UK wheat and oat exports hit multi-year highs in 2022/23: Grain market daily

Thursday, 17 August 2023

Market commentary

- UK feed wheat futures (Nov-23) gained £2.80/t yesterday, closing the session at £189.00/t. The Nov-24 contract closed at £198.00/t, up £3.70/t over the same period.

- European grain markets were supported yesterday following a Russian attack on the Ukrainian river port of Reni on the Danube. According to officials, Russian drone strikes damaged silos and warehouses at the port (Refinitiv).

- Paris rapeseed futures (Nov-23) closed yesterday at €460.50/t, up €7.25/t from Tuesday’s close. The Nov-24 contract was up €9.25/t over the same period, ending the session at €472.00/t.

- Rapeseed prices followed support in the US soyabean market yesterday. This support was due to ongoing uncertainty about the size of the US crop, and forecasts of tightening ending stocks. The US Midwest is also forecast a hot and dry spell, though its thought that rains at the end of the month will limit crop stress (Refinitiv).

UK wheat and oat exports hit multi-year highs in 2022/23

The latest HMRC trade data was released this week, including volumes exported and imported for the full 2022/23 season (July 2022 – June 2023). So, did the full season data show what was expected?

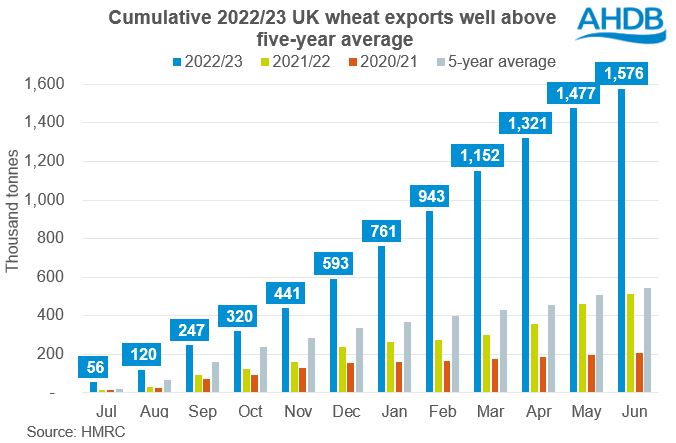

Wheat

As is well known, the UK held a substantial exportable surplus of feed wheat last season (2022/23), resulting in expectations of a firm export pace. Full season data (July – June) showed UK wheat exports (including durum) totalled 1.576 Mt. This is the greatest volume of UK wheat exports in a season since 2015/16, and well above the five-year average (2017/18 – 2021/22) of 546.4 Kt. It is also just below AHDB’s May balance sheet estimate of 1.650 Mt.

In terms of imports, throughout last season the UK imported 1.346 Mt of wheat. This is below the five-year average of 1.827 Mt, but slightly above AHDB’s May estimate of 1.200 Mt. Anecdotal reports suggest that availability of high protein milling wheat was tighter than expected towards the end of last season. This led to firm imports from Canada and Germany in the final quarter especially.

Barley

UK barley exports for the 2022/23 season totalled 1.116 Mt. This is slightly below the five-year average of 1.162 Mt, and broadly in line with AHDB’s May estimate of 1.150 Mt. Previous analysis highlighted strong demand for UK barley from the continent in the 2022/23 marketing year, due to a tight EU production outlook. As a result, UK barley exports to the EU totalled 1.104 Mt, the second greatest volume since 2015/16.

Maize

Maize imports last season totalled 2.099 Mt, below the five-year average of 2.458 Mt. Again, this is broadly in line with AHDB’s May estimate of 2.025 Mt. This volume of maize imports was also the lowest in a season since 2017/18. While the beginning of last season saw maize imports off to a strong start, as could be expected, due to the relative price of domestic grains, maize imports eased over the last few months 2022/23.

Oats

Oat exports in the 2022/23 season totalled 171.9 Kt, more than double the five-year average of 69.9 Kt, and the greatest volume since the mid-90s. The export figure was also higher than AHDB’s May estimate of 160 Kt, after an uptick in export pace in May and June, following a lull in March and April.

Find the full UK trade dataset here.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.