Arable Market Report - 17 April 2023

Monday, 17 April 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

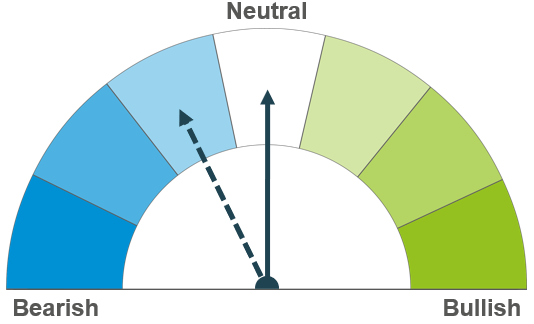

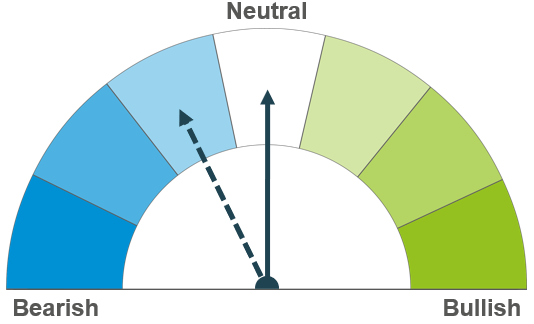

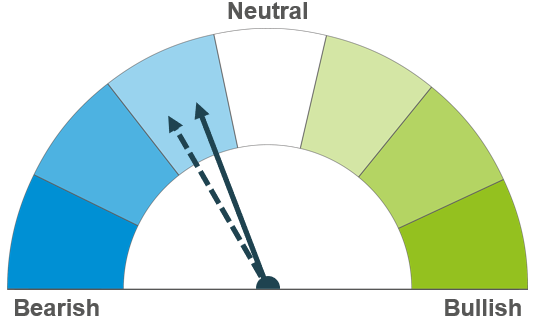

Short and longer term, cheap Black Sea supplies pressure global wheat prices. Though the renewal of the Ukrainian export deal (Black Sea Initiative) in May has the potential to create volatility and cap large price losses. Longer term, new crop condition will be key.

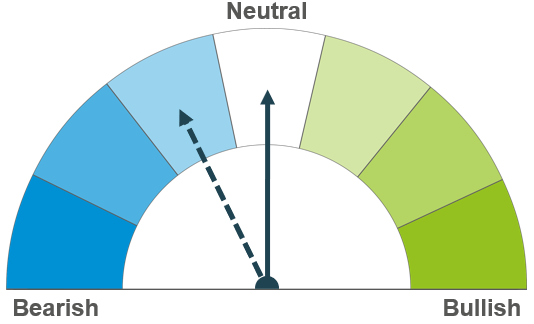

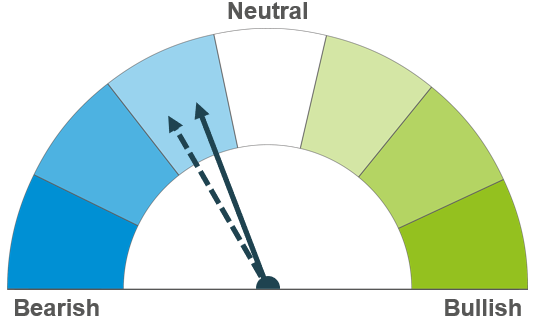

Demand news will be key for short term price direction, especially continued Chinese buying of US maize. Longer term, a large Brazilian crop and large forecast US crop, could pressure the market. US planting progress and weather will be followed by the market.

Barley prices continue to track the wider grains markets. The discount of ex-farm UK feed barley to UK feed wheat stood at £22.50/t as at 06 April, increased from the week before.

Global grain markets

Global grain futures

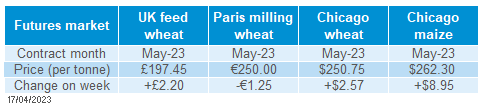

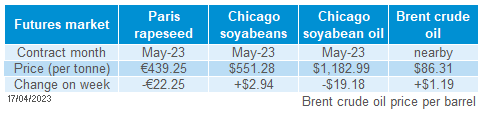

Last week, global wheat contracts saw mixed price action. Chicago wheat (May-23) gained on the week, supported by US wheat crop concerns, uncertainty surrounding the Black Sea Initiative (Ukrainian grain corridor) continuity, as well as some support from Chicago maize on Friday. Whereas, new-crop Chicago wheat (Nov-23) closed down slightly on the week. Despite an easing euro boosting Paris wheat prices on Friday, Paris wheat (May-23) saw a small decline on the week. Prices remain capped by plentiful Black Sea supply.

