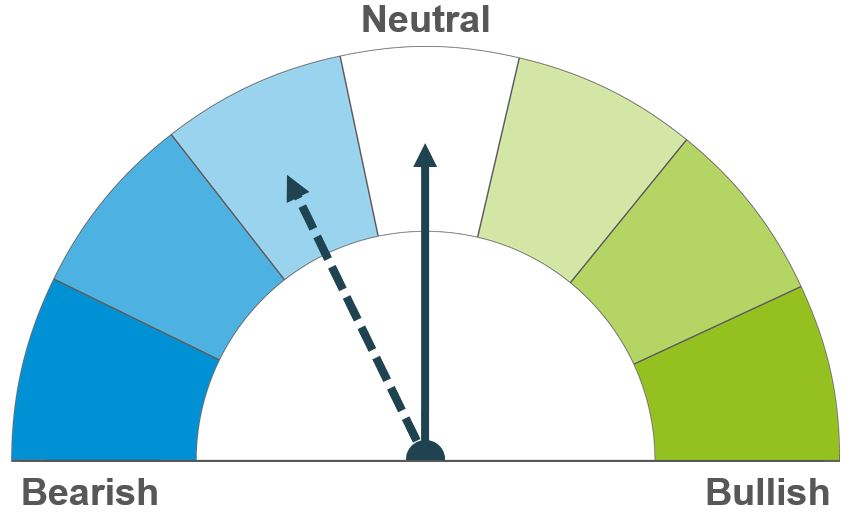

Wheat

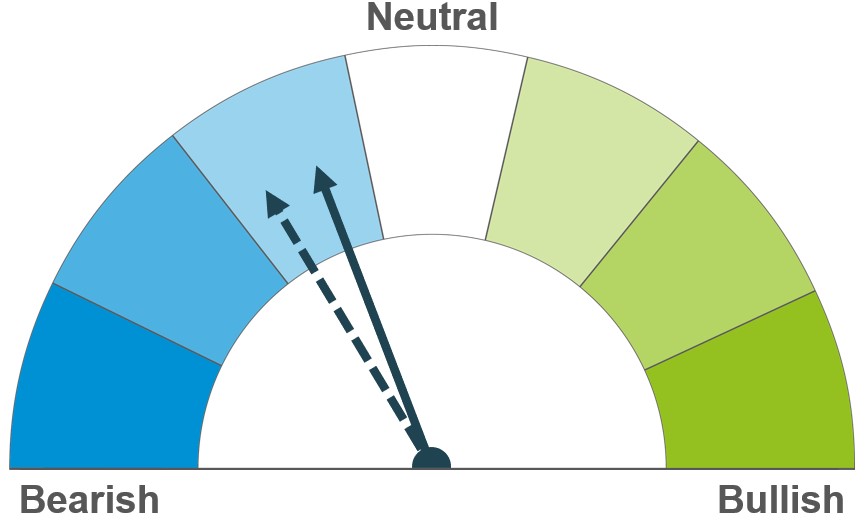

Maize

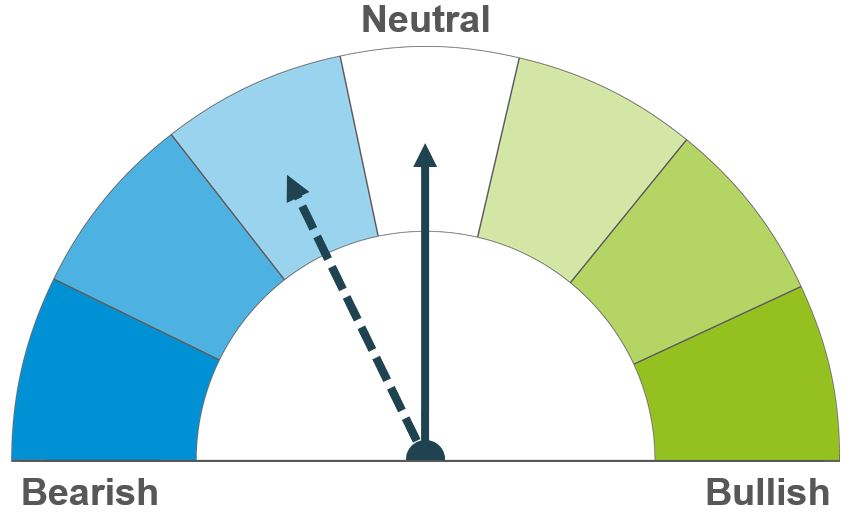

Barley

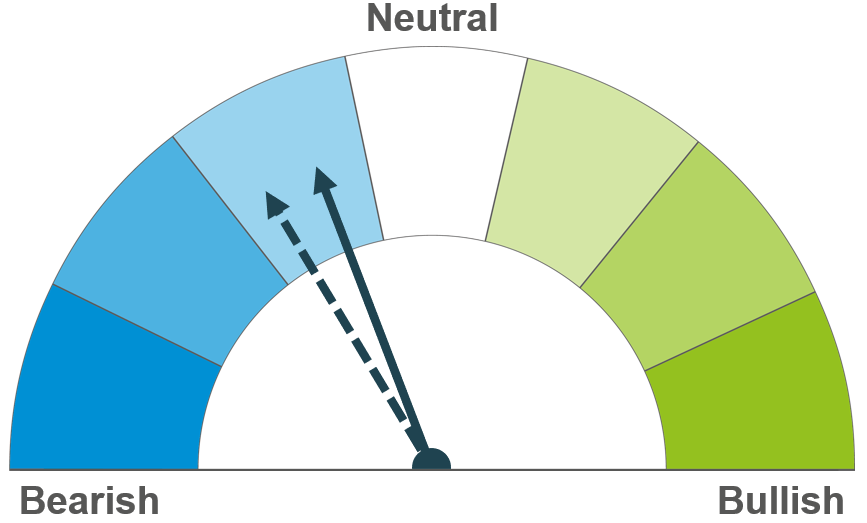

Large Black Sea exports are weighing on markets but there’s uncertainty over Southern Hemisphere wheat crops, with the next few weeks key to output. However, expectations of a well-supplied maize market are key longer-term.

Large US and South American maize crops are still expected, which, if confirmed, would more than outweigh lower US stocks and EU production. Key watch points for the next few weeks are USDA estimates on 12 October and early maize planting in South America.

Barley continues to follow the direction set by other grains. Tight global supplies are arguably priced in, though the Southern Hemisphere crops remain a watch point. Domestically, the price gap to wheat and maize will be key to feed demand going forward.

Global grain markets

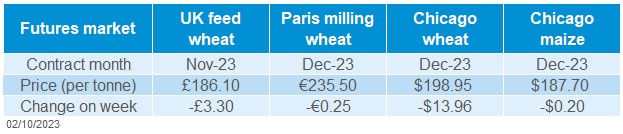

Global grain futures

Despite lifting at the start of the week due to concerns about Southern Hemisphere crops, global grain markets ended last week lower.

Mid week the market focused on the large supplies being exported from the Black Sea region. The world’s top wheat importer Egypt bought 170 Kt of Bulgarian and Romanian wheat last week, and Russian wheat is reportedly even more competitive outside of official tenders.

Chicago wheat prices were almost unchanged Friday to Thursday but slumped after the US production report on Friday afternoon. The USDA increased US wheat production by 2.1 Mt to 49.3 Mt, well above even the highest industry expectation of 47.8 Mt (Refinitiv, an LSEG business).

US maize stocks as of 1 September were towards the lower end of market expectations. This left Chicago maize futures prices broadly static Friday – Friday, but that support didn’t help wheat prices.

The EU Commission cut 1.9 Mt from its EU-27 maize harvest estimate, though at 59.8 Mt the crop is still 7.8 Mt larger than last year’s drought-impacted crop. The wheat crop was cut by 0.8 Mt to 125.3 Mt, now slightly below last year’s crop (125.7 Mt). The barley crop was also trimmed (-200 Kt), further confirming the tightness in global barley markets.

Concerns remain about Southern Hemisphere crops, with weather still dry in parts of Australia. In Argentina more rain is needed to support wheat yields with 13% of crops heading and maize areas as planting's underway (Buenos Aries Grain Exchange). In wheat-growing areas of Argentina, 39% of soils are now classed as regular or dry, up from 34% a week earlier, though this is still below last year’s 50% when drought sharply curbed output.

