Analyst Insight: Ukrainian grain weighs on EU markets

Thursday, 20 April 2023

Market commentary

- Old crop UK feed wheat (May-23) futures closed yesterday at £199.85/t, down £3.40/t from Tuesday’s close. New-crop futures (Nov-23) closed yesterday at £212.85/t, down £3.95/t over the same period.

- Domestic futures followed global wheat markets down yesterday, as rain is due across the US wheat belt and vessel inspections resumed under the Ukrainian grain export corridor (Black Sea Initiative). News also came on Poland and Romania allowing transit of Ukraine grain to ports, more on this below.

- Paris rapeseed futures (May-23) closed yesterday at €469.25/t, down €7.75/t from Tuesday’s close. Nov-23 futures closed at €474.00/t, down €6.00/t over the same period. Rapeseed prices followed pressure across Chicago soyabeans, as well as weakness in brent crude and wider vegetable oil contracts.

Ukrainian grain weighs on EU markets

The export of Ukrainian grain remains a key watchpoint in the market, short and long term, with uncertainty of supply keeping some volatility in global prices.

In recent weeks, market concern has been building around whether the Black Sea Initiative will be renewed. There has also been mounting concerns from some EU member countries about cheap Ukrainian grain pushing down local prices, which has played into some global wheat price pressure. Poland, Hungary, and Slovakia all announced bans on Ukrainian grain imports in the past week, and Bulgaria joined them temporarily yesterday too. Today, I run through this in more detail following a response from the European Commission.

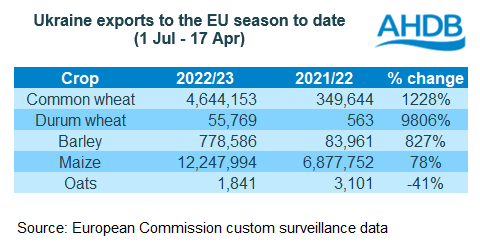

Large quantities moving into the EU

With the outbreak of war in Ukraine, movement of cereals and oilseeds from Ukraine changed. Eastern European countries become transit routes for Ukrainian grain that could not be shipped from Black Sea ports. Bottlenecks experienced in moving this grain has meant lots of grain has stayed in countries bordering Ukraine, pressuring grain prices for local farmers (Refinitiv).

It is important to remember, after the outbreak of war in Ukraine in February 2022, the Black Sea Initiative was only signed in July 2022, to allow the movement of grain from Ukrainian ports.

So, how much has moved into the EU?

Where now?

In response to mounting concerns and import bans, the European Commission said yesterday it would take emergency ‘preventative measures’, preparing €100 million in compensation for farmers in countries bordering Ukraine. Additionally, wheat, maize, rapeseed, and sunseed entering Bulgaria, Hungary, Poland, Romania, Slovakia would only be allowed should this grain/oilseed be set for export to other EU members or to the rest of the world. This is to remain in place until the end of June. Other sensitive products are now being looked at too.

What does this mean?

The forecast for this season’s EU ending stocks of major grains is higher on the month. The stock accumulation seen is said to stem from the high quantities of Ukrainian grain moving into the EU, according to consultancy Stratégie Grains.

Action taken by the European Commission may limit more build-up of Ukrainian grain in the EU. However, ultimately for wheat especially, large carry-in stocks for 2023/24 and large EU production for harvest 2023 forecast, will contribute to a heavy wheat balance next season (Stratégie Grains).

Looking to next season, a key point with understanding future price direction is that Ukraine’s grain harvest is due to fall again. Ukraine’s Ministry of Agriculture peg production of wheat in 2023/24 at 16.6Mt (-19% YOY), barley at 4.8Mt (-17%) and maize at 21.7Mt (-11%).

Thinking about price action over the next few months, the expiry of the Black Sea Initiative mid-May, plus agreements on movement into the EU will be important short term. However, ample cheap Black Sea supplies are expected to keep pressure on the wheat market as we move towards the end of the season.

Looking ahead, weather for Northern Hemisphere crops will be key. Though, overall grain production prospects look strong, with the exception of smaller Ukrainian production, and with larger carry-in stocks for the EU and UK, this could add to domestic new season price pressure.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.