Could rapeseed prices drop further? Grain market daily

Tuesday, 4 April 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £204.80/t, gaining £1.55/t from Friday’s close. New crop futures (Nov-23) closed at £219.10/t, gaining £1.35/t over the same period.

- Mixed trade in wheat markets yesterday, with the domestic market following Chicago wheat futures up. The USDA in its first weekly crop progress report of 2023 rated 28% of the US winter wheat crop in good to excellent condition as at 2 April. This is the lowest for this time of year on records dating back to 1989, as drought persists in large proportions of the Plains.

- The Paris market ended down on Monday, after a see-saw session, with the market reacting to higher crude oil prices, uncertain weather, and adjustments between old and new crop pricing (Refinitiv).

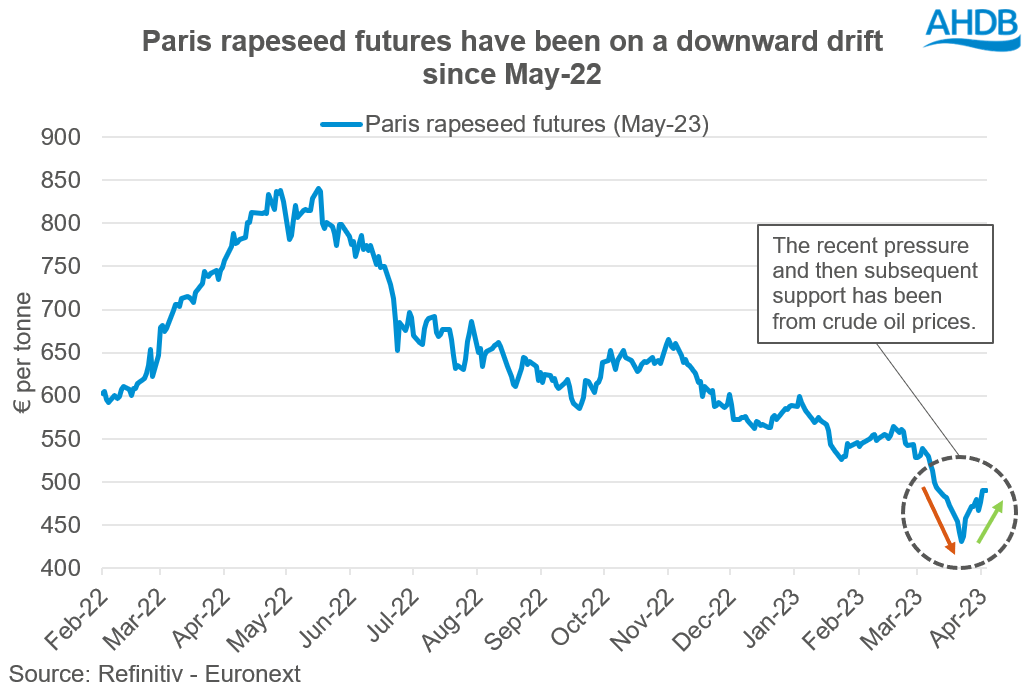

- Paris rapeseed futures (May-23) closed yesterday at €490.00/t, gaining €14.25/t from Friday’s close. Support comes from the upward movements in Brent crude oil futures (nearby), which closed yesterday at $84.93/barrel, gaining $5.04/barrel from Friday’s close. Crude oil was supported by surprise cuts to oil production from OPEC+, read more information on this in yesterday’s market report. While this recent support has broken rapeseeds latest losses, will it continue to keep prices higher – read more information below.

Could rapeseed prices drop further?

In March, old crop (May-23) Paris rapeseed futures lost over €50/t (1 to 31 Mar). Domestic prices also fell over the same period, with delivered rapeseed (into Erith, May-23) being quoted at £408.50/t last Friday (31 Mar), which was up £21.50/t on the week, but down from £466.00/t on 3 March.

When the 2023 crop was sown last Autumn, Paris rapeseed futures (May-23) were trading at well over €600/t, significantly above prices seen of late.

Rapeseed prices in general have been on a downward drift since they peaked last May, on the back of the start of the war in Ukraine. However, the decline has been accelerated over the last month, notably from pressure in crude oil markets, which have been influenced by the ups and downs in financial markets. Despite the recent support for rapeseed over the past week, on the back of crude oil prices rebounding somewhat, rapeseed prices still have the potential to be pressured further.

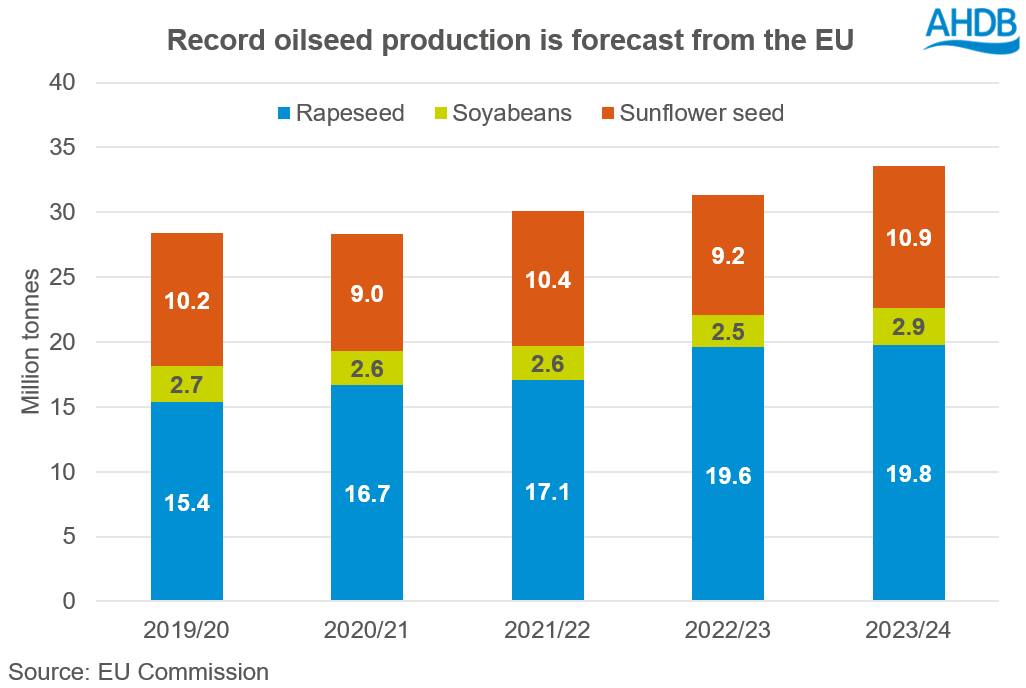

The reason for that, is the growing supply on the continent of oilseeds. According to latest estimates from the EU commission, total EU oilseed production (rapeseed, soyabeans, sunseed) is set to increase by 7% on the year in 2023 to 33.5Mt, a new record. A growth in supply will continue to pressure continental prices, which will inherently feed into our domestic prices, with all major oilseed production in the EU expected to grow for the 2023/24 marketing year.

Also, consumption for vegetable oil in the EU is being affected by high inflation at the moment, with meal consumption also being impacted by a reduction in animal feed demand (from the impacts of AI). The reduction in consumption is adding to ending stocks for 2022/23, leading to a larger carry-in for the 2023/24 marketing year.

What is critical to note is that declines in the oilseed complex will be moderated, due to the tightness in the global soyabean market, off the back of constrained global supply due to Argentina’s drought. However, there could still be further downward pressure onto rapeseed prices as we approach harvest 2023, with more than ample supplies expected from Europe.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.