More rises for AN prices in August: Grain market daily

Tuesday, 19 September 2023

Market commentary

- The UK feed wheat futures Nov-23 contract fell £2.15/t yesterday to £189.30/t. There were smaller falls for the May-24 (down £1.70/t to £199.80/t) and Nov-24 contracts (down £1.90/t to £199.60/t).

- Intense competition from Russian wheat was reported as the key reason for falls in European wheat prices (Refinitiv). There was also pressure from the Chicago wheat and maize markets, which fell due to poor export demand and the progressing US maize harvest.

- The US maize harvest was 9% complete by 17 September, the USDA reported last night, ahead of the five-year average of 7% complete. Meanwhile, the US soyabean harvest was 5% complete, also slightly ahead of average (4% complete).

- Ukraine has filed complaints with the World Trade Organization over bans on Ukrainian grain imports by Poland, Slovakia and Hungary. Meanwhile, Ukraine confirmed that a cargo ship, which arrived in the Black Sea port of Chornomorsk last week, had left carrying 3 Kt grain.

- Nov-23 Paris rapeseed futures fell €11.50/t yesterday closing at €433.25/t. The Nov-24 contract lost €7.75/t to close at €460.75/t. The expanding Canadian canola (rapeseed) and US soyabean harvests both weighed on prices.

More rises for AN prices in August

Nitrogen fertiliser prices in GB rose in August 2023, as natural gas prices firmed. Sterling also weakened against the US dollar increasing the cost of importing products to the UK, including ammonium nitrate (AN) and Diammonium Phosphate (DAP). Sterling reached its lowest level since mid-June on 25 August.

UK-produced AN with a 34.5% nitrogen (N) content rose £17/t from July to £370/t in August, while imported AN (34.5% N) rose £18/t to £362/t; both prices are the highest reported since May. Over the same period, granular urea (46% N) gained £20/t to average £417/t, the highest price since April. See the full GB fertiliser price series from AHDB.

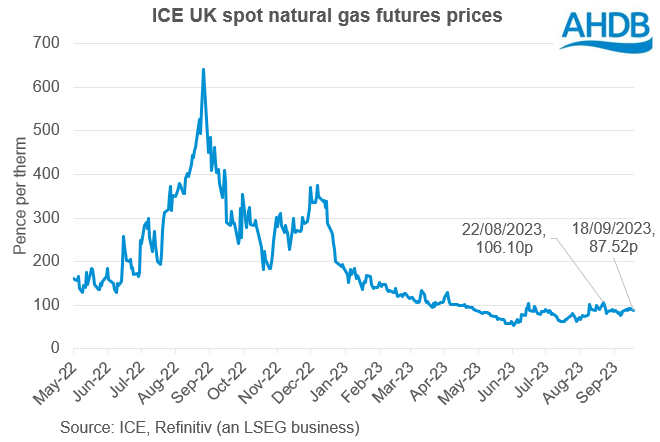

UK and European benchmark natural gas prices both rose in August. The spot UK futures contract peaked in the third week at 106.1 pence per therm, on news that workers at two Australian Liquified Natural Gas (LNG) export facilities planned to strike. Prices then eased back slightly as the strike was postponed.

Since Russia invaded Ukraine in February 2022, the UK and other European countries are much more reliant on imports of LNG. Australia is an important exporter of LNG, though not a major supplier of LNG to the UK and Europe (Refintiv). Nonetheless, the two export facilities affected by industrial action account for 5% of global LNG supply (Oilprice.com). So, a curtailment of Australian supplies still puts pressure on other sources to meet global demand.

Strike action began on Friday 8 September in Australia and escalated last week. However, so far, warmer weather in Europe (meaning lower heating demand) and stronger winds (higher energy production) are reducing the impact on prices in Europe and the UK. Also limiting the impact for now are fuller-than-average gas stores in Europe. Gas Infrastructure Europe (GIA) reports that stores were 94% full by 14 September, compared to 85% on average (2018-2022) for the time of year.

Looking ahead

While industrial action continues in Australia, it could support LNG and so all natural gas prices. Chinese demand for LNG has also been picking up recently, which could mean support for prices longer-term if it continues.

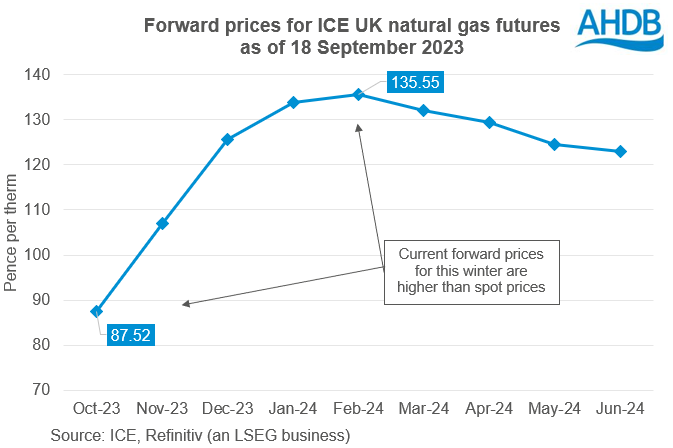

Meanwhile, winter weather across the northern hemisphere will influence gas demand for heating, and so prices. Despite warmer-than-average conditions being forecast over the next few months across Europe, current prices for winter delivery are still higher than spot prices. While an even milder winter could pressure prices, a colder winter could mean volatility and price rises.

Any rises in natural gas prices in the months ahead are likely to translate into higher nitrogen fertiliser prices. Sterling has also weakened further against the US dollar in the last few weeks. Unless the exchange rate trend changes, it could push up the cost of fertilisers in the UK, even if natural gas prices don’t rise.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.