Maize market explainer: Grain market daily

Wednesday, 5 April 2023

Market commentary

- Old crop (May-23) UK feed wheat futures fell back £3.95/t yesterday, to close at £200.85/t. New crop futures (Nov-23) lost £3.90/t over the same period, to close yesterday at £215.20/t. The carry into new crop now stands at £14.35/t.

- Today, as at 13:00, UK feed wheat futures (May-23) were trading at £195.50/t. This pressure follows Chicago wheat markets, on favourable US weather for spring planting.

- Domestic futures contracts followed global wheat and maize markets down yesterday, with improved (warmer and drier) US weather prospects for spring planting, despite the low US ‘good to excellent’ winter wheat ratings.

- Paris wheat markets too saw price action yesterday that increased the carry into the new season. From old crop (May-23) to new crop (Dec-23), this carry now stands at €6.00/t.

- Paris rapeseed futures (May-23) fell €11.75/t yesterday, to close at €478.25/t. Like wheat, new crop was also positioned for a carry into the new season yesterday, though much smaller. The new crop contract (Nov-23) closed at €478.50/t yesterday.

- Pressure came yesterday from a stronger euro, the Brent crude oil price rally on Monday slowing yesterday as well as some wider weakness in Chicago soyabean prices too. Chicago soyabean futures (May-23) closed yesterday at $557.53/t, down $1.65/t.

Maize market explainer

Volatile wheat prices have certainly dominated news in recent weeks and months in grain markets. However, over the past few weeks we have been seeing a different movement in maize markets, with less significant falls than wheat.

Today, I look at the reasons why this is happening, whether this might continue and what this could mean for maize prices – the floor to the grain market.

Falls capped on maize markets

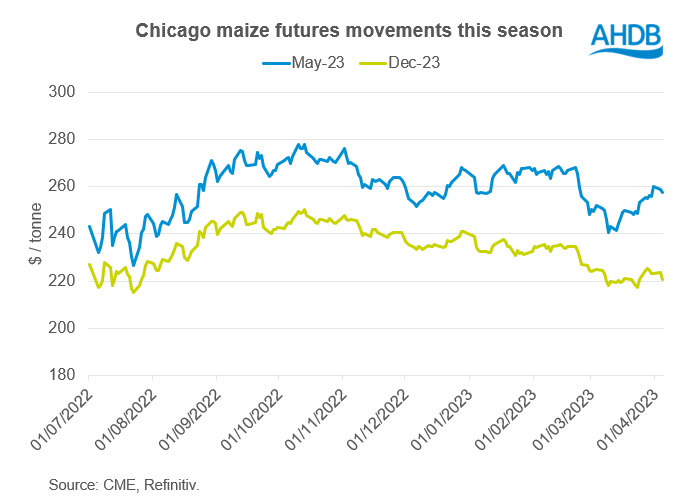

Since the start of 2023, old crop (May-23) Chicago maize futures have fallen 2% and new crop futures (Nov-23) have fallen 8% over the same time frame. So, let’s compare this to wheat markets. Over the same period, May-23 and Dec-23 Chicago wheat futures have fallen 12% and 9% respectively, with Paris wheat futures dropping 17% (May-23) and 10% (Dec-23). UK feed wheat futures also have fallen 18% (May-23) and 7% (Nov-23) over the same period too.

There seems to be several key factors to why maize markets have not seen falls to the same extent as wheat markets. Firstly, the Argentinian supply outlook has been reduced on drought conditions. In addition to this, tight US stocks, combined with continued Chinese buying has also provided some support to markets in recent weeks. This is also in the context of war ongoing in Ukraine too, though maize has continued to leave Ukraine. Lastly, wheat markets have been pressured, unlike maize, by competitive Black Sea supplies.

Global supply - drought impacted Argentinian maize crop

Maize harvest has started in Argentina, though at 7% complete nationally to 29 March, this lags behind the same point last year of 14.4% and the five-year average of 16.7% complete according to the Buenos Aires Grain Exchange.

It is understood that early maize yields have been impacted by hot and dry conditions during grain filling and yields of late planted maize are expected to be impacted by high temperatures during pollination (Soybean and Corn Advisor). The Argentinian crop is currently forecast at 36Mt by the Buenos Aires Grain Exchange, down from 52Mt in 2021/22.

