Market report − 25 September 2023

Monday, 25 September 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

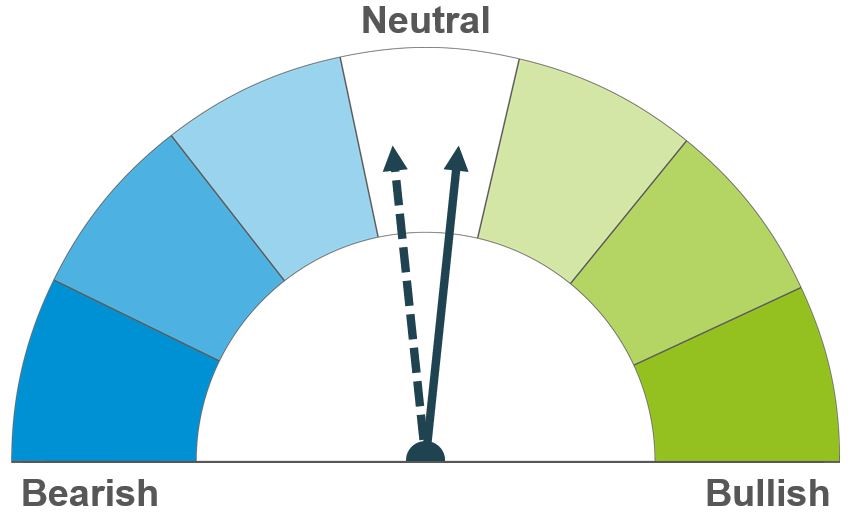

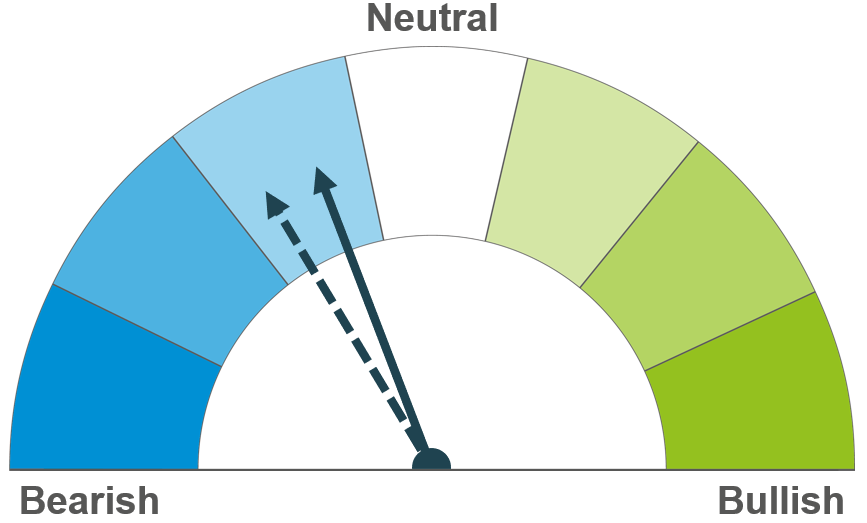

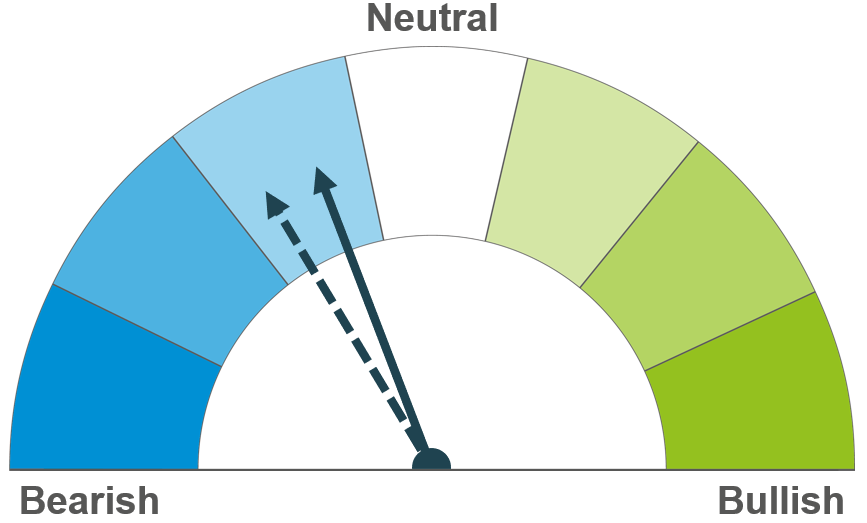

Wheat

Competitive Black Sea supplies weigh on the wheat market, though Southern Hemisphere supply concerns cap losses. Longer term, both the quantity and quality of global supplies remains in focus, though large maize supplies look likely to bring a bearish sentiment for feed wheat.

