Market report − 18 September 2023

Monday, 18 September 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

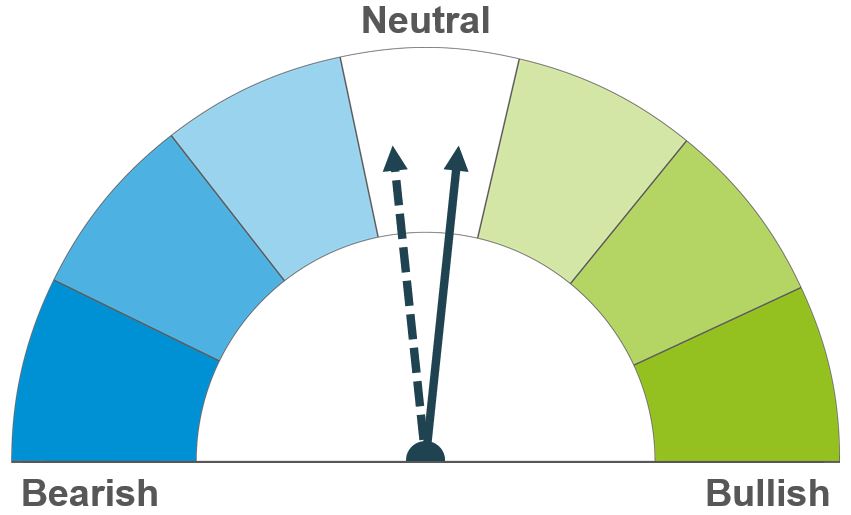

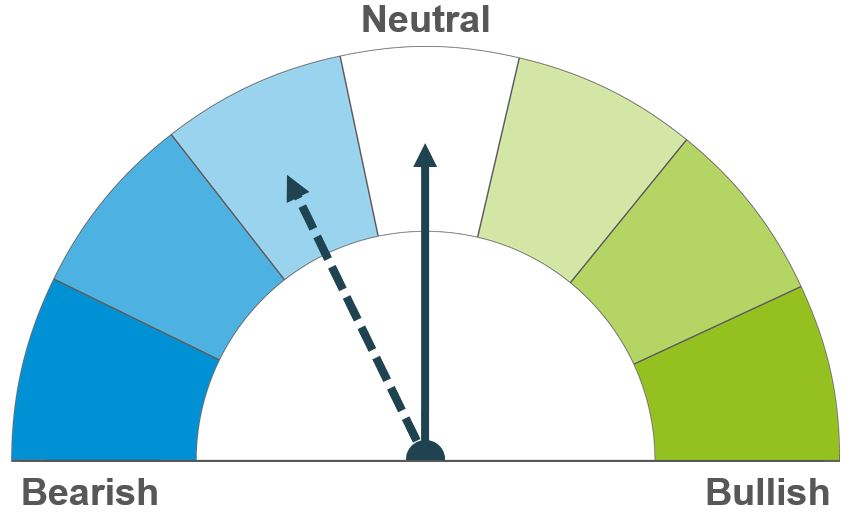

Global supply remains in focus, importantly both quantity and quality. Competitive and plentiful Black Sea supplies continue to cap major gains. Longer term, a boosted maize supply outlook looks likely to pressure feed markets.

Maize supply looks boosted for the EU and US crops, easing some short-term uncertainty. The market will monitor development of these crops, key for price direction. Longer term, large South American crops are forecast.

Barley continues to follow the wider grain complex. Boosted by maize supplies, the feed grain market looks well supplied currently.

Global grain markets

Global grain futures

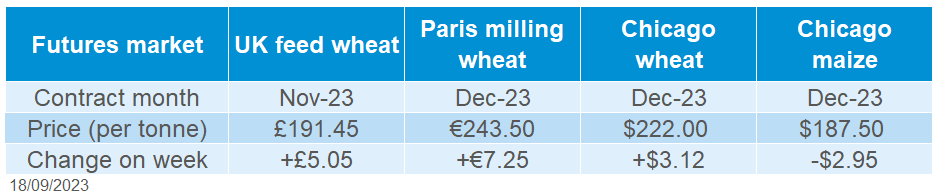

Chicago and Paris wheat markets felt some support last week, though Chicago maize markets ended the week lower. Wheat markets felt a boost towards the end of last week due to supply concerns from the southern hemisphere, though expectations of competitive exports from Russia and the wider Black Sea area kept a cap on large gains.

