US maize crop conditions continue to drive global prices: Grain market daily

Tuesday, 4 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £192.70/t yesterday, down £2.20/t from Friday’s close. The Nov-24 contract closed at £198.50/t, down £2.25/t over the same period.

- Domestic prices followed global grain markets down, as US crop condition scores climbed on the back of widespread rains across the Midwest. Read more on this below.

- Paris rapeseed (Nov-23) gained €8.50/t over yesterday’s session, closing at €464.75/t. The Nov-24 contract closed at €460.00/t, up €4.25/t over the session.

- Continued dry weather in Europe and the US fuel concerns over this season’s soyabean and rapeseed production. The association of German farmers DBV, said this morning that their winter rapeseed crop is expected to fall 4% on the year to around 4.11 Mt.

US maize crop conditions continue to drive global prices

The US winter wheat harvest is progressing, and spring crops are in their key growth stage across the Midwest. As a result, weather in the US remains a key driver for global grain and oilseed markets at the moment.

Yesterday, the USDA released its latest weekly crop progress report, and some much-needed rain in certain areas last week looks to have improved maize conditions slightly, though more rain is required to lessen yield concerns looking ahead.

Improved maize conditions?

As has been well reported, some key US maize producing states have been experiencing extreme drought conditions. As US maize is currently towards the end of the flowering stage, the crop is particularly sensitive to moisture and temperature stresses. However, Illinois, Iowa and Nebraska received up to six inches of rain in certain areas over the last seven days.

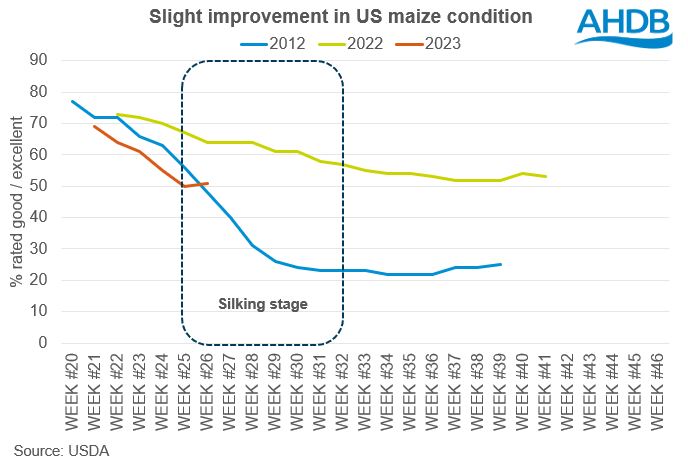

In yesterday’s crop progress report, as at week ending 2 July, 51% of the US maize crop was rated in good/excellent condition, this was up slightly from 50% the previous week, but down from 64% at the same point last season.

As outlined in a recent grain market daily, there is a correlation between US maize conditions at the silking phase and final yields. With the US maize crop now/soon to be entering the silking phase (which is the reproductive phase), weather over the next few weeks will be a big factor in yield potential. Currently, the forecast over the next seven days is for more rain, with up to five inches due in parts of Iowa. Crop condition scores over the next few weeks will be a watchpoint as the recent rains take effect on the crop.

What could this mean for global supply?

While the condition of the maize crop is relatively poor in comparison to previous years, on Friday the USDA released its 2023 acreage report, showing a 6% rise in the US maize planted area year on year. At 38.1 Mha, this area represents the third highest acreage since 1944 (behind 2012 and 2013).

This poses the question of whether reduced yields could be balanced out by increased area. The current yield estimate by the USDA (as at 9 June) is 11.4 t/ha. Combining this with the new acreage figure, production would sit just under 435 Mt. However, given that crop conditions have declined significantly since the beginning of June, it’s likely the yield estimate will be reduced in the coming WASDE report. If we were to take the minimum average yield from the past 10 years (9.9 t/ha in 2013/14) the production estimate would sit at just over 375 Mt, which would still be higher than the 10-year average of 361 Mt.

To conclude, the recent rains are helping to improve US maize conditions, though the next few weeks will be critical for yield potential as the crop enters the silking phase. Conditions are now better than those in 2012 when the US also suffered from drought, and at this point its unlikely yields will drop as low as then. As long as the weather continues to improve, we can still expect a relatively large crop from the US, given the larger planted area. News of improved weather and therefore conditions, could weigh on the global market in the short term at least.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.