Russia continues to cause concerns that the Black Sea Initiative may not be extended again mid-May, unless obstacles to Russia exporting their grain and fertiliser are removed by the West. On Friday, Russia said there is still time to remove these obstacles. The deal is due to expire 19 May, as we move closer to this date, we might expect some price volatility. Today, Russia has reportedly blocked ship inspections again, according to Ukraine’s Restoration Ministry.

Cheap Black Sea wheat has lent pressure to global wheat prices for several months and continues to do so. Though news came yesterday that Poland and Hungary have announced bans on grain and other food stuff imports from Ukraine. This comes after concerns from EU members of cheap Ukrainian grain pushing down price paid to local farmers.

The USDA released the latest WASDE last week, though no huge market reactions were seen in response.

New crop is in focus for price action. As reported in our previous Market Report, US winter wheat ‘good to excellent’ condition remains poor. Weather remains a key watchpoint, for condition improvement as well as US maize planting. FranceAgriMer pegs French soft wheat condition up slightly (1 percentage point) at 94% good to excellent as at 10 April.

The rise in Chicago maize futures (May-23) from Chinese buying, also supported wheat values at the end of last week. The USDA reported private sales last week, totalling 437Kt for 2022/23 and 272Kt for 2023/24.

UK focus

Delivered cereals

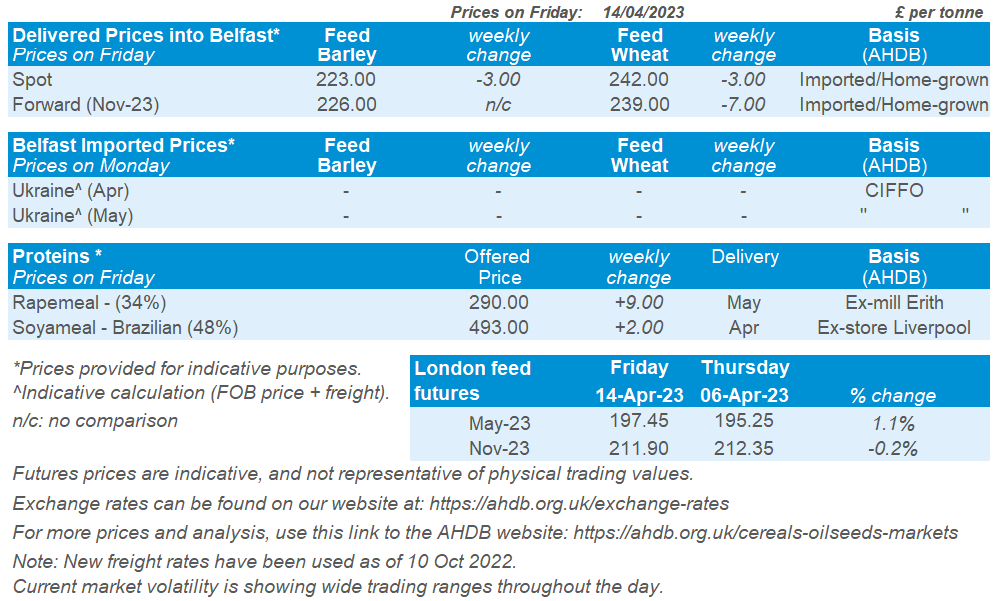

Old crop UK feed wheat (May-23) futures gained last week (Thursday to Friday), up £2.20/t to close on Friday at £197.45/t. New-crop futures (Nov-23) closed on Friday at £211.90/t, down £0.45/t over the same period. This followed US wheat futures movements.

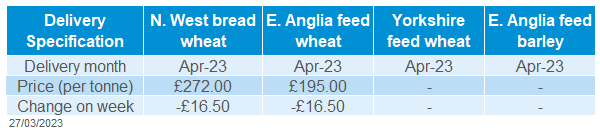

Domestic delivered prices followed futures movements (Wednesday to Thursday). On Thursday, feed wheat delivered into East Anglia (April delivery) was quoted at £193.50/t, down £4.50/t on the week.

