Analyst Insight: An unbalanced 2022/23 wheat balance sheet

Thursday, 21 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £190.20/t yesterday, up £1.20/t from Tuesday’s close. The Nov-24 contract closed at £199.15/t, up £1.05/t over the same period.

- EU wheat markets firmed yesterday on the back of strong export demand and rising tensions between Ukraine and bordering EU states. The European Union said last Friday that it would not extend the ban on imports of Ukrainian grain to Ukraine’s five EU neighbours. However, Poland, Hungary and Slovakia have extended the ban themselves, with Poland warning it will impose more restrictions should the dispute with Ukraine escalate (Refinitiv).

- Paris rapeseed futures (Nov-23) closed at €449.00/t yesterday, up €8.75/t over the session. The Nov-24 contract closed at €470.50/t up €3.75/t from Tuesday’s close.

- Rapeseed prices followed support in the US soyabeans market yesterday. Chicago soyabean futures were supported due to bargain buying as prices reached their lowest since mid-August. Traders are also awaiting more yield data as harvest progresses across the Midwest.

An unbalanced 2022/23 wheat balance sheet

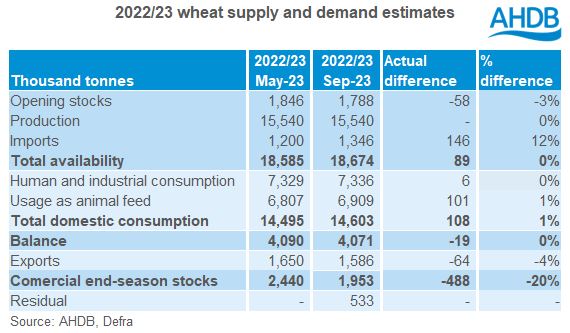

Earlier today, the final balance sheets for the 2022/23 season were published. After the full season official statistics were taken into account, residuals have been identified for wheat and maize, while a deficit for barley has been identified. Theoretically, a balance sheet should ‘balance’ when official data for domestic supplies, usage, trade and stocks is accumulated at the end of a season. However, given that the majority of the statistics used are collected through surveys, as opposed to a full census, it is to be expected that there are margins of error, leading to an imbalance or residual/deficit.

While a residual or deficit can be expected, the 2022/23 wheat balance sheet shows a particularly heavy residual of 533 Kt.

What are the main revisions from May’s wheat estimates?

In the estimates made back in May, it was anticipated that heavy supplies (largely due to a big crop), outweighed lacklustre domestic consumption (due to relatively low animal feed usage), leading to expectations of high ending stocks. Anecdotal reports from industry also supported these expectations and end of season stocks for wheat were estimated at 2.44 Mt.

Generally, availability and consumption were fairly in line with our May estimates. Though as can be seen in the table above, end of season stocks were actually estimated 488 Kt lower when using official statistics and, as mentioned previously, September’s end-season estimates leave a residual of 533 Kt.

Where does the residual belong?

With such a large residual this year, it’s important to assess which estimates could actually hold the unaccounted-for wheat. Of course, there will always be a margin of error in any survey, but we can be fairly confident in the reliability of the trade data and cereal usage surveys. The fed on farm figure is perhaps less reliable, though we know that it is unlikely that we will see great fluctuations (relative to production) in this figure year-on-year. Therefore, it is without doubt that the heavy residual that is left will not belong (at least entirely) in this figure, especially given last season’s wheat market conditions.

This leaves us with the Defra 2022/23 production and on-farm stocks figures.

The Defra UK total wheat production figure for harvest 2022 is 15.54 Mt. The confidence interval for the England production figure is -/+ 2.1% (note: there is no confidence interval available for devolved nations). When applied to the UK total figure this means that production could be just over 329 Kt lower or higher than their official estimate. Therefore, if the production figure was at the lowest end of the confidence interval, 329 Kt could be trimmed from the residual. Reports from industry indicate that there was less wheat available than initially thought as we approached the end of the season, supporting the idea that we had a smaller crop than Defra estimated.

Similarly, the confidence interval for the England and Wales on-farm stocks survey is -/+ 21.1%. There is no confidence interval available for Scotland and Northern Ireland, but when only considering England and Wales we could see another 182 Kt trimmed off the residual. However, given the reports of less availability than anticipated towards the end of the season, it’s unlikely that end-season stocks would be considerably higher than reported.

While there is some margin of error in survey results for usage, as well as some uncertainty in the fed on-farm figure, we are confident that the majority of the residual sits within the Defra production, and to a lesser extent, the on-farm stocks figures.

This same theory can be applied to the other cereals on the balance sheet too, for example, the barley deficit is likely due to a higher production figure, or lower ending stocks than we have on paper.

What does wheat availability look like heading into the rest of this season?

As it stands, it looks like availability is likely to be tighter this season (2023/24) than last. The estimated end of season stocks for 2022/23 suggest that we started 2023/24 with greater year-on-year, but below average, wheat opening stocks.

Defra’s provisional estimate for total English wheat area for harvest 2023 is also down 5% on the year. This, combined with reports of lower yields, has led to the assumption of a smaller crop this season. With lower domestic availability, an increase in imports this season will depend on domestic quality and overall demand. Imports have seen a slow start, with the volume of total wheat imported in July the smallest for this month since 2019/20 at 93.12 Kt. Although, this is likely a lag effect from the previous season, given harvest didn’t get fully underway until August.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.