Oil price rises, where next? Grain market daily

Friday, 22 September 2023

Market commentary

- Domestic futures saw only small movements overall yesterday. UK feed wheat futures (Nov-23) closed yesterday at £189.85/t, down £0.35/t from Wednesday’s close. Nov-24 futures closed at £199.40/t yesterday, up £0.25/t over the same period

- Global markets felt some weakness yesterday as the market digested the competitiveness of Black Sea wheat for global tenders for Algeria and Egypt. Though the weakening of the sterling may have softened falls on domestic markets

- The first grain ship has set sail from a Ukrainian Black Sea port Chornomorsk, since Russia quit the Black Sea Initiative, as reported by Refinitiv. The ship is carrying 17.6 Kt of Ukrainian wheat for Egypt, the second ship this week to use the new temporary humanitarian corridor

- The International Grains Council released their latest report yesterday, raising global maize production for this season slightly on a larger forecast Ukrainian crop. Whereas the 2023/24 world wheat crop was trimmed 0.6 Mt to 783.5 Mt, with downgrades for Australia, Canada, the EU and Argentina, partially offset by larger forecast crops from Russia and Ukraine

- Paris rapeseed futures (Nov-23) closed yesterday at €439.50/t, down €9.50/t from Wednesday’s close. Pressure was seen across the wider Chicago soyabean and Malaysian palm oil markets yesterday, pushing down prices

Oil price rises, where next?

Energy markets have been seeing price volatility in recent weeks and months. Earlier in the week, Helen discussed the rise for August UK produced and imported AN prices (34.5% N), with UK and European benchmark natural gas prices rising in August too. With fuel a key input on farm, and oil markets one part of the wider oilseed and vegetable oil puzzle, it is important to understand where next for oil prices and what impact this could have.

So, what’s happening in the oil side of the energy market?

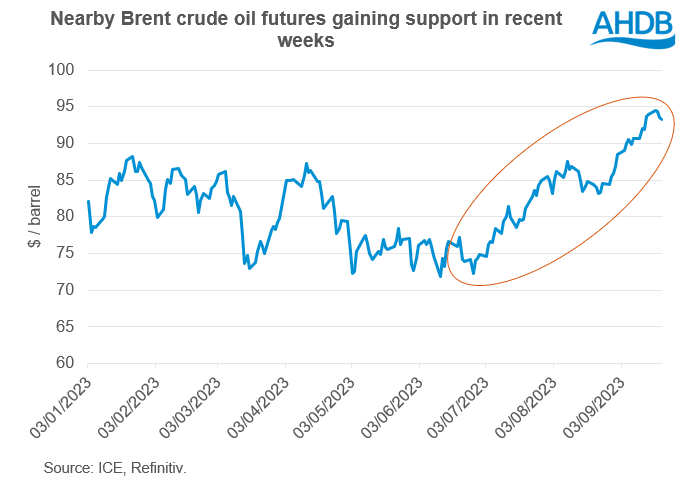

Nearby Brent crude oil futures have risen 25% since the end of June. Supporting prices on the Brent crude oil contract has been the improved economic outlook with inflation easing and the tightening of oil supply and demand on the global market.

Saudia Arabia and Russia announced voluntary cuts, as reported earlier this month, on top of the cuts already announced in April by OPEC+. Saudi Arabia will extend its voluntary oil output cut of 1m barrels per day until the end of December 2023. Whereas Russia have extended their voluntary decision to reduce oil exports by 300K barrels per day to the end of this year.

On top of this, strong summer travel and strong Chinese buying has boosted demand in recent months – China has been reportedly building stockpiles. But strong imports may not look to continue for China, as reported by Bloomberg, as analysts expect slow economic recovery post-COVID.

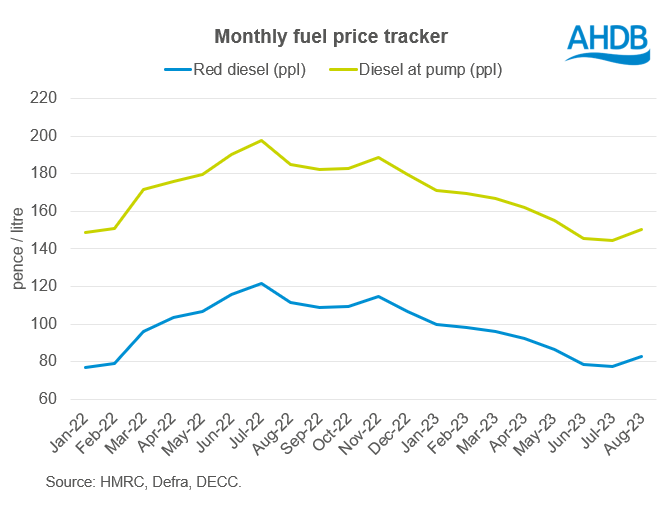

What does this mean for the price at farm level? Red diesel prices have also seen a rise in recent weeks, following support in wider oil markets. Yesterday, UK red diesel prices were reported to be at 87.46 pence/litre (Boiler Juice).

Will support continue?

Oil prices are currently in backwardation. What does this mean? Well, the spot price is higher than the forward prices. Though, to the end of this year, the US Energy Information Administration (EIA) forecast Brent crude oil prices to feel support from tighter global oil inventories but to ease in the second half of 2024 as inventories build again. Longer term, global oil demand is in question according to the IEA, with thoughts that the post-pandemic recovery will have largely run its course, plus with the energy transition picking up pace.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.