Arable Market Report - 31 July 2023

Monday, 31 July 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

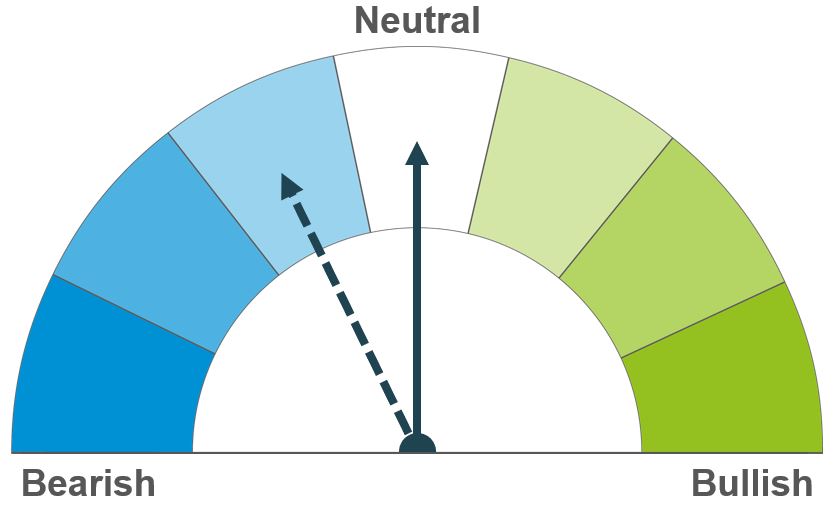

Tightness in global wheat supplies could bring support compared to maize prices. Uncertainty over Ukrainian exports puts more pressure on other major exporting nations to meet demand in the short-term. However, total grain supplies, especially US maize yields, will still influence the price direction.

Unless US maize yields are lower than the market currently expects, the market will gain confidence in total global grain supplies. Without lower yields, or other threats to supply, markets could return to a more bearish tone.

Global barley supplies remain tight and could tighten further if Canadian crop forecasts reduce. This could support barley prices relative to other grains, but price direction will still depend on the wider global grain outlook.

Global grain markets

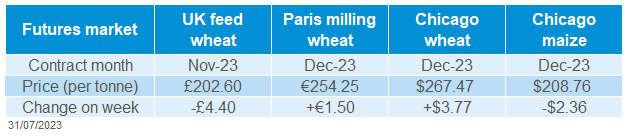

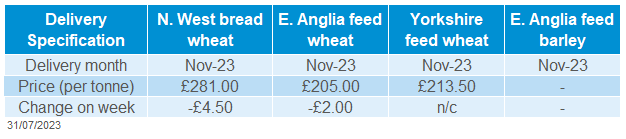

Global grain futures

Markets rose sharply after Russian air strikes damaged the Danube port of Reni. However, prices dropped back as the week progressed on forecasts of more favourable weather in the US Midwest and technical trading. There were also fewer reports of new air or missile strikes in Ukraine as the week went on. Refinitiv reports that the funds were net sellers of Chicago wheat and maize futures from Wednesday onwards.

Ukraine’s central bank expects the Black Sea corridor to be closed while the war continues. With questions over shipping via the Danube and what capacity there is for land exports, it is unclear how much Ukraine could export. Also, NATO increased its surveillance of the Black Sea last week.

Much of the top US maize growing area, the Midwest, experienced a heatwave last week and the proportion of US maize crops experiencing drought expanded again from 55% to 59%. High temperatures and drought during the crops’ current growth stages can reduce yields. However, much of July has been cooler than average, so the impact on yields is uncertain. Rain and cooler temperatures were expected to return over the weekend and continue into August.

A crop tour by the Wheat Quality Council in North Dakota in the US found better-than-expected spring wheat yield prospects. This is despite hot and dry conditions and raised optimism that yields for other crops in the US could also be better than forecast.

Hot, dry conditions are weakening yield prospects in parts of Canada. In the top wheat-growing province of Saskatchewan, just 35% of spring wheat crops were rated good / excellent on 24 July, down from 50% on 10 July. Barley and oat ratings were also sharply lower.

The EU Commission reduced its forecasts for EU-27 wheat, barley, and maize crops. This follows lower yield potential in the latest MARS report, which also flagged concerns about quality due to ongoing rain in parts of Eastern Europe. As a result, EU-27 wheat end of 2023/24 stocks (exc. Durum) are now pegged 3.1 Mt lower than was forecast in June and 2.5 Mt lower than 2022/23. Barley stocks are also now expected to contract over 2023/24, instead of expanding.

