Arable market report - 03 April 2023

Monday, 3 April 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

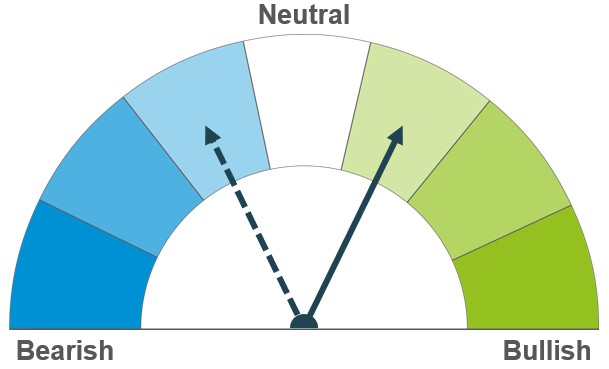

Competitive supplies from the Black Sea region continue to pressure prices in the short and long-term. However, speculation over potentially reduced Russian supplies from July will likely keep prices volatile.

Strong Chinese demand and lower US stocks continue to provide some support in maize markets short term. Longer-term, the large Brazilian crop will likely put pressure on global prices.

Barley prices continue to track the wider grains complex. Discount of ex-farm UK feed barley to UK feed wheat stood at £19.40/t as at 23 March, widening on the week.

Global grain markets

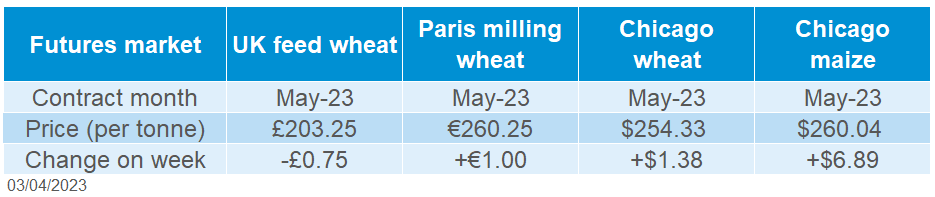

Global grain futures

Global grain markets remained volatile last week. Old crop Chicago wheat futures (May-23) were up slightly (0.5%) across the week (Friday to Friday), with new crop futures also up over the week (1%) with concerns over Russian supplies a key driver at the beginning of the week. Competitive Black Sea supplies, as well as larger than expected US plantings weighed on grain markets. Though smaller than anticipated US maize stocks as well as strong Chinese demand added some support for global maize futures.

Competitive Black Sea supplies continue to bring down grain prices on the continent. It was reported on Friday that prime ministers of Poland, Hungary, Romania, Bulgaria and Slovakia had sent a letter to the European Commission calling for measures to prevent Ukrainian grain from ending up in EU markets. It also suggested that if certain measures weren’t successful, tariffs and tariff quotas should be reintroduced (Refinitiv). This will be something to watch over the next few days.

Also on Friday, the USDA released their US prospective plantings and quarterly grain stocks reports. All wheat plantings for 2023/24 were larger than analysts expected at 20.2Mha, up 9% on the year. Spring wheat area is estimated at 4.3Mha, down 2% on the year. Maize plantings were also greater than trade estimates, pegged at 37.2Mha up 4% on the year. However, according to Refinitiv, analysts also warned that wet weather in southern parts of the US crop belt and snow in the Dakotas and Minnesota could delay plantings in the coming weeks.

The US quarterly stocks report also saw unexpected results. US maize stocks trade estimates averaged 189.7Mt in a pre-report Reuters poll, though the USDA pegged maize stocks at 187.9Mt, down 5% from the same point last year. Strong demand from China for US maize is ongoing with more flash sales seen over the last week. This strong demand combined with smaller stocks saw old crop futures (May-23) climb 2.7% across the week (Friday to Friday), whereas an increased planted area estimate limited any gains on new crop futures (Dec-23), up just 1.1% over the same period.

UK focus

Delivered cereals

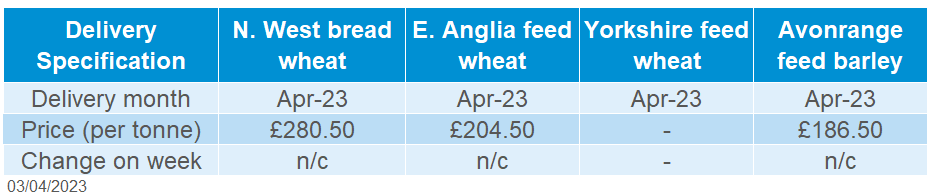

Domestic feed wheat futures were also volatile last week. Old crop futures (May-23) ended the session on Friday at £203.25/t, down 0.4% from the previous week. New crop futures were up 1% over the week, closing on Friday at £217.75/t.

Delivered prices followed Thursday to Thursday futures movement last week. Feed wheat delivered into East Anglia (May delivery) was quoted at £205.50/t, up £8.50/t on the week. For the same destination, feed wheat for July delivery was quoted at £208.50, gaining £9.00/t across the week.

