- Home

- News

- Further cuts to animal feed, but increased wheat export prospects in latest UK S&D: Grain market daily

Further cuts to animal feed, but increased wheat export prospects in latest UK S&D: Grain market daily

Thursday, 30 March 2023

Market commentary

- UK feed wheat futures (May-23) closed at £209.75/t yesterday, up £1.25/t from Tuesday’s close. The Nov-23 contract gained £2.70/t over the same period, closing at £221.75/t.

- Global wheat markets continued to climb yesterday following concerns over Russian supplies. Global grain trader Cargill said that it would take a step back from the Russian market and no longer handle the country’s grain at its export terminal (Refinitiv). According to Bloomberg, Russia is trying to take back control of its own export logistics.

- Paris rapeseed futures (May-23) climbed €7.75/t yesterday, ending the session at €479.50/t. New crop prices (Nov-23) closed at €477.75/t, up €5.50/t over the same period.

- According to Refinitiv, rainfall deficits in parts of Europe are leading to concerns over rapeseed yield potential and therefore production prospects, with more rain needed in south-Western Europe especially.

Further cuts to animal feed, but increased wheat export prospects in latest UK S&D

Earlier today, AHDB published the latest UK cereal supply and demand estimates for the 2022/23 season. The main revisions include a further reduction in total cereal demand for animal feed, as well as increased exports for wheat and oats following a rally in exports as of late.

Increased full season wheat and oat exports forecast

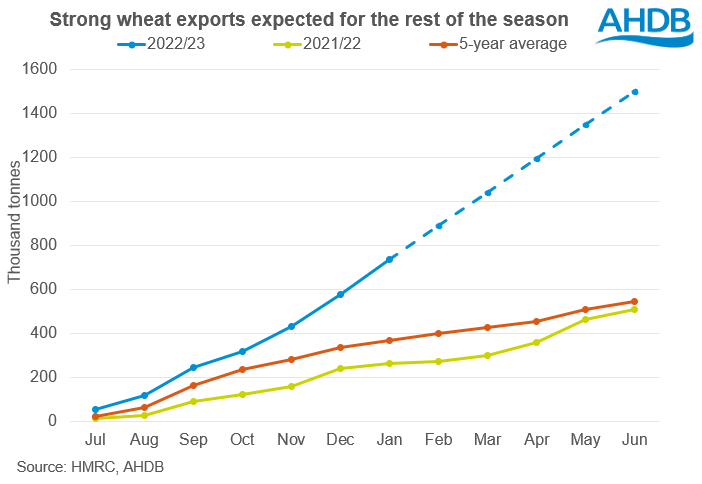

Total availability of wheat is estimated slightly lower on reduced imports, yet a reduction in domestic consumption has increased the wheat balance further in the latest estimates. If realised, the wheat balance will be the largest since 2019/20. Due to this heavy wheat balance, it’s perhaps not surprising that wheat exports this season are looking stronger. Wheat exports for the 2022/23 season have been revised up 350Kt from January’s estimate and up 989Kt on the year to 1.5Mt.

From July 2022 to January 2023, the UK exported 736Kt of wheat, with January alone accounting for 159Kt. Therefore, to reach the 1.5Mt estimate, the UK would need to export a minimum of 153Kt of wheat a month for the remaining five months of the season. According to European Commission data, 1.130Mt of UK common wheat has been imported by the EU up to 27 March. Anecdotal reports also suggest that the export pace was strong in February and March, with firm commitments for April too. It’s important to point out that price competitiveness and continued buying will be crucial for export direction over the rest of the season, as cheaper Black Sea supplies continue to weigh on the market.

Despite the increase in exports, closing stocks of wheat are still expected to be high at 2.475Mt, up 34% on the year and if realised these would be the largest closing stocks since 2015/16.

