US spring cropping in focus before harvest: Grain market daily

Wednesday, 6 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £185.30/t, gaining £1.30/t from Monday’s close. New crop futures (Nov-24) closed at £195.00/t, gaining £1.00/t over the same period.

- There was a mixture of news in grain markets yesterday, which led to a mix in traded futures for both Chicago and Paris markets. However, UK feed wheat futures closed up across the board, partly supported by sterling weakening against the dollar. Trading closed yesterday at £1 = $1.2563. Markets were weighed on from Black Sea supplies but also are digesting the data on lower production from major wheat exporter, Australia. Read more in yesterday’s Grain Market Daily.

- In other news, it was reported yesterday that there could be revival to the Black Sea Grain Initiative. Turkish President Erdogan is in close contact with the UN and discussions on the matter are expected to continue at its general assembly this month (Refinitiv).

- Paris rapeseed futures (Nov-23) closed yesterday at €455.75/t, down €9.50/t from Monday’s close, following the pressure in Malaysian palm oil futures. Chicago soyabeans ended mixed, however nearby prices dropped due to chart-based selling.

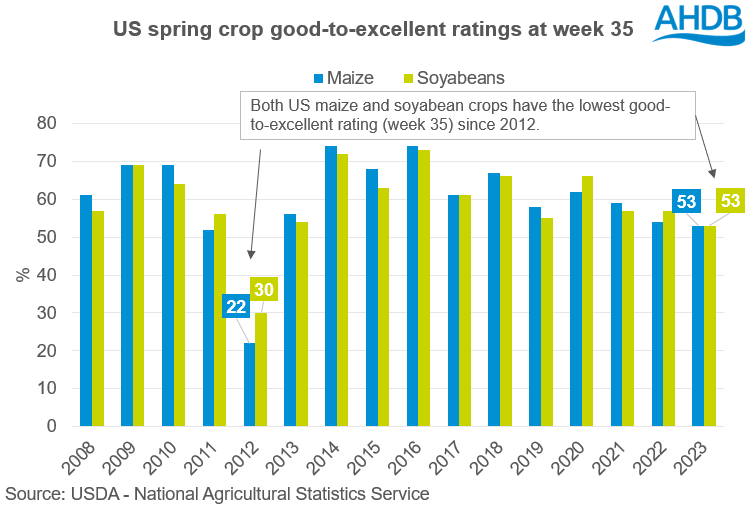

- In the latest US crop progress report released yesterday, both US soyabean and maize crop good-to-excellent ratings dropped further than expected from the recent dry weather over the US Midwest – more on this below.

US spring cropping in focus before harvest: Grain market daily

US spring crops are approaching maturity for harvest to begin over the next month. Recent hot temperatures over the past few weeks look to have impacted the condition of both US maize and soyabean crops.

From a price point of view, the hot dry weather in August put a bullish spur into soyabean markets as this crop, in large, it entered its critical development stages during the hot weather. At this point, maize had surpassed its critical stages. By the second week in August, 65% of US maize had moved beyond the silking phase (when most sensitive to heat stress) into the dough phase. For context, Chicago soyabean (Nov-23) futures gained 2.8% over the month of August, while Chicago maize futures (Dec-23) dropped 6.8%.

The longer-term outlook in the AHDB market reports for both maize and soyabean crops remains bearish, due to the large crops anticipated from South America boosting the supply outlook. However, it is important to remember the US soyabean and maize crops are forecast to account for 28% and 32% of global production this season (2023/24). Therefore, larger cuts than expected of these US crops could put a bullish spur into markets and if extensive, could change the longer-term sentiment.

The recent hot weather over the US Midwest has impacted these crops which is reflective in the crop condition scores.

Latest data (to week ending 3 September) shows that 53% of the US soyabean area is in good-to-excellent condition, down from 58% in the previous week. For maize, 53% of the crop is now rated good-to-excellent, down from 56% in the previous week.

Both of these crops are the lowest rated (at week 35) condition since the disastrous year of 2012, in which a widespread drought significantly impacted US spring crops.

Despite these crops being the worse rated in week 35 since 2012, they remain much better in comparison (as shown in graph). The five-year average (2018–2022) for these crops at this point in the growing season (week 35) is around 60% good-to-excellent, the current crops are only marginally below this average.

In states like Iowa (the largest producing soyabean and maize state) up until 29 August 2023, 18% of the state was in ‘extreme drought’ – up from 5% the week before (data to 22 August). However, this doesn’t compare to the same week in 2012, when 58% of Iowa was impacted by ‘extreme drought’.

As for the outlook from this information, it is unlikely we are going to see large downward revisions to these crops considering the previous trim to yields, though we could see marginal revisions in the September World Agricultural Supply & Demand Estimate out next Tuesday (12 Sep). Going forward, the US weather forecast over the next week is set to be cooler and rains are expected in parts of the US Midwest. This weather will still influence final yields, but it will become less relevant as the maize starts to mature and the leaves start to drop from soyabeans.

All in all, the US appears to be well supplied with maize and is expected to produce a near record crop this autumn. Though more caution remains with US soyabean markets, because:

- This recent hot weather has impacted soyabeans due to being at their critical development stage

- 2023/24 US soyabean ending stocks are currently expected to be the tightest since 2015/16, any further downward revisions to this crop could see that tighten further

US demand for soyabeans is expected to be strong this marketing year. If stocks in the US do tighten further from a lower soyabean production this autumn, we could see sustained support in the oilseed complex. Ultimately, into 2024 this will subside with large South American crops expected to come to market. While these crops are not even in the ground yet, on paper this is enough to anticipate prices being pressured into 2024.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.