Last week, the latest World Agricultural Supply and Demand Estimates (WASDE) were released by the USDA. Globally, the outlook for wheat was for lower supplies, consumption, exports and ending stocks when compared to last month’s report. Global wheat supplies are estimated to decline by 7.2 Mt to 1,054.5 Mt. This is due to downward revisions to production for major exporters: Australia (-3 Mt), Canada (-2 Mt), Argentina (-1 Mt) and the EU (-1 Mt), though this was expected by the market. Find out more about the WASDE report.

Australia is feeling a spring heatwave across large parts of the southeast, with temperatures expected to peak up to 16°C above September’s average, something to monitor. Higher temperatures are likely to last until Wednesday across the states of South Australia, Victoria, and New South Wales.

A competitive Black Sea supply is keeping a cap on large price gains. Russian wheat exports for 2023/24 were pegged by the USDA at 49 Mt in the latest September WASDE report, up 1 Mt from the previous USDA forecast in August. Ukrainian grain also continues to flow.

The European Commission said it would not extend a ban on Ukrainian grain imports to Poland, Hungary, Slovakia, Romania and Bulgaria on Friday, which has been in place since May. However, Poland, Slovakia and Hungary responded to this by reimposing their own restrictions on Ukrainian grain imports. Though Ukrainian grain in transit to other destinations will still be allowed.

Maize markets have been feeling pressure from a large supply outlook from the EU and US. Consultancy Stratégie Grains have raised their EU 2023 maize crop forecast by nearly 1 Mt to 59.6 Mt, after beneficial summer rains. In the latest WASDE, the USDA slightly increased US maize production forecasts for this season on a larger acreage, despite a small reduction in yield prospects. With large Brazilian maize shipments expected to reduce overseas demand for US origin maize too, stock forecasts look boosted.

UK focus

Delivered cereals

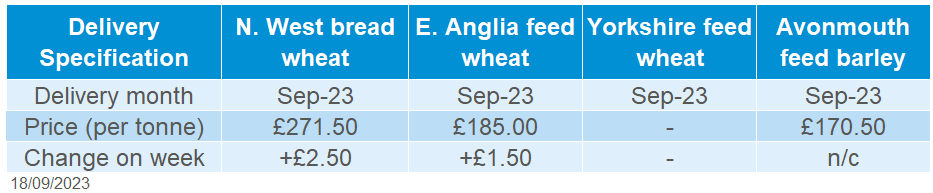

UK feed wheat futures (Nov-23) closed on Friday at £191.45/t, up £5.05/t over the week. Nov-24 futures closed at £201.50/t on Friday, gaining just £2.50/t over the same period. Domestic futures followed the support in wider global wheat markets.

Looking to domestic delivered prices, some support filtered through in many areas, Thursday-to-Thursday. Feed wheat delivered into East Anglia (September delivery) was quoted on Thursday at £185.00/t, up £1.50/t over the week.

Bread wheat delivered into the North West (September delivery) was quoted on Thursday at £271.50/t, up £2.50/t over the week.

The latest GB harvest report was released on Friday, using data to week ending 12 September. GB winter barley is now complete, with winter wheat harvest 99% and oat harvest 98% complete to this date. Spring barley was 87% complete to week ending 12 September, a big jump up from a fortnight ago (59% complete) but still lagging the 5-year average. Key regions with area still to be harvested are across the North East and Scotland. Read more on the harvest progress, yields and quality.

This season’s UK export campaign has got off to a slower start than last year for wheat, barley and oats, according to data from HMRC.

The latest GB fertiliser prices were released on Friday. UK produced AN (34.5%) was quoted for August at £370/t. This is up £17/t from July 2023.

Oilseeds

Rapeseed

Soyabeans

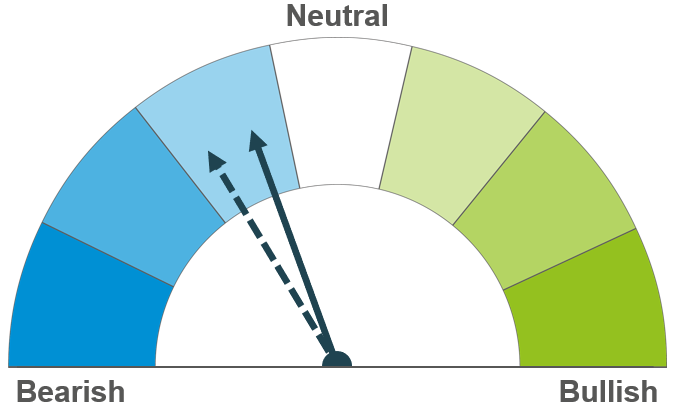

Short-term, rapeseed prices are likely to follow soyabean's sentiment. Longer term, rapeseed markets are well-supplied despite marginal cuts to EU and Canadian crops. Also, soyabean supply could weigh on the market longer-term.