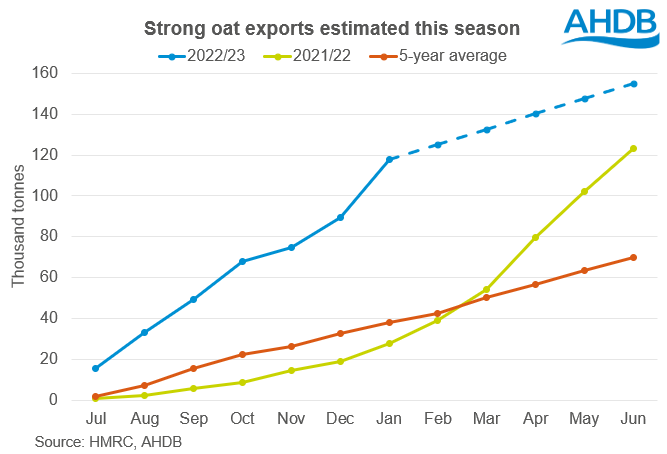

Moving on to oats, the balance of oat supply and demand is up 29Kt from January’s estimate largely due to cuts in animal feed usage, and now sits at 273Kt. However, the export forecast has also increased from the last estimates, now at 155Kt, based on a strong export pace so far this season. If realised, this would be the largest amount of UK oat exports since 2002/03. In the season to date (Jul-Jan), the UK exported 117.6Kt of oats, more than four times what had been exported at the same point last season. Again, latest data from the European Commission suggests that the EU has imported 137.7Kt of oats from the UK up to end-March.

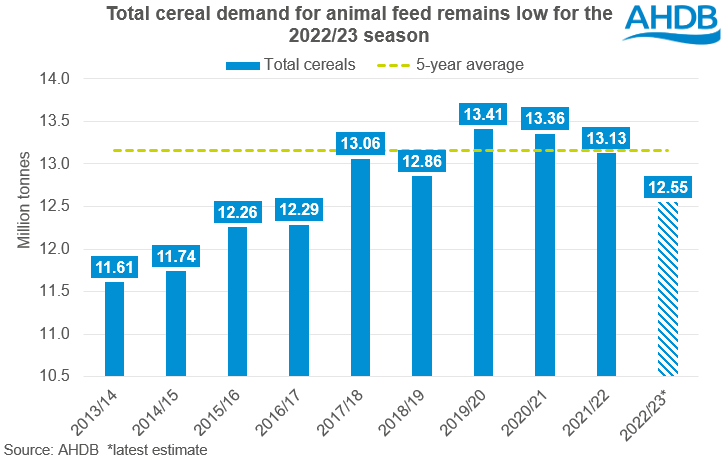

Further cuts to animal feed demand

Total cereals demand in 2022/23 for animal feed has been revised down 240Kt from January’s estimate, now at 12.549Mt. This is 579Kt lower on the year and remains the lowest level since 2016/17.

Throughout the season, animal feed production has declined at a greater rate than first anticipated, as challenges from high input costs in the livestock sector squeeze margins. Since January’s estimates, cattle feed demand is expected to be lower, with tightening dairy margins and producers expected to be relying more on forage and grazing. Having said this, some regions experienced poor forage quality this season, giving a slight boost to feed requirements over the winter. In AHDB’s winter agri-market outlook, pig meat production was also forecast to decline, indicating continued losses in feed demand from the sector too. Significant declines in poultry feed production are also expected to continue. The weather will remain a key watchpoint for ruminant feed demand over the rest of the season. According to GrassCheckGB, grass growth is still slightly behind average, though forecasts suggest growth is on an upwards trend, something to monitor moving forward.

For wheat specifically, the estimate for demand in animal feed has been revised down by 3% from January’s estimate and now sits at 6.95Mt. The decrease is largely due to an overall decline in animal feed production across all sectors, though anecdotal reports suggest wheat will be prominent in rations for the remainder of the season, due to high availability and price relativity.

Usage of barley in animal feed is also down from January’s estimate (by 12Kt) at 4.06Mt. Again, the drop in usage is in line with a reduced outlook for animal feed demand overall.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.