The global barley outlook and where next for prices: Grain market daily

Wednesday, 27 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £192.75/t, down £1.15/t from Monday’s close. Nov-24 futures closed at £203.00/t yesterday, up £0.10/t over the same period.

- Global markets saw mixed movements yesterday, with US markets slightly gaining and Paris markets seeing a slight fall. Markets seemed to be settling after Monday’s gains.

- Russian attacks on Ukrainian port infrastructure and grain storage facilities were reported yesterday, at the exporting district of Izmail. Though competitive Black Sea supplies picking up global demand keeps large price gains capped.

- East European countries are calling on the European Commission to impose more checks on the solidarity lanes for Ukrainian grain moving across borders. This follows on from disputes between Ukraine and some EU member states on restrictions to prevent Ukrainian grain moving across the border and pressuring domestic price levels.

- Paris rapeseed futures (Nov-23) closed yesterday at €440.75/t, unchanged from the day before. Nov-24 futures fell €1.25/t over the same period, to close at €462.75/t. Feeling pressure with Malaysian palm oil despite US soyabean price gains.

The global barley outlook and where next for prices

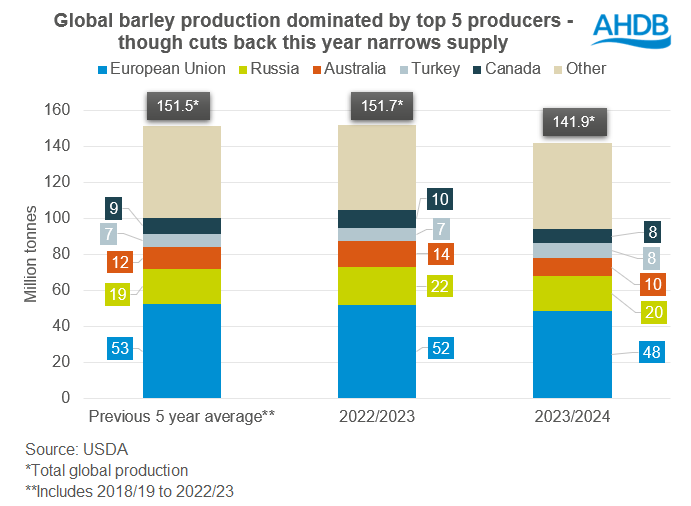

Though the supply outlook looks slightly bigger than previously expected, global barley supply is forecast to be squeezed this season (2023/24) and ending stocks tighter. Though global beer demand is in focus too.

Total global production is forecast to be the lowest since 2018/19, with trims seen to crops in many of this year’s top 5 producers including the EU, Russia, Australia, and Canada year-on-year.

The market has been following closely the dry weather seen across Canada, as well as areas of Australia considering the El Niño weather pattern setting in. Australia will be a key area to watch considering the hot weather they are currently seeing. For context, Australia is currently set to account for 21% of global exports for the 2023/24 marketing year.

We have talked in detail on the EU too, with sharp reductions to crops in Spain and Denmark due to dry conditions early in the season. This is the second successive large cut year on year to Spain’s barley crop, with last year Spain seeing hot and dry weather. Though importantly, the RMI reported in their latest report released last week, a slight rise to their forecast EU + UK production to 54.65 Mt due to improved winter barley yields in France, Germany, and the UK. RMI Analytics also add that this is important considering the poorer spring barley results in Denmark, Sweden, Finland, and Germany.

The Ukrainian and Russian crops are better than previously expected too. In the south and central regions of Russia, higher yields have been reported as harvest finishes up according to the RMI Analytics. Russia is a key spring barley producer, with spring barley accounting for 89% of total barley production on average over 2017 to 2021. Plus, Ukrainian production is forecast higher than earlier expected. Though availability remains at the front of the minds in the market and Ukrainian production remains below pre-war levels.

The global supply outlook remains tight though, and quality too is in focus considering the difficult harvest for many across the EU and UK especially. In France, most winter barley has been meeting malting requirements according to FranceAgriMer. But specific weights are varying following stormy conditions over summer. Spring barley results look more variable. In the UK, rain at harvest caused difficult conditions and germination data varies by region. With harvests finishing up, more data will be coming available indicating quality of barley crops.

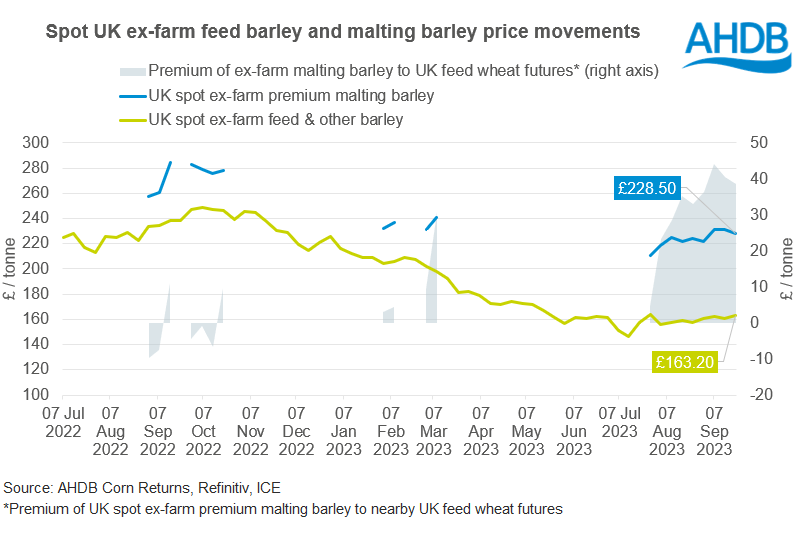

Domestic barley price movements

We have been seeing domestic spot ex-farm UK malting barley prices rising in recent weeks, and a widening of the premium of malting barley to domestic feed wheat futures.

So, where next for prices? Well, the RMI Analytics reported last week that European and global malting barley prices have been softening slightly, as Northern Hemisphere harvest finishes up and news is absorbed. Plus, going forward, boosted maize supplies pressuring the feed grain complex overall will be something to monitor. Though the tight supply balance is keeping malting barley prices elevated, and the market will follow news emerging on quality closely. Global demand for malt will be something to watch going forward, though domestic demand is reportedly remaining strong with capacity increases online.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.