UK focus

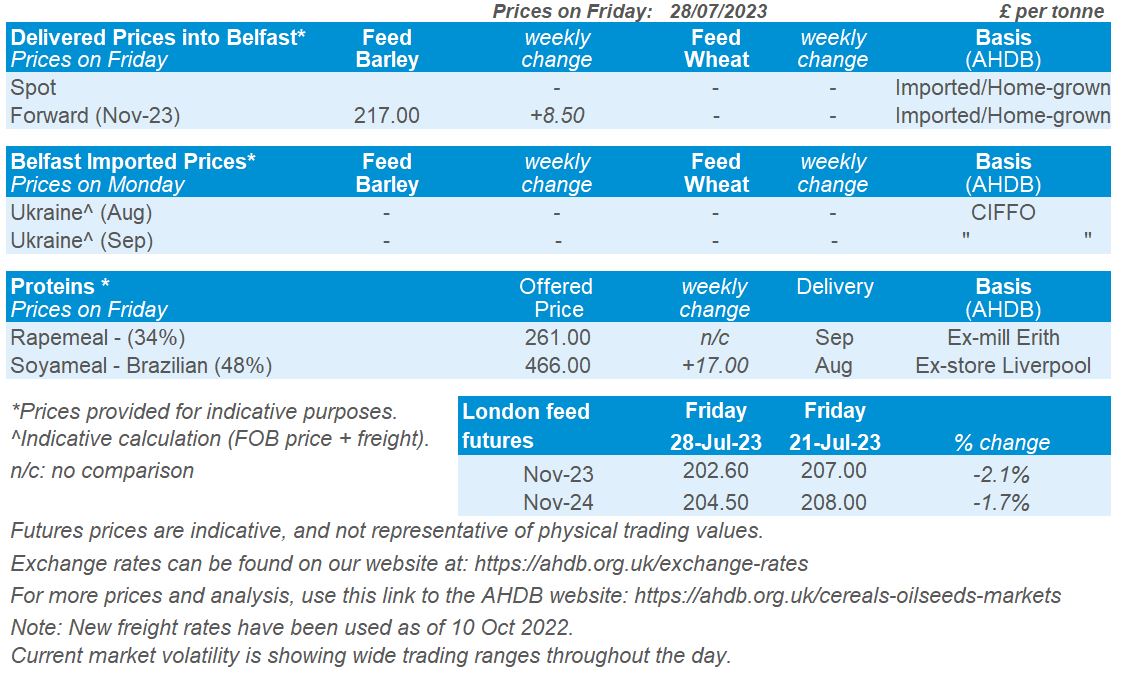

Delivered cereals

Despite gaining sharply last Monday, Nov-23 UK feed wheat futures ended last week at £202.60/t, down £4.40/t from Friday 21 July.

Full spec bread wheat delivered to the North West in Nov-23 was £281.00/t as at Thursday’s close in AHDB’s delivered price survey. This equated to a £75.00/t premium over Nov-23 futures. Full spec biscuit wheat for the same delivery (North West, Nov-23) was £228.50/t, equating to a £22.50/t premium over Nov-23 futures.

Farmers across the UK planted an estimated 1.746 Mha to wheat for harvest 2023, according to the AHDB Planting and Variety Survey. This is 1% less than for harvest 2022, with more barley and oilseed rape being grown. Across GB, Group 1 and 2 varieties account for an estimated 44% of the area.

At 1,154 Kha, the UK barley area is up 5% from 2022 and the largest since 2019. More winter and spring barley was planted. Scotland’s spring barley area is up 7% to 251 Kha, the largest area since 2020.

Meanwhile, the GB oat area is down 7% to 161 Kha, which is the smallest area since 2017.

Unsurprisingly, AHDB’s first harvest report of 2023 showed that recent wet weather slowed the start of the GB harvest. As of 25 July, 48% of the winter barley area was cut, behind last year’s rapid pace (93% complete) and slightly behind the five-year average (56%). So far, yields are ranging from 5.0 – 11.0 t/ha. Better yields have been reported on heavier soils, whereas lighter land suffered more from water stress during grain fill. Very small areas of winter wheat, spring barley and oats have also been harvested, in mostly southern regions.

