Argentinian maize and soyabean production cut further in latest WASDE: Grain market daily

Wednesday, 12 April 2023

Market commentary

- UK feed wheat futures (May-23) closed at £195.10/t yesterday, down £0.15/t from last Thursday’s close. New crop futures (Nov-23) lost £1.25/t over the same period, ending the session at £211.10/t.

- According to Refinitiv, beneficial rainfall across Europe over the last couple of weeks has benefited the European wheat outlook, though parts of south-western Europe particularly still need more rain to reduce potential dryness stress.

- Reportedly no ships were inspected yesterday under the Ukraine Black Sea grain deal according to Refinitiv, as “parties needed time to reach an agreement on operational priorities” as stated by the UN. Routine inspections are due to resume today.

- Paris rapeseed futures (May-23) closed at €460.50/t yesterday, down €1.00/t from Thursday’s close. New crop futures (Nov-23) were also down €1.00/t over the session, closing at €464.25/t.

- Forecasts of a good European rapeseed harvest continues to pressure prices. France’s Farm Ministry pegged its rapeseed area for harvest 2023 at 1.34Mha this morning, up 9.3% on the year.

Argentinian maize and soyabean production cut further in latest WASDE

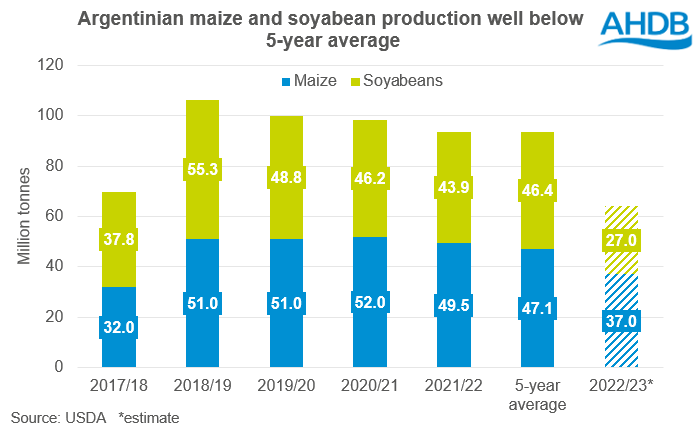

Yesterday, the USDA released their latest World Agricultural Supply and Demand Estimates (WASDE). With much of the market focus now on new crop conditions for next season’s production, the report didn’t result in any major market reactions. However, South American production remains a watchpoint, and as expected by many, further revisions were made to Argentinian maize and soyabean crops. So how did the revisions compare to analyst’s expectations? And what does that mean for the global supply and demand balance?

Maize

Ahead of yesterday’s report, in a Refinitiv poll, the average of analysts’ estimates for Argentinian maize production sat at 37.1Mt. Analyst expectations were fairly accurate, with production pegged at 37.0Mt, down 3.0Mt from last month’s estimate. If realised, production would be the lowest since 2017/18, as the extreme drought and continued heat throughout March pressures yield prospects for late-planted maize. While this is now the fourth month in a row that the USDA has cut Argentinian maize production, it’s worth noting that the estimate remains above the Buenos Aires Grain Exchange estimate of 36.0Mt. Brazil’s maize crop also remains pegged at 125Mt, a record high.

As global production was trimmed, Argentina’s exports were also revised to 25.0Mt, down 3Mt from the previous months report. In terms of what this means for global supply and demand, analysts had predicted world maize ending stocks to be at 295.0Mt. The USDA pegged stocks at 295.4Mt, slightly higher than expected, but down 1.1Mt on last month’s estimate. Yesterday’s report did not lead to much price action on the US maize market, suggesting much of this news had already been priced in. Chicago maize futures (May-23) closed at $256.30/t, down $1.18/t from Monday’s close. New crop futures (Dec-23) lost $1.37/t over the same period, ending the session at $220.18/t.

Despite large cuts to Argentinian production, and tight US stocks as at the end of March, much of this is priced in. It’s likely that demand will be a key driver of price direction. We know supply is going to increase going forward too, with a large Brazilian crop on the market, plus a large US crop due in September.

Soyabeans

The soyabean production estimate for Argentina was also expected to be cut in yesterday’s report, with analyst estimates averaging 29.3Mt. In the report, the figure was revised down by 6.0Mt from last month, now pegged at 27Mt, again due to the hot and dry weather conditions in March. If realised, this would be down around 19Mt on the five-year average. The USDA soyabean figure also remains above the Buenos Aires Grain Exchange estimate, which sits at 25.0Mt. Soyameal also saw a cut in global production, now pegged at 247.6Mt, largely due to a cut in Argentinian production.

The cut to Argentinian soyabean production was partially offset by a rise in the Brazilian production estimate. Analysts predicted a rise of 670Kt from last month’s report to 153.7Mt. However, the USDA pegged Brazilian soyabean production at 154Mt, up 1.0Mt from their previous estimate.

Despite the overall cut in global production, total domestic consumption of soyabeans was revised down by 5.3Mt, now estimated at 365.8Mt. As a result, soyabean ending stocks were raised slightly to 100.3Mt, up 28Kt on last month’s estimate, and up 1.7Mt on analyst expectations.

In terms of market reactions, with a greater-than-expected cut to the Argentinian soyabean production, Chicago soyabean futures (May-23) gained $3.67/t over yesterday’s session, closing at $550.09/t. Soyameal markets followed suit. The May-23 Chicago soyameal futures contract gained $7.83/t yesterday, ending the session at $504.5/t.

Wheat

While there weren’t any major revisions to global wheat supply and demand, there were some small tweaks. Global production was revised up very slightly to 789.0Mt, and global wheat consumption revised up nearly 3Mt, to 796.1Mt.

These revisions saw world wheat ending stocks revised down by 2.2Mt, now pegged at 265.1Mt, below analyst expectations of 267.1Mt.

Chicago wheat markets saw a muted, slightly bearish, reaction yesterday, with the May-23 contract down $1.65/t, closing at $247.63/t. Global wheat markets remain pressured by cheap Black Sea wheat. Looking forward, US weather will be a key watchpoint over the next few weeks, as will any news on the renewal of the Black Sea Initiative.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.