UK barley exports into the EU holding firm pace: Grain market daily

Friday, 14 April 2023

Market commentary

- Old crop UK feed wheat (May-23) closed at £193.50/t yesterday, down £1.25/t from Wednesday’s close. Whereas new-crop futures (Nov-23) fell £3.65/t over the same period, to close at £207.80/t. This closes the carry from old crop (May-23) to new crop (Nov-23) slightly, to £14.30/t.

- This pressure followed movements down on Paris and Chicago wheat contracts. Ample Black Sea supply continues to pressure prices, though losses were capped as Russia continues to stir up concerns that the Black Sea Initiative (Ukraine grain export corridor) may not be renewed next month. Russia would like removal of obstacles caused by western sanctions, for their grain and fertiliser exports.

- Paris rapeseed (May-23) futures lost €6.50/t yesterday, to close at €443.00/t. This followed weakness in wider vegetable oils and brent crude oil.

- Chicago soyabean (May-23) futures fell $1.19/t yesterday to close at $551.47/t. Whereas, Nov-23 futures gained $1.74/t over the same period, to close at $482.21/t.

- On Wednesday, the Rosario Grains Exchange trimmed their soyabean crop forecast for 2022/23 to 23Mt, down from 27Mt, and maize was cut from 35Mt to 32Mt for 2022/23. Yesterday, the Buenos Aires Grains Exchange said farmers would likely leave large tracts of soy fields unharvested due to drought damage. Therefore, more cuts were possible (Refinitiv).

UK barley exports into the EU holding firm pace

Yesterday, HMRC published the latest UK trade data figures, with an update for grain imports and exports up to the end of February. As is well known, due to a large surplus of domestic feed wheat this season, the pace of wheat exports has been strong over the past few months. Data up to the end of February shows wheat exports at 927.1Kt so far this season (July to February), up more than three times from the same point last year. Though it’s important to remember, large ending stocks are still forecast this season with large availability and lacklustre domestic demand.

It has also been well reported that oat exports have been up this season. In yesterday’s figures, up to the end of February, UK oat exports totalled 128.7Kt, also up more than three times on the season.

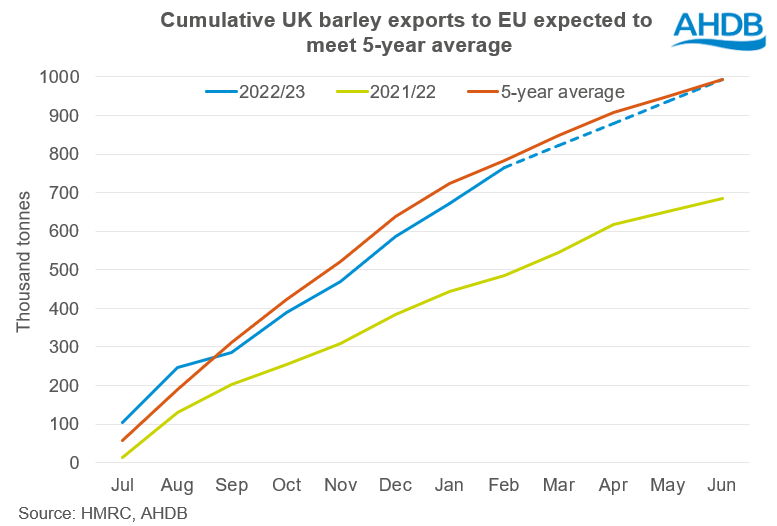

UK barley exports have been less in focus this season. The AHDB’s most recent supply and demand estimates pegs full season 2022/23 barley exports at 1.0Mt, down 162Kt on the five-year average. So, what is the picture so far? And what are the export prospects for the rest of this marketing year?

Exports so far

Up to the end of February, the UK had exported 774.8Kt of barley, up 38% on the year, but down 14% on the five-year average. In the month of February alone, the UK exported 97.5Kt of barley, the highest volume for that specific month since 2015/16, and just above the same month in 2019/20.

Of what has been exported so far this season, 99% has gone to the EU. On average over the past five years (2017/18 – 2021/22), 88% of barley exports have gone to the EU, suggesting this year there is a much greater proportion heading to the continent.

When looking at prices, Black Sea feed barley for FOB has been most competitive globally over the past few months. As at 07 March, the most recent UK spot feed barley price (FOB), was €241.00/t. For comparison, as at 08 March, Black Sea feed barley was €239.00/t. Although one month ago, this gives an idication of pricing to Black Sea barley.

According to the European Commission, as at 10 April, the UK remained the largest origin for EU barley imports, making up a 52.0% share, closely followed by Ukraine making up a 44.6% share. EU Commission custom surveillance data pegs barley imports from the UK at 903.6Kt as at 10 April, indicating the strong export campaign seen in February has continued over the past few weeks too.

Nearly 50% of total barley heading to the EU is going to Spain including UK origin, Ukraine and others using EU Commission custom surveillance data. Using HMRC data July to February, 41% of UK barley exports were destined for Spain. Spain experienced a poor harvest this season, producing 6.6Mt of barley according to the European Commission, compared to their 5-year average of 8.43Mt, hence the requirement for strong imports.

Export prospects

Looking ahead, as mentioned previously, UK barley exports have been forecast to sit at 1.0Mt this season. Looking at the EU specifically, based on the proportion going to the EU so far (99.3%), we could expect around 993Kt to go to the EU, meeting the five-year average. Based on HMRC data up to end of February, this would mean exports to the EU for the remaining 4 months of the season would only need to reach 56Kt a month, much less than what we’ve seen exported over the past few months. That poses the question, is there potential for us to export more than previously anticipated?

Having said this, global prices are falling, and UK barley could face increased global competition. Large barley stocks in Russia and Australia continue to weigh down on prices, though much like wheat, barley markets remain reactive to any news on the war in Ukraine.

It was confirmed today by China's Commerce Ministry that China is reviewing their levy of anti-dumping tariff on Australian barley coming into the country. This comes after news on Tuesday of Australia reaching an agreement with China to resolve the dispute. If barriers are lifted, French barley would have to compete against cheaper Australian supplies for Chinese demand, which could in turn drive down European prices.

Stratégie Grains currently estimate British barley imports to the EU to sit at just over 1Mt, not far from AHDB’s estimate. Could we see UK barley exports slow down slightly for the last few months of the season, as the EU sees a rise in Romanian and Black Sea barley?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.