Bread wheat delivered into the North West for April delivery, was quoted at £280.50/t on Thursday.

Feed barley into Avonmouth for May delivery was quoted at £187.50/t, up £3.00/t on the week.

On Thursday, the AHDB published the latest UK cereal supply and demand estimates for the 2022/23 season. The main revisions include a further reduction in total cereal demand for animal feed, as well as increased exports for wheat and oats, reflecting the recent export data.

On Friday, the latest crop development report was released, with conditions scores to the week ending 28 March 2023. The report showed that generally the mild autumn enabled crops to establish well, with 90% of winter wheat in good or excellent condition. More recently, increased heavy rainfall throughout March has delayed spring drilling for some, as well as delaying fertiliser and pesticide applications in some regions. It is also noted there is some disease pressure in winter barley crops. Something to watch over the next few weeks. Read more in Friday’s Grain Market Daily.

Oilseeds

Rapeseed

Soyabeans

There has been some short-term support in rapeseed prices from crude oil and soyabeans, but global rapeseed supply is expected to grow next year which could weigh on prices further, short and longer term.

Short-term the bullish news from the USDA (for stocks and plantings) has supported prices. However, the US are expected to sow the third largest soyabean area on record. Focus will be on US weather in the coming weeks.

Global oilseed markets

Global oilseed futures

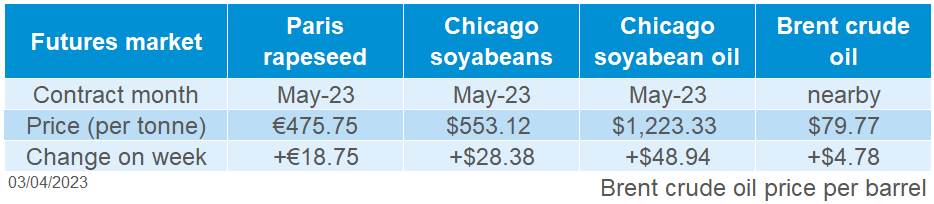

Chicago soyabean futures (May-23) gained 5.4% across the week to close on Friday at $553.12/t. There was support across the week for the oilseed complex notably from the USDA soyabean stocks and plantings data. Further to that, support in crude oil markets too.

On Friday, the USDA forecast that the US is estimated to sow 35.4Mha of soyabeans for the 2023/24 marketing year, the third highest on record. However, this data was below the average analyst estimates of 35.7Mha in a Reuters poll, which added to some support. Further to that, there is caution from the market that area expansion could be lower than estimates due to heavy snow and wet conditions in some Northern US states that could delay plantings – this is a watch point currently though as soyabean plantings usually start in May after maize has started.

As for US soyabean stocks (as at 01 Mar) the report estimated stocks at 45.9Mt, down 13% from a year ago, and down on the analyst estimates which was at 47.4Mt in a Reuters poll, which added to the support.

In other news, there has been a flurry of support in nearby Brent crude oil futures which closed on Friday at $79.77/barrel, gaining $4.78/barrel across the week and supporting vegetable oil prices. Gains were cited to be from supply disruption in the Middle East combined with optimism that the banking sector turmoil is being constrained. This morning, the same contract is trading at $84.06/barrel (11:00) from the news that Saudi Arabia and other OPEC+ members have announced surprised cuts of around 1M barrels per day, on top of the existing plans to continue cutting 2M barrels per day which was originally agreed in November.

Rapeseed focus

UK delivered oilseed prices

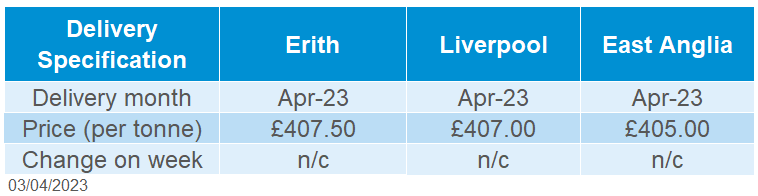

Rapeseed prices followed up the support with soyabeans and crude oil. Paris rapeseed futures (May-23) closed Friday at €475.75/t, gaining €18.75/t across the week. This gain across the week was reflected in our domestic delivered prices with rapeseed (into Erith, May-23) quoted at £408.50/t, gaining £21.50/t across the week.

Stratégie Grain’s oilseed report has cut EU rapeseed production for 2023/24 to 19.5Mt, down 100Kt on last month’s report. This is due to dry weather in south-eastern Europe, but overall conditions in the EU are looking favourable for the crop and downward pressure could continue if estimated global rapeseed production comes to fruition.

The latest GB crop development report was released on Friday, with conditions scores to the week ending 28 March 2023. Oilseed rape crops were rated 70% good-excellent, up from 64% at the same point last year. Variable crop establishment has been noted, arising from slow establishment due to dry autumn condition and issues with cabbage stem flea beetle (CSFB) infestations. Though, it is reported most have recovered or have been replaced, read more information on all major crops here.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.