Maize

Global maize supply looks boosted this season. As the US harvest progresses, we could see more harvest pressure on prices. Longer term, large South American crops could boost supply further.

Barley

The global barley market remains tightly supplied. However, with large maize crops boosting global feed grain supplies, feed barley prices will still need to follow the wider grain complex.

Global grain markets

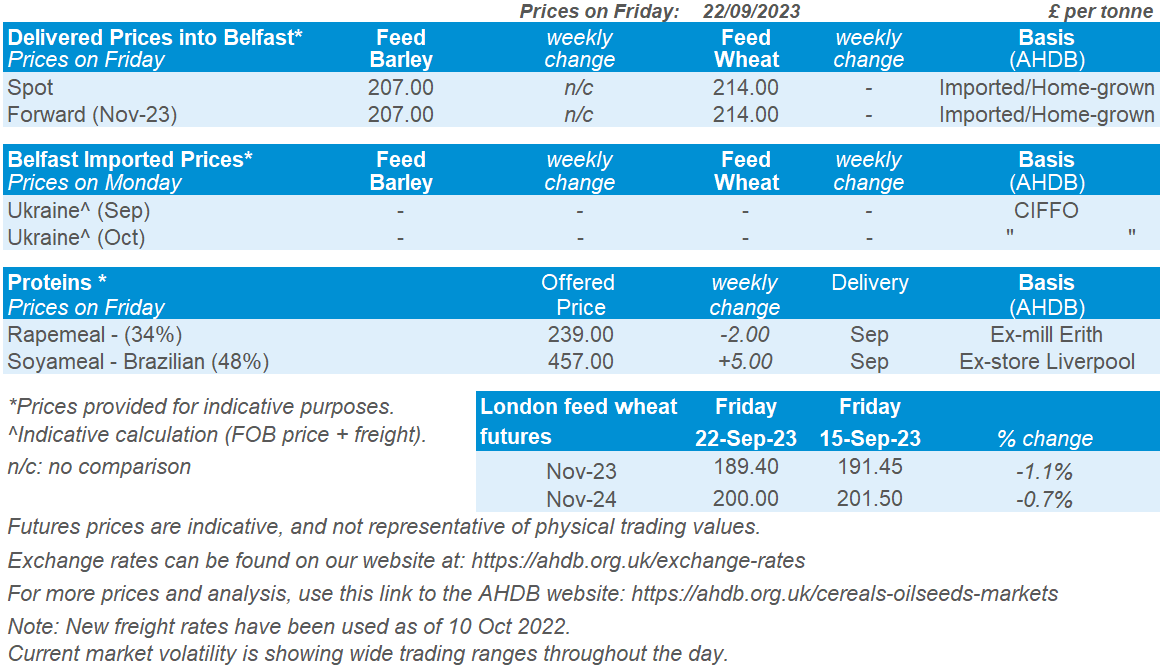

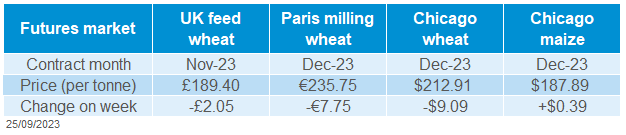

Global grain futures

Global wheat markets felt pressure overall last week. Competitive Black Sea supplies weighed on prices, though concern over dry weather in Australia and Argentina limited losses. The US dollar strengthening also played into movements last week.

Last week saw a few global tenders coming through, and the market digested the competitiveness of supply on the market currently. Algeria booked around 600 Kt of milling wheat, and Egypt purchased 120 Kt tons of Romanian wheat. Interestingly, Russian offers were aligned at a single price for both these tenders, and some commentators suggest this represents an unofficial floor price. The volumes booked by Egypt were small compared to the large offers on the table.

The first grain ship has set sail from a Ukrainian Black Sea port since Russia quit the Black Sea Initiative (Refinitiv, an LSEG business). The ship left Chornomorsk carrying 17.6 Kt of Ukrainian wheat for Egypt, the second ship last week to use the new temporary humanitarian corridor.