Bread wheat delivered into the North West (April delivery) was quoted at £270.00/t, down £4.50/t on the week.

Feed barley delivered into Avonrange (May delivery) was quoted on Thursday at £178.50/t, down £4.00/t from the previous week.

The latest trade data released by HMRC, up to February, was published last week. The latest data shows wheat exports at 927Kt so far this season (July to February), up more than three times from the same period last season. UK oat and barley exports totalled 129Kt and 775Kt over the same period. For analysis on this, please follow this link.

The latest GB fertiliser price was released last week. Domestic AN fertiliser for March was quoted at £465/t, the same price as imported AN too.

Oilseeds

Rapeseed

Soyabeans

Short-term, losses in vegetable oil markets continue to weigh on rapeseed prices. Longer-term, ample supplies forecast in Europe will likely pressure prices moving forward, with European weather remaining a watchpoint.

With the record Brazilian crop now coming onto the global market, prices are under pressure in the short and long term. Doubts over future Chinese demand could also weigh on the market.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures (May-23) saw little change on the week, up 0.5% (Thursday 06 April - Friday 14 April), closing at $551.28/t on Friday. The US soyabean market saw some support at the beginning of the week following a further cut to Argentinian soyabean production in the latest WASDE released on Tuesday. However, soyabean futures were then pressured towards the end of the week after China’s Agriculture Ministry issued a three-year plan to reduce the use of soyameal in animal feed production. Chicago soyabean futures were also pressured after the estimated size of the Brazilian soyabean crop was increased further last week by Brazilian agency Conab.

Following the release of this month’s USDA World Agricultural Supply and Demand Estimates (WASDE), Chicago soyabean markets were supported, as Argentinian production was cut further than analysts had expected. In a pre-report Refinitiv poll, trade estimates averaged 29.3Mt. Tuesday’s report pegged Argentinian production at 27Mt, down 6Mt from last month, due to the hot and dry weather throughout March.

While Argentinian production has been slashed further, the Brazilian soyabean crop remains at a record high this season. On Thursday, the Brazilian governments food supply and statistics agency Conab, revised the estimate of the country’s soyabean crop up by 2.2Mt, now pegged at 153.6Mt. According to Conab, record average yields have been recorded across Brazil, as harvest draws to a close across many parts of the country. It was also noted that lower fertiliser applications were compensated by adequate rainfall and sufficient sun exposure in the key producing regions. Plentiful Brazilian supplies coming onto the market will likely add a bearish sentiment over the next few weeks as harvest concludes, something to watch out for.

On Friday, China’s Agriculture Ministry issued a plan to limit soyameal rations in animal feed production to under 13% by 2025, down from the 14.5% inclusion in 2022. The plan comes as China, the world top soyabean importer, aims to reduce its heavy reliance on imports. Instead, the Ministry hopes that it can improve self-sufficiency. On the back of this news on Friday, soyameal futures lost $4.30/t from Thursday’s close, ending the session at $506.59/t.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures came under pressure last week alongside losses in the wider vegetable oil complex, as well as beneficial weather conditions across Europe. The May-23 contract was down 4.8% on the week (Thursday 06 April to Friday 14 April).

Rapeseed markets followed losses in global soyabean oil markets last week. Chicago soyabean oil (May-23) was down 1.6% over the week, closing at $1182.99/t. Malaysian palm oil futures (May-23) were also down 1.6% over the same period.

Refinitiv Commodities Research said on Wednesday that soil moisture had elevated across much of the continent over the past couple of weeks, benefitting winter crop condition. Rapeseed production in the EU-27 + UK remains at 22.0Mt for harvest 2023/24, unchanged from the previous estimate.

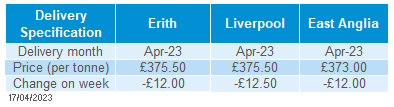

Delivered rapeseed prices (into Erith for April delivery) followed futures price movements last week, quoted at £375.50/t on Friday, down £12.00/t from the previous Thursday.

HMRC released the latest trade data on Thursday, with an update for rapeseed exports up to the end of February. This season to date (July – February), the UK imported 540.1Kt of rapeseed, down 27% from the same point last season.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.