Impact of Russia pulling out of Black Sea Initiative: Grain market daily

Tuesday, 18 July 2023

Market commentary

- Yesterday, UK feed wheat futures (Nov-23) initially traded higher than Friday’s close due to the news that Russia was withdrawing from the Black Sea Grain Initiative (see below). The Nov-23 contract traded as high as £202.80/t during the day. But prices softened in the afternoon and the Nov-23 contract closed at £196.00/t, £0.30/t below Friday’s close.

- The condition of US maize and soyabean crops improved again last week as the cool, wet weather continued. The USDA reports that as at 16 July, 57% of US maize crops were in a good or excellent condition, up from 55% the week before and just 50% a month ago. Also, 55% of US soyabean crops were rated as in a good / excellent condition, up from 51% a week before.

- Paris rapeseed futures (Nov-23) gained €4.50/t yesterday to close at €475.75/t. This likely followed rises in Winnipeg canola futures due to the concern about the impact of the lack of rain on Canadian canola (rapeseed) crops.

- This morning Ukrainian authorities reported damage to port infrastructure in Odessa by Russian missile strikes (Refinitiv). Details are not available yet. The port is an important access point to the Black Sea for Ukraine.

Impact of Russia pulling out of Black Sea Initiative

Yesterday, Russia announced that it was halting its participation in the Black Sea Initiative, or the Ukraine export corridor deal.

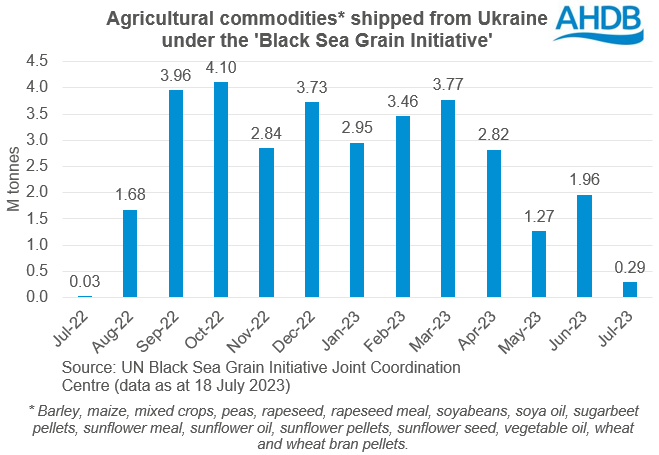

The deal was initially brokered by the UN and Turkey in July 2022, for shipment of foodstuffs and fertiliser from Ukraine via the Black Sea for 120 days. All parties (Russia, Ukraine, Turkey, and the UN) agreed to extend the deal for a further 120 days in November. But then Russia only agreed to an extension of 60 days in March and then again in May. The latest deal expired yesterday (17 July).

When the corridor came up for renewal in May, it was touch and go to whether Russia would extend the deal further or not, as it claimed its side of the bargain was not upheld. So, Russia halting its participation in the deal yesterday may not come as a huge surprise, with Russia reportedly claiming that its parts of the deal still have not been implemented.

While no sanctions have been put on exports of food and fertiliser from Russia since they invaded Ukraine, restrictions on payments, logistics and insurance have caused barriers to shipments. Russia has said that if its end of the deal is fulfilled, then it will rejoin the deal, allowing Ukraine to export foodstuffs and fertiliser through the Black Sea once again.

Impact on supply and prices

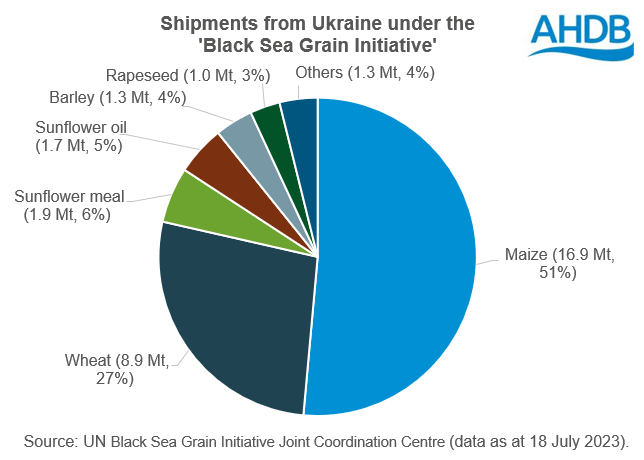

The war and the implications of the war in Ukraine is now somewhat factored into markets, with prices being driven once again by the wider supply and demand fundamentals. In terms of total grains, globally this season, we are expected to have an ample supply and demand balance, which is somewhat bearing down on markets. That said, the wheat balance sheet looks to be more tightly balanced, which has been outweighed by plentiful maize supply.

It's important to note that Ukraine are expected to have smaller cereal crops once again this season (2023/24), due to the impact of war in the country. The Ukrainian consultancy, UkrAgroConsult, have total grain production for 2023/24 currently pegged at 47.34Mt. This is down from 53.86Mt last season, which was also a smaller production year. With smaller crops, comes a smaller exportable surplus.

Ukraine still has the option to export grains via road and rail through Europe to its end destination. While neighbouring EU countries have bumper stocks of grain carried over from 2022/23, partly due to cheap Ukrainian supply, it is likely that Ukrainian grain will be allowed to enter these countries, as long as it is to transit to further destinations, as is the case now. Obviously exporting grain this way, takes more time / will be more expensive.

The other option Ukraine has is to export via river, specifically the Danube, which is likely to become a popular option. However, this will also lead to increased logistical costs and will also take more time.

With a smaller supply of grain from Ukraine this season again, it is likely that Ukraine will be able to continue to export its surplus via rail, road, and river. While Ukraine may be able to ‘make do’ with exporting grain this way in the short-term, in the longer term, what impact this may have on domestic pricing in Ukraine and therefore planting decisions going forward needs consideration.

Inevitably the pausing of the Black Sea Initiative will add some volatility to markets in the short term. However, any support from this may be short lived, given the backdrop of ample global grain supply this season. That said, with the 2023 crops yet to be in the shed, if global grain production is lower than expected or there are further weather issues in key producing nations, then we could see markets react accordingly.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.PNG)