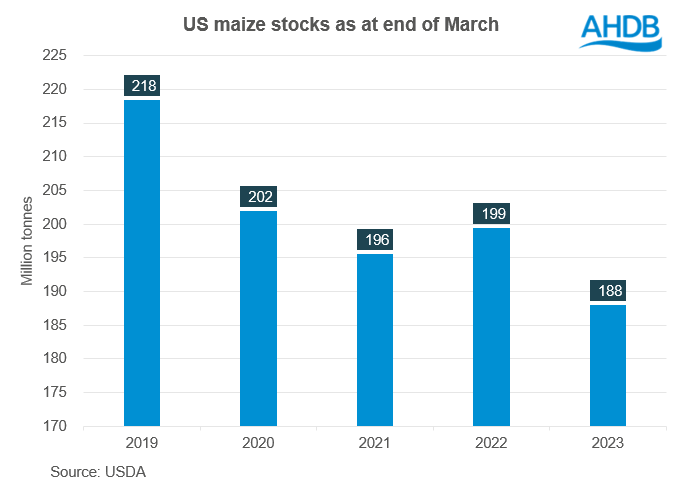

US stocks tight

In addition to Argentinian crop concerns, as well as the ongoing war in Ukraine impacting maize harvest, US maize stocks as at the end of March were tighter than seen in previous seasons.

As the world’s largest maize exporter for the past five years, accounting for an average of 33% of global maize exports (2017/18 – 2021/22), the US is important to global availability (USDA). US maize exports are expected to be down on the year, with the USDA forecasting the US to be the second biggest global maize exporter in 2022/23, after Brazil who have had an ample crop.

Chinese buying

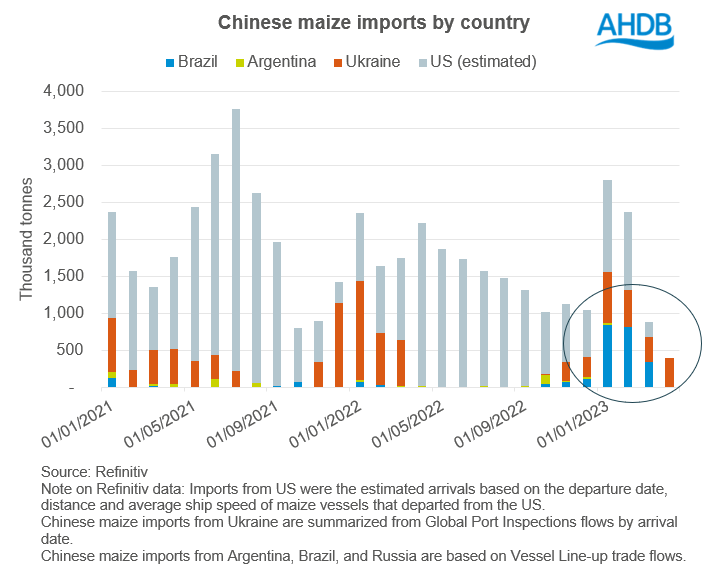

Finally, flash sales of US maize to China, has also lent some support to prices in recent weeks. So how much are China importing and from where?

We can see in the graph that while China is still purchasing from the US, and Ukraine, they are more heavily relying on Brazilian maize this season too.

What does this mean?

Despite some support remaining in the maize market, old crop wheat prices continue to fall, pressured by competitive Black Sea wheat.

I have talked about many factors supporting maize markets short term, with tight US stocks and reduced Argentinian supply, met with continued Chinese purchasing, but how much of this is priced in? Short term, demand may be a key influence on price direction, including the outlook for Chinese buying, as well as demand outlets for ethanol in the US and Europe.

However, what we do know is that supply looks to increase going forward. The large Brazilian crop is on the market, plus a large US maize area is forecast for 2023/24 (37.2Mha, up 4% on the year). Plantings have started too and are 2% complete, as at 02 April. US harvest is due in September. If this large crop is realised, we could expect some maize price pressure as the year progresses.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.