UK wheat futures rise after latest air strikes on Ukraine: Grain market daily

Tuesday, 25 July 2023

Market commentary

- Yesterday, Nov-23 UK feed wheat futures rose £9.00/t to £216.00/t due to the escalation of the war in Ukraine (see below). The Nov-24 contract gained £6.50/t to £214.50/t.

- There were large rises across the global wheat market. Sep-23 Chicago wheat futures rose by its daily trading limit of $22.05/t (60c/bu) to reach $278.31/t, its highest price since late February. The trading limit expands to $33.07/t (90c/bu) today. Sep-23 Paris wheat futures gained €17.50/t, to close at €264.75/t.

- Speculative traders still held large short positions in Chicago wheat futures last Tuesday (CFTC). So, the price rises over the past week may have been accelerated by these traders needing to re-position.

- Oilseed prices also rose, but to a lesser extent. Paris rapeseed Nov-23 futures rose by €6.75/t to €487.00/t. The Aug-23 contract closed lower, but this was likely influenced by technical factors as its last trading day approaches (31 July).

- Initial trades on Paris wheat futures are lower this morning, suggesting some profit-taking. At midday (UK time) the Sep-23 contract was trading around €259.00/t.

UK wheat futures rise after latest air strikes on Ukraine

As covered in yesterday’s Market Report, Russian air strikes using drones damaged port infrastructure and destroyed grain storage in Reni, on the Danube. Wheat prices, including UK feed wheat futures, rose sharply after the attacks.

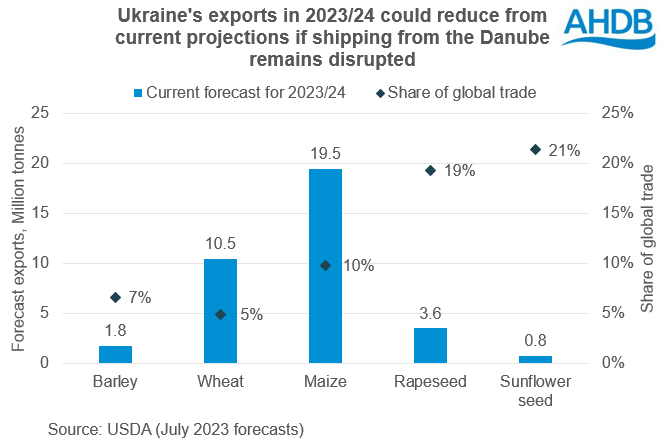

The Danube ports had become an important shipping route for Ukraine during the war. After the export corridor deal (officially known as the Black Sea Initiative) ended last week, the volume shipped via the Danube was expected to grow further. Rabobank estimated that the export capacity of the Danube ports was at 2.5 Mt of grain and oilseeds per month before the air strikes. Ukraine’s exports could fall from the current forecasts if shipping from the Danube continues to be limited.

What’s more, Ukrainian exports to the EU are restricted, after the large quantities of Ukrainian grain moving into the EU pushed down local prices. The EU currently only allows Ukrainian grain and oilseeds to enter Bulgaria, Hungary, Poland, Romania and Slovakia if those crops are in transit to elsewhere. The restrictions are due to end on 15 September, though these countries have requested an extension.

The UN have also asked Russia to enter talks about returning to the Black Sea Initiative, but so far this has been rebuffed by Russian sources.

Lower exports from Ukraine would again put extra pressure on other major exporters to supply the world. This would especially impact wheat, given the smaller US crop, and that stocks in major exporting countries were already expected to fall to multi-year lows.

One of the regions where the market will look to help meet global demand, at least in the short term, is the EU. Yesterday, the European Commission monthly MARS report cut its projections for all cereal and oilseed yields, apart from winter barley. The cuts follow drier-than-usual conditions in larger parts of western, central and northern Europe, as well as in eastern Romania; these downgrades added to the market sentiment yesterday.

US crop conditions broadly stable

The condition score for US maize was unchanged from a week earlier in last night’s report from the USDA. As of 23 July, 57% of the US maize crop remained in a good or excellent condition (vs 61% a year ago). Meanwhile, for soyabeans 54% of the crop is rated as good or excellent. This is down one percentage point from 16 July and five percentage points lower than a year ago.

The stability in crop conditions is a positive, ahead of the hotter and drier weather forecast for this week. Over two-thirds (68%) of the US maize crop are now ‘silking’. This is a critical development stage for the crop when hot and/or dry weather can cause more yield loss than at any other. Meanwhile, over a third (35%) of the soyabean crop is now setting its pods. Once the pods are formed, crops can suffer the greatest yield losses from any moisture stress. Next week’s condition scores will be closely watched.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.