Capping price losses are current concerns for Southern Hemisphere supply. Australia is in the middle of an intense heatwave, with temperatures in South Australia, New South Wales, and Western Australia due to reach 12–15°C above the above average this week. The Bureau of Meteorology has now declared an El Niño is underway. At a critical time for Australian wheat development, this will be followed by the market closely.

Sales of Argentina’s upcoming wheat crop, due to arrive at the end of 2023, are the slowest in seven years, according to Refinitiv. The weather has been dry in Argentina for some areas, and farmers are waiting for some rain to arrive before selling. Plus, with a general election next month, some farmers are anticipating tax cuts on grain exports.

Meanwhile, Chicago maize futures (Dec-23) ended up on Friday near unchanged. After reaching its lowest price since 2021 on Monday, the contract saw a small rebound. US harvest pressure is likely to grow in the next couple of weeks.

UK focus

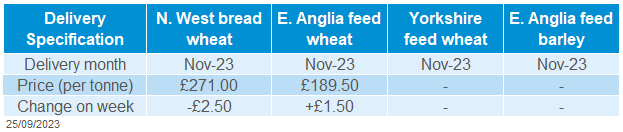

Delivered cereals

UK feed wheat futures (Nov-23) closed on Friday at £189.40/t, down £2.05/t over the week. Nov-24 futures closed on Friday at £200.00/t, down £1.50/t over the same time frame. Though a weakening of the pound to the US dollar softened some falls on Thursday on the domestic market, overall domestic futures followed overall pressure on global markets last week.

In contrast to futures movements last week, domestic physical markets gained on the week. The domestic market was reportedly quiet last week. Feed wheat delivered into East Anglia (September delivery) was quoted on Thursday at £187.00/t, up £2.00/t over the week.

Whereas bread wheat delivered into the North West (September delivery) was quoted at £269.00/t, down £2.50/t on the week.

Feed barley delivered into Avonmouth (November delivery) was quoted on Thursday at £173.50/t.

Last week, the end of season 2022/23 UK cereal supply and demand estimates were released. After the full season official statistics were taken into account, residuals have been identified for wheat and maize, while a deficit for barley has been identified.

Read what might be causing the ‘unbalanced’ balance sheet for wheat

Oilseeds

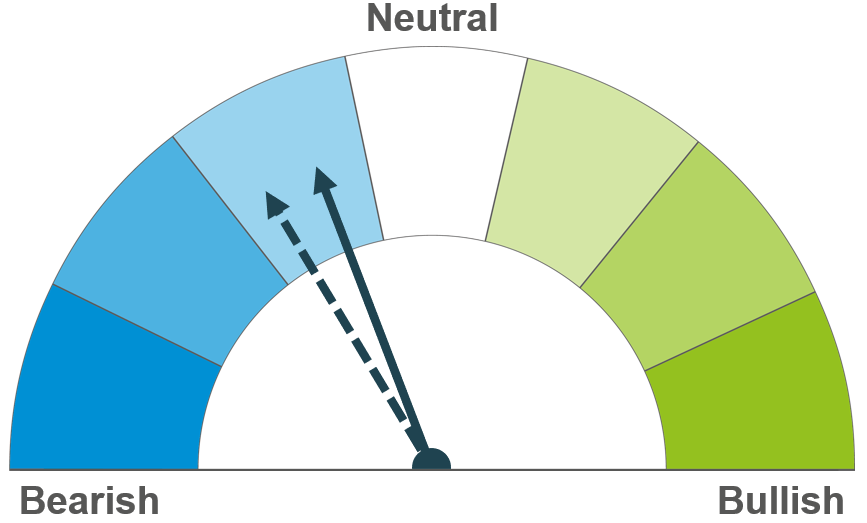

Rapeseed

Rapeseed prices are facing pressure from the Canadian harvest and soyabeans in the short term, though currency shifts may help offset some of that pressure. Global rapeseed supplies are expected to be high this season, which along with high soyabean supplies, continues to point to a mildly bearish outlook.

Soyabeans

Harvest pressure in the US and a strong US dollar is weighing on soyabean markets in the short term. Longer-term global supplies look ample, but that’s contingent on US yields and the South American crops.

