Quality worries in Europe as rain stalls harvest: Grain market daily

Friday, 4 August 2023

Market commentary

- UK feed wheat futures slipped lower again yesterday as the global market concentrated on the competitiveness of Russian wheat and favourable weather forecasts for US maize. The Nov-23 contract lost £0.70/t to close at £195.15/t.

- Egypt’s state buyer, GASC, bought mainly Russian wheat in its latest tender. On Wednesday night GASC said it bought 360 Kt of wheat, of which 300 Kt was Russian.

- Commodity firm StoneX projects the US maize yield at 11.12 t/ha, only slightly (0.02 t/ha) below the official US forecast made in July. For soyabeans, StoneX pegs the US yield at 3.40 t/ha, below the current USDA projection of 3.50 t/ha. The USDA will issue its next crop forecasts on Friday 11 August, including the first yield forecasts based on a crop survey.

- Strong US export sales of soyabeans, along with the lower StoneX soyabean yield projection, pushed Chicago soyabean futures up yesterday. This filtered through to Paris rapeseed futures. The Nov-23 Paris rapeseed futures contract gained €15.25/t yesterday, closing at €459.75/t.

- However, global wheat futures are trading higher again today. Ukrainian drones attacked and reportedly damaged a warship in the Russian naval base at Novorossiysk overnight (Refinitiv). Grain loading operations at this key port paused but have resumed.

Quality worries in Europe as rain stalls harvest

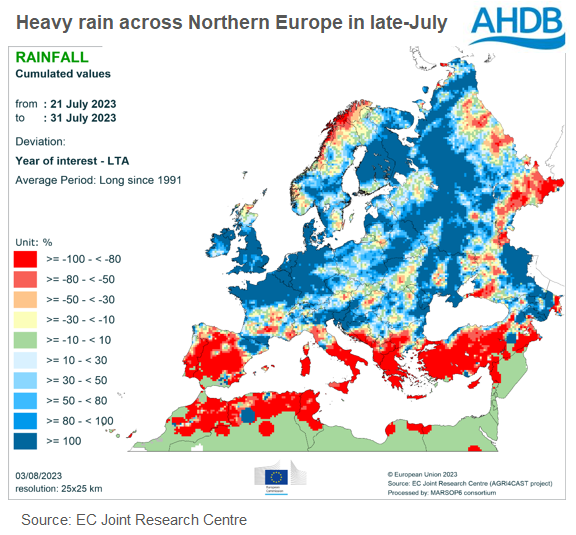

Wet weather is stalling harvests in parts of Europe, including the top wheat and rapeseed producers, France, and Germany. In France, most of the harvest was gathered before the weather broke but in Germany, there are growing concerns about yields and quality.

Germany

Wet weather is seriously hampering the German harvest. Although the winter barley was mostly harvested before the weather turned 14 days ago, the German Farmers’ Association (DBV) reported yesterday that less than 20% of the combined wheat, rye and triticale area has been cleared. Around half the winter rapeseed area also remains in the field.

Local analysts AMI report that many crops are already ripe, especially in southern areas. So, the harvest delays are likely to lead to both quality and yield downgrades, the question is to what extent. Fears are particularly high for malting barley crops, with German prices rising (AMI).

France

Meanwhile, in France, wet weather is slowing progress in the closing stages of the wheat harvest. Most crops were gathered before the rain, though there is concern for the quality of later harvested crops.

As of 31 July, 87% of wheat (exc. Durum) was cut, up just four percentage points in a week (FranceAgriMer). Winter barley harvesting is complete, and just 5% of the spring barley area remained as of Monday (31 July).

The French government this morning increased its forecasts for 2023 wheat and barley output (from July) due to slightly higher yields. The rapeseed crop estimate is 0.3 Mt lower than in July due to lower sunshine at flowering reducing yields. But, at 4.3 Mt, the crop is still well above average.

Meanwhile, maize crops remain in good condition, with nearly all crops in their critical reproductive stage.

Impact on the UK

In Europe, forecasts show more rain over the weekend, especially for Germany but the potential for some drier weather next week.

If the quality of German wheat suffers from the wet harvest, it could contribute to UK milling premiums staying strong. UK bread wheat premiums were high in the 2022/23 season.

This is a particular concern given that dry weather threatens Canadian crops too. Last week, crop condition scores were sharply lower than in mid-July due to the dry conditions. There has been limited rain since then, and the forecast also looks drier than usual for many regions over the coming week.

Canada, Germany, and to a lesser extent France, are key sources of wheat for the UK. Germany and Canada often supply high-protein bread wheat for blending with UK crops. Germany, France, and Canada accounted for 69% of UK imports last season (July 2022 to May 2023).

Germany, France, and Canada are also important players in the global rapeseed and barley markets. If there are reductions to rapeseed crops in Germany or Canada, it could tighten global rapeseed availability. This could in turn support rapeseed prices relative to those for other oilseeds. Meanwhile, the European barley market already looks tight this season (2023/24). Final yields and quality will be important to determining barley’s price relationship to other grains.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.