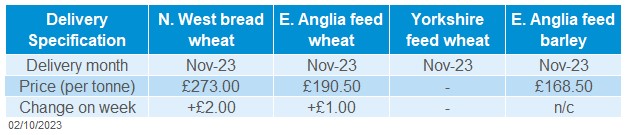

UK focus

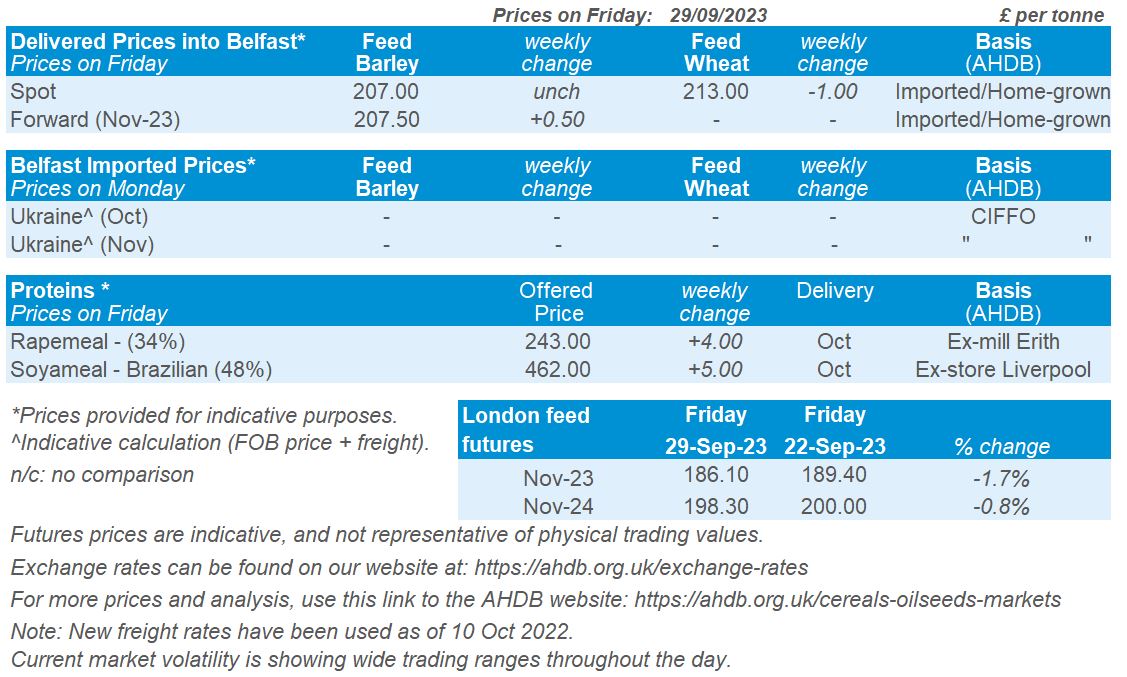

Delivered cereals

UK feed wheat futures (Nov-23) closed at £186.10/t on Friday, down £3.30/t from a week earlier following the trend of global markets.

The physical market was reportedly quiet last week as farmers focused on cultivations where the heavy rain allowed, reluctant to sell at current feed grain price levels. Feed wheat delivered to East Anglia (Nov) was up £1.00/t Thursday to Thursday to £190.50/t. Feed barley for the same delivery was reported at £168.50/t, a £22.00/t discount.

Bread milling premiums remain high, supported by lower quality across Europe this season after wet weather at harvest. Bread wheat delivered to the North West (Nov) was reported at £273.00/t as of 28 September, up £2.00/t from the previous week.

The latest UK usage data shows that demand from the GB compound feed industry and UK integrated poultry units remained sluggish in August. However, the amount of barley used by brewers, maltsters and distillers was strong, carrying on the theme from last season. More barley was also used in animal feed in August.

The GB harvest is all-but wrapped up. Our final GB harvest report of 2023 showed there are just a few fields of spring barley left to harvest in the North East of England and Scotland. The estimated yield range for spring barley has reduced again to 5.2–5.5 t/ha, which is below the five-year average.