Oilseeds

Rapeseed

Soyabeans

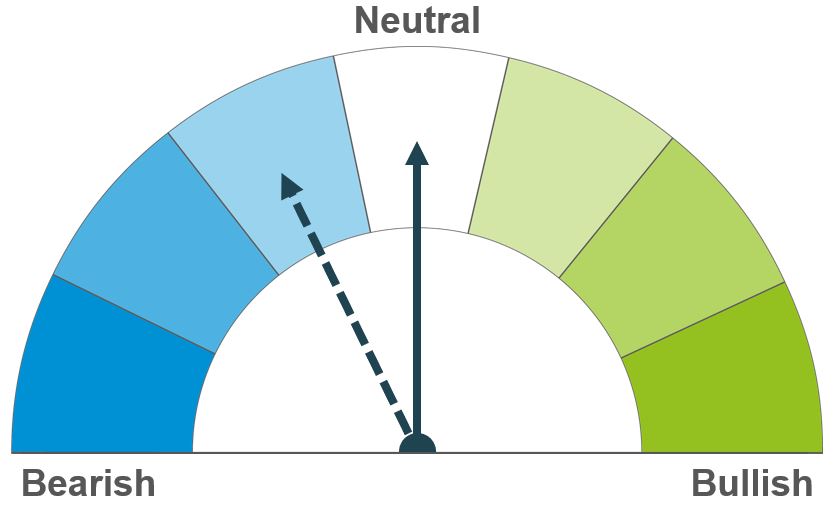

Short-term, an improved US soyabean outlook could pressure rapeseed prices. However, Black Sea exports remain in focus and any escalation could balance out any pressure in prices. Longer term, global and EU rapeseed markets look well supplied this season.

US weather remains in focus short term, with the crop in its critical growth stage. Longer-term, abundant South American supplies are likely to weigh on prices in 2024.

Global oilseed markets

Global oilseed futures

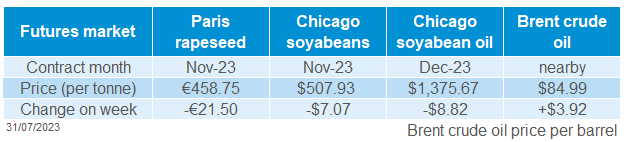

Last week, Chicago soyabean futures (Nov-23) fell 1.4% Friday to Friday. Despite climbs at the beginning of the week, an improved weather outlook across the US Midwest for August has a brought a bearish sentiment to the market. The wider market volatility due to escalations between Russia and Ukraine also seemed to settle towards the end of the week.

As of the week ending 23 July, 70% of the US soyabean crop was in its ‘blooming’ stage. This means that over the next few weeks, the crop will be particularly sensitive to moisture and temperature stress. The weather forecast for 8-14 days’ time is for cooler temperatures and ‘normal’ precipitation leading to an improved crop outlook. However, in the next seven days limited rain is forecast in some of the key soyabean producing states, with parts of Minnesota and Iowa not due any at all. This will be something to watch throughout the week.

The ongoing conflict in the Black Sea region will also be a watchpoint in oilseed markets. Ukrainian oilseed prices remain competitive against rivals and attractive to European buyers. This means that oilseed markets will likely be reactive to further news on export routes and/or any destruction of infrastructure on the Danube.

Malaysian palm oil futures (October delivery) have been weakening in line with the wider oilseed complex and fell to their weakest levels in nearly two weeks at midday today (UTC+8). On the other hand, Brent Crude oil futures saw some support across the last week. The nearby contract gained 4.8% (Friday – Friday) on the back of concerns that Saudi Arabia would extend voluntary output cuts into September, tightening global supply.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) were down 4.5% last week (Friday to Friday) as pressure filtered through from soyabean markets and the market reactions surrounding the Black Sea situation stabilised.

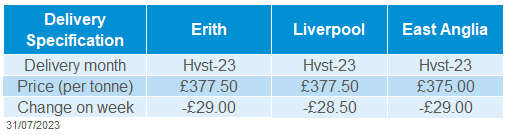

Domestic delivered prices followed futures price movement last week. On Friday, rapeseed delivered into Erith for harvest delivery was quoted at £377.50/t, down £29.00/t on the week.

On Friday, Stratégie Grains revised down its 2023/24 EU rapeseed production figure to 19.3 Mt, from the previous forecast of 19.8 Mt at the end of June. This is largely due to initial rapeseed yields being below expectations.

On Thursday, AHDB published the 2023 Planting and Variety Survey results. In the survey, the GB OSR area is estimated at 402 Kha, this is 11% higher than 2022 levels.

AHDB’s first harvest progress report of this season was also published at the end of last week. Wet weather meant that the winter oilseed rape harvest was only 21% complete by 25 July, well behind this point last year and slightly behind the five-year average. Yields are also variable, ranging from 1.0 – 4.9 t/ha, and averaging 3.0 t/ha. Read more on this in Friday’s Grain Market Daily.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.