US outlook better than expected – September WASDE round up: Grain market daily

Wednesday, 13 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £184.35/t, down £1.65/t from Monday’s close. New crop futures (Nov-24) closed at £196.50/t, down £2.25/t over the same period.

- Our domestic market followed the downward movement in the Paris wheat market, which was pressured from continued competitive Black Sea supplies. It appears that continued large Russian exports and on-going shipments from Ukraine is outweighing the revisions in the WASDE to wheat production in major exports (notably Canada, Australia and Argentina). Also, it is likely European markets didn’t gain with Chicago, as both the UK and Paris market closed shortly after the release of the USDA report.

- Chicago wheat futures started yesterday, pressured from Russian exports, but ended higher as the USDA cut world wheat stocks in the latest report – more information on this below.

- Paris rapeseed futures (Nov-23) closed yesterday at €430.50/t, down €14.00/t from Monday’s close. Rapeseed prices were pressured by downward movements in palm oil and soyabean markets.

US outlook better than expected – September WASDE roundup

Yesterday, the USDA released its latest World Agricultural Supply and Demand Estimates (WASDE). The main focus for this release was further information on what the hot and dry weather over August had done to US spring crops. There were anticipations of decreases to US crops from the trade, with the lower than anticipated crop rating scores over the last couple of weeks in the USDA crop progress reports.

There were some changes to US spring cropping prospects, these came as a marginal surprise (more discussed below). However, all-in-all, this WASDE report did not have many surprises than what was already known within the market.

Broadly summarising, global wheat stocks are expected to tighten – more on this below. However, large Russian wheat availability, combined with high maize and coarse grain stocks, continues to cap any major price increases. There was a marginal decrease to global oilseed availability, but this was largely expected. Also, there is increases to Ukrainian oilseed supplies, with exports revised up with production.

US spring crops

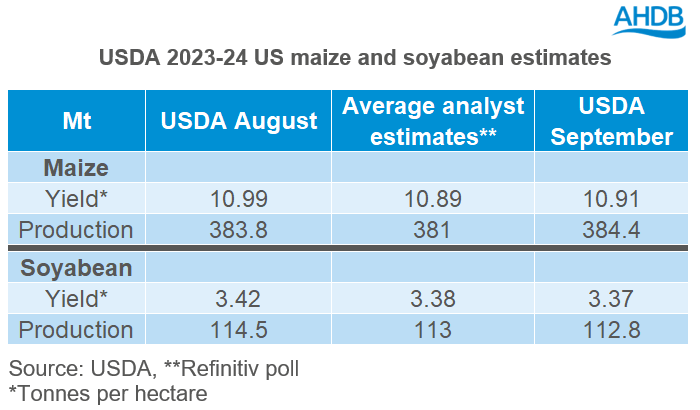

To start with, US maize yield estimates were not as low as market expectations, with the USDA estimating yields at 10.91 t/ha, down from August (10.99 Mt), but higher than trade expectations of 10.89 t/ha (Refinitiv). The outlook for US maize production was actually increased in the report from a higher acreage, outweighing the downward yield revisions. The US maize crop is now estimated at 384.4 Mt, up from August (383.8 Mt) and now marginally behind the record crop in 2016/17 (384.8 Mt). From this report, markets were pressured with Chicago maize futures (Dec-23) closing down 1.9% yesterday, to settle at $187.60/t.

For US soyabeans, yields are now estimated at 3.37 t/ha, down from the August report (3.42 t/ha). These were also marginally lower than analyst expectations of 3.38 t/ha (Refinitiv). With yields falling lower and planted area remaining relatively unchanged, the US soyabean crop is estimated at 112.8 Mt, down from August’s estimate of 114.5 Mt. While this is the smallest US crop since 2019/20 (96.7 Mt), it remains relatively high in a historical context.

The main watchpoint for US soyabeans is the continued decrease to ending stocks, which are now estimated at 5.99 Mt, which remain the lowest since 2015/16. However, with yields only marginally below average trade expectations, Chicago soyabean futures (Nov-23) were pressured 1.6% yesterday to close at $494.70/t.

Globally, the outlook for wheat is lower supplies, consumption, exports and ending stocks when compared to last month’s report. Global wheat supplies are estimated to decline by 7.2 Mt to 1,054.5 Mt. This is due to downward revisions to production for major exporters: Australia (-3 Mt), Canada (-2 Mt), Argentina (-1 Mt) and the EU (-1 Mt). Much of this was expected from recent data and information from the respective countries’ government consultancies.

Global wheat production is now estimated at 787.3 Mt, down 6 Mt from the August report. This will be the first year-on-year decline to global wheat production since 2018/19. Also ending stocks of global wheat are now estimated at 258.61 Mt, the lowest since 2015/16.

Despite this, coarse grain (maize, sorghum, barley, oats, rye, millet, and mixed grains) supplies can still have the ability to weigh on wheat prices. Globally, coarse grain production and ending stocks are estimated to increase in 2023/24. Furthermore, in the September WASDE, Russian exports were revised up 1 Mt, now estimated at 49 Mt. This is higher than Sovecon’s latest estimate of 48.6 Mt. This confirms that export trade is anticipated to flow from the Black Sea and there is a lot of Russian wheat coming to the market.

Following the increases to US maize production (see above), global production of maize is now estimated at 1,214.3 Mt, up 5% on the year. There was also a marginal downward revision to global domestic use (-0.6 Mt), which means global ending stocks of maize are now estimated at 314.0 Mt, up 2.94 Mt from last month’s report.

As expected, South American crops remain unrevised as this is just foreseen estimations from the prospective plantings over the coming months. The information from this latest WASDE report just confirms our bearish longer-term outlook for maize markets. This is ultimately going to weigh on the grains complex, especially if the expected South American supplies come to market in 2024.

For 2023/24, global oilseed output is revised down by 2.8 Mt on the month to 660.9 Mt. Aside from the downward revisions from the US soyabean crop (see above), there is also lower rapeseed production for Canada (-0.8 Mt) and lower rapeseed (- 0.5 Mt) and sunflower (- 0.2 Mt) production from the EU. Similar to the wheat outlook this revision has been expected and is factored into the market.

There were increases to Ukrainian rapeseed, sun seed and soyabean production. Ukrainian rapeseed production is now estimated at 4.3 Mt, with exports increasing by 150 Kt. This is something that could continue to weigh on continental rapeseed prices as Ukrainian supplies are plentiful and can easily be exported into the EU market.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.