Oilseeds

Rapeseed

Soyabeans

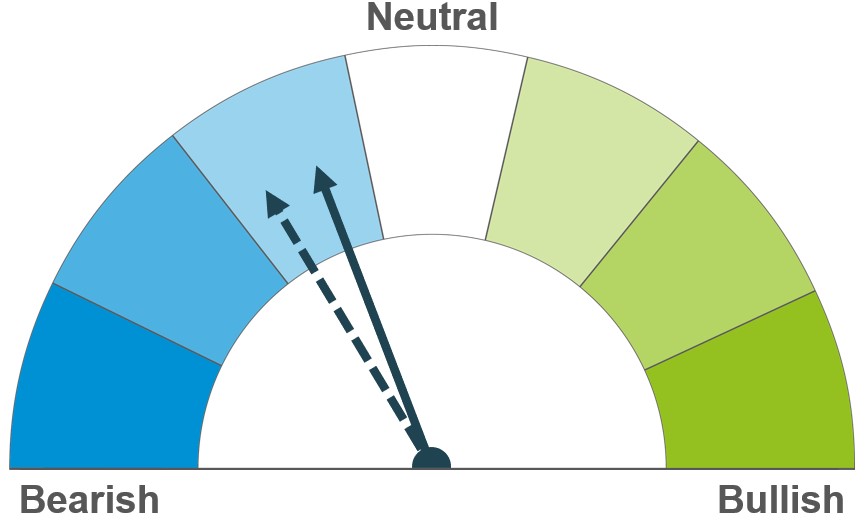

Rapeseed prices are being pressured by the Canadian canola harvest, as well as heavier-than-expected US soyabean stocks short-term. Longer-term, global rapeseed supplies look to be plentiful.

Harvest pressure and heavier stocks in the US are weighing on prices short-term. Longer-term, global supplies look ample should US and South American crops be as expected.

Global oilseed markets

Global oilseed futures

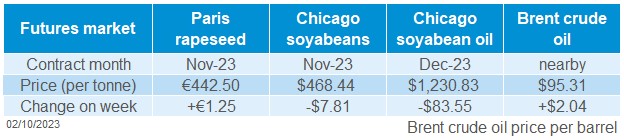

Crude oil and Canadian canola prices filtered into the US soyabean market last week. Towards the end of the week traders also adjusted positions as they awaited the USDA quarterly stocks data for further direction. Chicago soyabeans futures (Nov-23) were up 0.3% Friday to Thursday last week, though then fell 2% during Friday’s session following the USDA update.

On Friday, the USDA released its quarterly stocks figures. The data showed that as at 1 September, US soyabean stocks totalled 7.3 Mt. This figure is at the top of the range of analysts’ estimates taken in a Refinitiv pre-report poll, leading to a bearish sentiment in the market. However, it is slightly below the same point last year, when US soyabean stocks totalled 7.5 Mt.

In Saskatchewan, Canada’s top producer of canola (rapeseed), harvest was 80% complete by 25 September. Though with limited export demand, farmers are thought to have slowed down sales while waiting for higher prices.

Nearby crude oil futures were up 2.2% last week as global output cuts continue. Supply curbs implemented by OPEC+ have seen Brent crude prices rising since late June. According to Refintiv, the volume of WTI crude oil coming to Europe in September was estimated to be sharply lower than in previous months, which could explain the more recent rise in prices. However, prices eased back again at the end of last week, so are something to watch moving forward.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) gained 0.3% last week (Friday to Friday), with prices largely influenced by the US soyabean market. Prices fell €2.50/t during Friday’s session, as the bearish US soyabean news impacted oilseed markets.

In our delivered price survey, rapeseed delivered into Erith for October delivery was quoted at £374.00/t, up £7.50/t on the week. This was relatively in line with futures price movement around late-morning on Friday when the survey was carried out.

On Thursday, the European Commission revised up the 2023 EU rapeseed crop to 19.6 Mt, from the previous estimate of 19.1 Mt. If realised, this would be the largest crop since 2017, and up 12.8% on the five-year average.

Our sixth and final harvest report for harvest 2023 was released on Friday. The report showed that GB harvest of oilseed rape (OSR) is complete, but that yields appear to be below the five-year average. The report also shows that planting of OSR for harvest 2024 began mid-August, and has continued into September, though establishment has been variable.

Download 2023 Harvest Progress Report 6

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.