Markets expect smaller US maize and soyabean crops: Grain market daily

Tuesday, 12 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £186.00/t yesterday, down £0.40/t from Friday’s close. The Nov-24 contract closed at £198.75/t, down £0.25/t over the same period.

- Competitive Russian supplies continue to weigh down on the market, with prices inching even lower last week. The price of 12.5% protein Russian wheat scheduled for free-on-board (FOB) October delivery was $240/t, compared to $245/t a week earlier (IKAR).

- Paris rapeseed futures (Nov-23) ended yesterday’s session at €444.50/t, down €4.50/t. The Nov-24 contract was down €4.25/t over the same period, closing at €464.50/t.

- Rapeseed futures followed US soyabean futures down yesterday as markets adjust ahead of today’s USDA’s World Agricultural Supply and Demand Estimates (WASDE). Read more on this below.

Markets expect smaller US maize and soyabean crops

Later today, the USDA is due to release its September World Agricultural Supply and Demand Estimates (WASDE). Ahead of the release, traders are adjusting their positions and there is added uncertainty in global grain and oilseed markets. Due to declining conditions of the US soyabean and maize crops, markets are expecting downward revisions in the latest update. So, what exactly can we expect?

Maize

The quality and yields of US maize are in focus due to the recent hot weather. In the USDA’s latest crop condition scores, released yesterday, 52% of maize was rated as in good-excellent condition, down from 53% the previous week. This is also slightly lower than at the same point last year and below the five-year average of 59%.

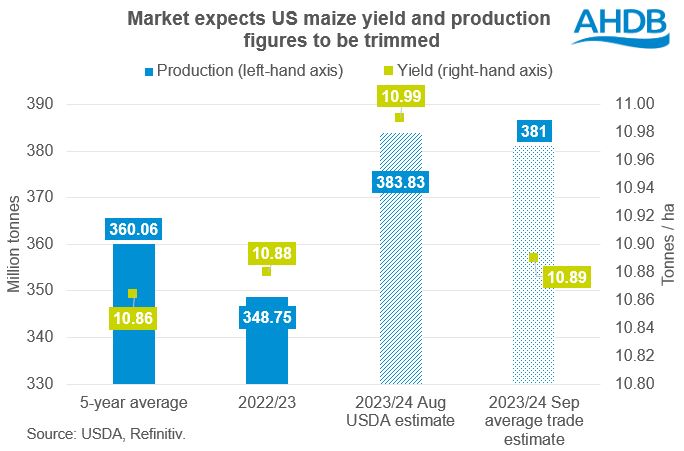

In terms of analyst expectations, in a Refinitv pre-report poll, the average trade estimate suggests that US maize yield will be pegged at 10.89 t/ha, down from last month’s estimate of 10.99 t/ha. Given that harvested area is expected to remain relatively unchanged from August’s estimate, the US maize production figure is expected to fall from 383.8 Mt last month, to c.381 Mt.

However, according to Refinitiv, the general feeling in the wider market is that the USDA may have underestimated the planted area. Therefore, even if we do see trims to the yield estimate, production may not be as greatly impacted.

In terms of what today’s maize update might mean for markets, if the USDA make greater cuts than expected, we could see some short-term support in prices. Equally, if cuts are smaller than analysts think, we could see some bearish sentiment in the market.

Soyabeans

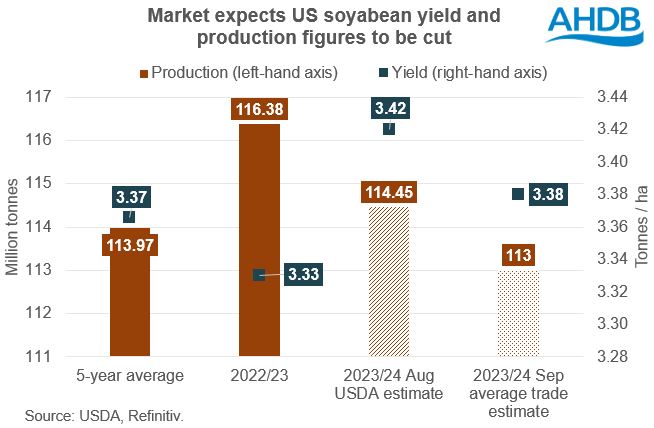

The proportion of US soyabeans in good-excellent condition was rated at 52% yesterday, down from 53% a week earlier. Much like maize, this condition score is below the same point last year, and below the five-year average of 60%. This leaves questions over what the USDA will predict for this year’s crop.

According to the Refinitiv pre-report poll, the average trade estimate for the US soyabean yield sits at 3.38 t/ha, down from August’s estimate of 3.42 t/ha. Analysts also expect that the US soyabean production figure will be revised down from 114.45 Mt to c.113 Mt.

Again, if the data released tonight is significantly different to expectations, this could lead to support or pressure in soyabean prices, which could filter through into rapeseed futures. Look out for more information on the results of the WASDE in tomorrow’s Grain market daily.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.