Exports off to slower start in 2023/24: Grain market daily

Thursday, 14 September 2023

Market commentary

- UK feed wheat futures rose yesterday as the global market digested the USDA supply and demand estimates. Global wheat stocks are forecast to fall this season, and as a percentage of demand would be close to 2007/08 levels. However, this situation has been forecast a few times recently and not materialised, so this and large maize supplies, tempered the market’s reaction. Plus, the USDA’s estimate for the Russian crop of 85.0 Mt is well below SovEcon’s August estimate of 92.1 Mt.

- Also supporting wheat prices was the Ukrainian-Russian war. Ukraine reported that Russian air strikes since mid-July have damaged over 100 port infrastructure facilities and reduced export potential through the Danube by 0.5 Mt per month.

- The Rosario Grain Exchange cut 0.6 Mt from its estimate of the Argentine wheat crop, now pegged at 15.0 Mt, following dry weather in some areas. Plus, to enable the forecast maize area to be planted, enough rain is needed over the next two weeks.

- As a result, the UK feed wheat futures Nov-23 contract gained £3.40/t to close at £187.75/t yesterday, while the Nov-24 contract gained £4.05/t to £200.55/t. This is the highest Nov-23 price for two weeks, and the highest Nov-24 price for a month.

- Paris rapeseed futures were largely unchanged at the close yesterday, following a similar trend to Chicago soyabean futures. The Nov-23 contract finished the day at €431.25/t, up €0.75/t, while the Nov-24 contract lost €0.25/t to close at €458.25/t.

Exports off to slower start in 2023/24

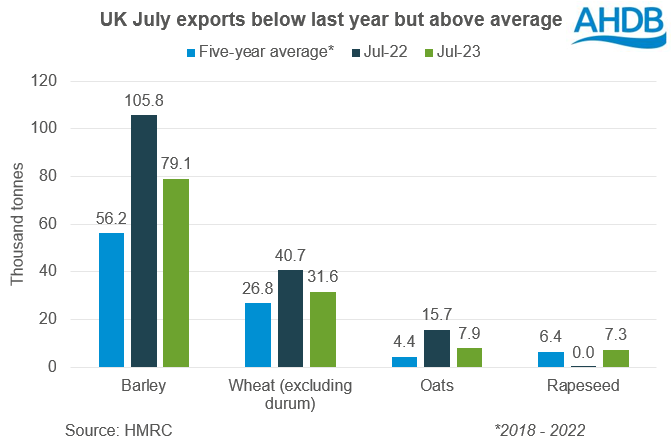

The 2023/24 UK export campaign got off to a slower start than last year for wheat, barley and oats, according to data from HMRC. In July 2023, the UK exported less wheat, barley, and oats than in July 2022. Falling prices through spring, followed by the weather market in June and the later start to the domestic 2023 harvest potentially restricted pre-harvest sales for July 2023 compared to last year.

While July 2023 exports of wheat, barley and oats were below the first month of the 2022/23 campaign, they were above the previous five-year average.

Barley exports in July totalled 79.1 Kt; this was supported by larger shipments to Spain (49.7 Kt), where crops are particularly small this year due to drought, and Ireland (20.6 Kt).

Similarly, Spain was the top destination for UK wheat (excluding durum) in July (9.1 Kt), followed by the Netherlands (9.0 Kt) and Ireland (7.0 Kt). Belgium was the main destination for oats, taking 7.5 Kt of the monthly total of 7.8 Kt.

For rapeseed, exports in July totalled 7.3 Kt. This is the largest volume for the month of July since July 2020, although it is some way below that year’s 25.2 Kt exports. The larger export volume likely reflects the larger expected crop due to the expanded area planted for harvest 2023.

Exports of wheat, barley, and oats are likely to remain lower than 2022 in August at least, due to the slower pace of harvest. Further, last season (2022/23) recorded the strongest wheat and oats exports in multiple years. So, it wouldn’t be too surprising if the exports of wheat and oats continue to lag last year’s pace. However, total export potential depends on the final stocks and crop sizes, quality, domestic demand, and price competitiveness.

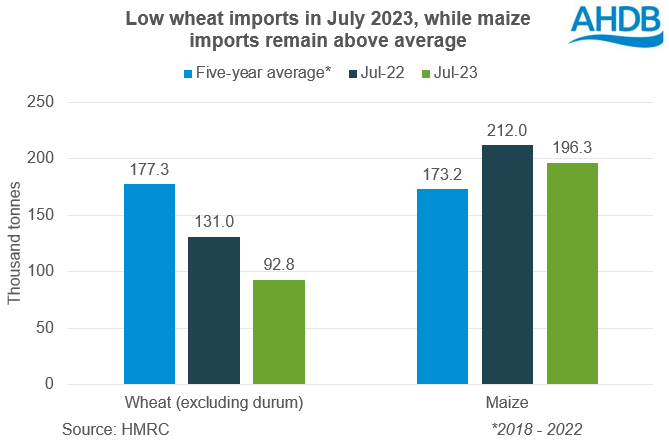

Imports also down in July

Wheat imports (excluding durum) in July 2023 were the smallest since March and the lowest for the first month of the season since 2019-20 at 92.8 Kt. The total includes notable volumes from Germany (38.3 Kt) and Canada (41.4 Kt), but very little (just 151 t) from France. This is the main difference from recent years, when the UK has imported large volumes of French wheat especially in the early months of the season.

In terms of what happens next for wheat imports, UK quality will be key to the overall volume. But the cost of importing German milling wheat currently looks comparable to UK wheat into the North. Depending on UK quality, this could support import levels in the months ahead. However, Germany’s crop has suffered from harvest delays. Interim quality results from the Max Rubner Institute show lower ‘A’ and ‘E’ wheat availability, with poorer protein quality and lower Hagberg Falling Numbers. This could push the UK to other origins to fulfil its milling import requirements, especially later in the season.

Imports of maize in July were also below July 2022, but above the five-year average at 196.3 Kt. Global maize supplies look far more comfortable than global wheat supplies this season, which could give an price incentive to use more maize in the UK this year.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.