Global oilseed markets

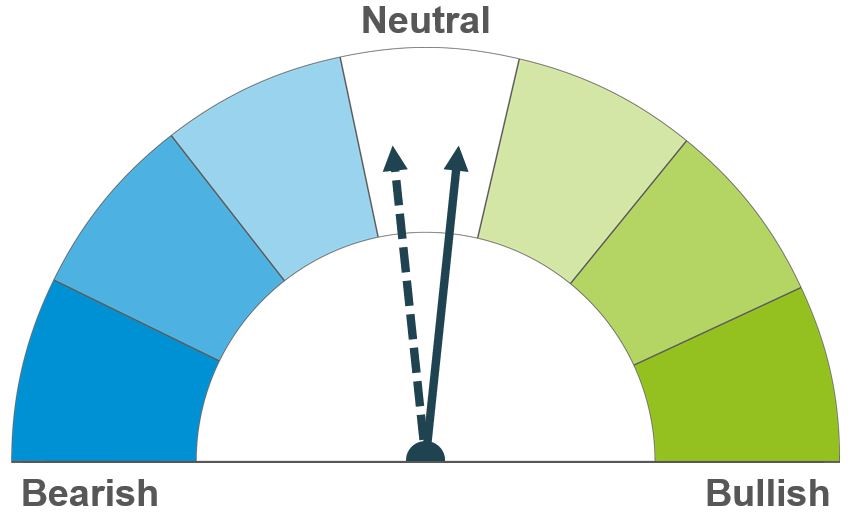

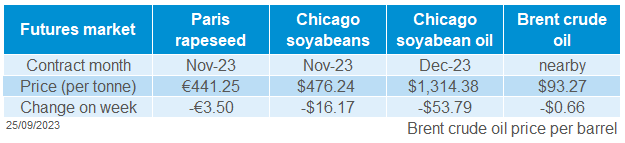

Global oilseed futures

Harvest pressure on US soyabean prices, plus a stronger US dollar, pulled the global oilseed pricing complex lower last week. The US dollar is now the strongest it’s been against a basket of top currencies since March (Refinitiv, an LSEG business).

Selling by speculative traders also likely contributed to the decline in soyabean prices, with industry reports suggesting investment funds reduced their net-long position last week. A lift in crude oil prices helped stabilise prices on Friday.

The US soyabean harvest is advancing, though still in relatively early days, so we need to wait for clarity on yields. The market already seems to expect the USDA to cut the US yield from the current 3.37 t/ha on 12 October after hot weather in August, but the extent is important. If the US soyabean yield falls below 3.36 t/ha (50 bushels per acre), it will mean a tighter US supply and demand picture with support for prices. But a smaller cut is likely to weigh on prices.

Planting of the 2023/24 soyabean crops has begun in Brazil, where Conab expects a record 45.3 Mha to be planted. This area would be 3% larger than last season’s area, which produced the record 2022/23 crop (154.6 Mt). On Thursday, the agency also tentatively pegged the 2023/23 crop at 162.4 Mt, vs. the USDA’s 163.0 Mt.

Dry weather in Argentina led the Buenos Aries Grain Exchange to reduce its forecast for the 2023/24 sunflower area by 50 Kha last week. Soyabean planting has yet to start, but the Government expects a similar area to last season.

Rapeseed focus

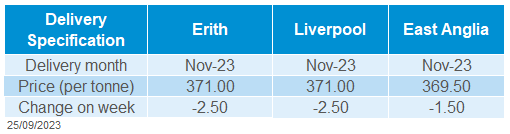

UK delivered oilseed prices

Paris rapeseed futures prices fell by less than Chicago soyabean futures last week due to the narrow gap to Winnipeg canola futures and a weaker euro against the US dollar. The Nov-23 contract fell €3.50/t to €441.25/t, while the Nov-24 contract fell €1.50/t to €467.00/t.

In AHDB’s delivered price survey, rapeseed delivered to Erith in November was £371.00/t on Friday, down £2.50/t from 15 September. A fall in sterling against the euro generally supported UK prices compared to Paris futures. However, there were steeper price falls for September and October delivery.

The Canadian canola (rapeseed) harvest is moving into the latter stages. By 18 September, 65% of the crop had been cut in Saskatchewan, the top-producing province.

The Grain Industry Association of Western Australia (GIWA) trimmed its forecast of the region’s canola crop last week from 2.51 Mt in August to 2.26 Mt. This follows sustained dry weather, though the report noted the stabilising effect of rain in mid-September.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.