Markets are still focused on US weather, though some pressure could be expected over the coming weeks as harvest accelerates. Longer-term South American crops are going to weigh, very soon the market focus will switch to these crops.

Global oilseed markets

Global oilseed futures

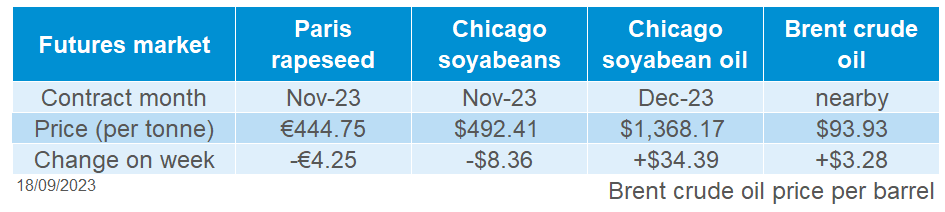

There was a mix of bearish and bullish news across the week driving oilseed markets. However, bearish news outweighed as Chicago soyabean futures (Nov-23) were pressured 2% across the week closing Friday at $492.41/t.

At the start of the week the market was pressured from the September USDA World Agricultural Supply and Demand Estimates. General consensus from the report was that the US outlook for soyabeans was better than expected by the market. There were downward revisions to US soyabean yields which was reflected in revisions to production. Though this was broadly already factored into the market. The main watchpoint for US soyabeans is the continued trim to ending stocks, which are now estimated at 5.99 Mt, remaining the lowest since 2015/16.

However, from this report there was volatile trading on Chicago soyabean futures as traders digested the outlook for tight domestic supplies. Also, uncertainty over what recent weather impacts mean for this US crop, as this heat wave could have impacted soyabean pod weights. From this support in the middle of the week, futures were pressured 1.5% on Friday on technical selling, profit taking and seasonal harvest pressure hanging on the market.

Further to that, there was data released from the National Oilseed Processors Association (who account for 95% of US soyabean crushing). In their latest data, it was estimated that 161.5m bushels of soyabeans were processed in August, down 6.8% from the month earlier. This was below analyst estimates in a Reuters Survey, who estimated the figure to be 167.8m bushels. Reasons for the reduced number are due to more widespread processor downtime then expected, which limited demand. It is reported that US exports of soyabeans have been struggling to compete with Brazilian shipments.

Focus remains on Brazil for the longer-term sentiment of this oilseed market. According to Abiove, Brazilian vegetable oil group, Brazilian exports are expected to reach 99 Mt in 2023. This is up 500 Kt from a month earlier, as strong demand is expected from China following Brazil’s record crop in 2022/23. For 2023/24, planting has started for another record Brazilian soyabean crop, 0.4% of soyabean area for 2023/24 is sown, versus 0.16% at the same point last year (Patria Agronegocios).

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed Friday at €444.75/t, down €4.25/t across the week. Rapeseed was pressured at the start of the week with soyabean markets. However, the market did recoup some gains on Thursday, with the latest data released from Stat Can, who estimated that Canadian farmers are going to harvest less canola for 2023/24. The crop is now estimated at 17.4 Mt, down 7% from last year and the second smallest in 9-years, with the smallest being the drought year in 2021.

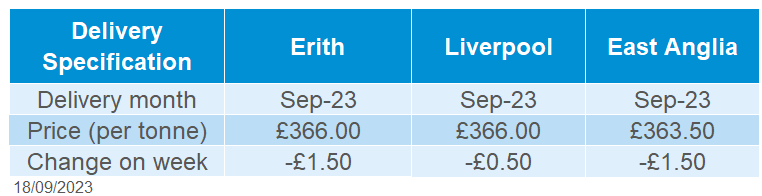

Domestic delivered rapeseed (into Erith, Sep-23) was quoted at £366.00/t on Friday, down £1.50/t across the week.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.