Black Sea Initiative, to be renewed this month? Grain market daily

Wednesday, 5 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £191.50/t, down £1.20/t from Monday’s close. Nov-24 futures fell £2.50/t over the same period, to close yesterday at £196.00/t.

- Though Paris milling wheat (Dec-23) did see a small gain of €0.50/t, to close yesterday at €234.75/t. The contract saw light trade but was supported by renewed concern the Black Sea initiative will not be extended past mid-July expiry (Refinitiv).

- Paris rapeseed futures (Nov-23) closed at €455.75/t yesterday, down €9.00/t from Monday’s close. This followed losses seen in Malaysian palm oil futures.

- Nearby brent crude oil futures gained $1.60/barrel yesterday, to close at $76.25/barrel.

Black Sea Initiative, to be renewed this month?

Yesterday, domestic UK feed wheat futures fell for the third trading day in a row. Movements were limited, with a lack of direction from US markets which were closed for Independence Day. Though sentiment seems to follow pressure from the previous day’s global losses, on improved US crop condition scores.

Weather remains a key focus for the market, as it always is for this time of the year. Though as mentioned above in market commentary, extension of the Black Sea Initiative remains a market mover in the background. So, what can we expect as we head to the renewal date on 17 July?

Russian demands continue for SWIFT

Yesterday, Russia restated their demands for their state agricultural bank to be reconnected to SWIFT, to avert the collapse of the deal (Refinitiv). This follows news the EU were considering a proposal for the Russian agricultural bank to set up a subsidiary to reconnect to SWIFT. This was dismissed by a Russian Foreign Ministry spokesperson, saying it would take many months to set up a subsidiary and connect. A UN attempt to create an alternative payment channel with JP Morgan has also been reportedly rejected according to the Russian spokesperson.

The UN says it continues to work on facilitation of Russian fertiliser exports too.

So, what does this mean for the deal? Britain's UN Ambassador said on Monday she was not confident the grain deal would be renewed. We have been in this position before, looking back to the past few renewals these have been to the wire. Something to watch closely.

Ukraine optimistic grain flow will continue

Though, as we wait to hear more news on whether the Black Sea Initiative will be renewed, what will happen if the deal is not renewed?

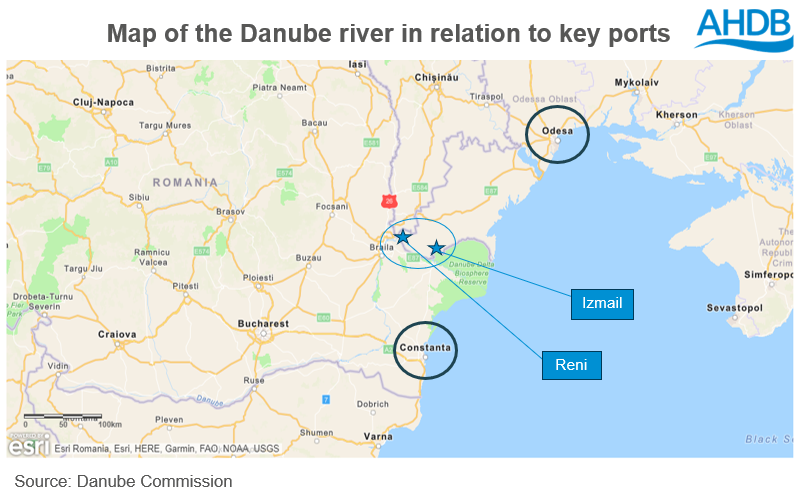

Ukrainian consultancy, UkrAgroConsult, have made it clear that grain flows are likely to shift to the Danube region. Though the consultancy says the increase in logistics costs from the grain corridor to Danube ports is inevitable, by how much is dependent on the region’s capacity to respond to the increased grain flow. UkrAgroConsult say the cost of grain delivery by barge from the ports of Izmail or Reni to Constanta is $25-30/t. On 23 June, a vessel with deadweight on 24Kt was loaded at Izmail seaport, a port record.

The consultancy also highlights ways to increase grain movement, as well as reduce logistic costs in this outcome. An example to reduce logistic costs is suggested through a discount on railway transit tariff through Moldova to the port of Reni. The tariff was set to increase from 1 July, with cost rises compounded by weakening Ukrainian currency to Swiss franc.

Though as we move towards the renewal date, global grain prices are likely to see some volatility. As we saw last season, if the market see Black Sea supply continue to move, risk built into prices (pushing prices higher) could be retraced. However, key questions remain around what a change in logistics might mean for domestic Ukrainian pricing, and for planting decisions going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.