Could US maize yields drive prices up? Grain market daily

Friday, 23 June 2023

Market commentary

- Nov-23 UK feed wheat futures closed at £209.20/t yesterday, up £1.70/t from Wednesday. This is £6.55/t above Friday’s close. Worries that the Ukrainian export corridor may close next month and lower German crop forecasts supported European prices.

- US maize and wheat prices closed lower last night (after the UK market closed) as traders booked profits made in the week so far, plus forecasts of rain in the US. Depending on what news and information is available to the market today, this could influence UK futures prices.

- The French harvest is progressing with 10% of winter barley, 2% of soft wheat and 1% of spring barley cut by 19 June (FranceAgriMer).

- Paris rapeseed prices fell again yesterday, with the Nov-23 contract down €14.25/t to €449.00/t. This is attributed to lower-than-expected US biofuel targets, plus forecast rain in the US, which could benefit soyabeans (Refinitiv). Selling by speculative traders also likely contributed to the falls.

Could US maize yields drive prices up?

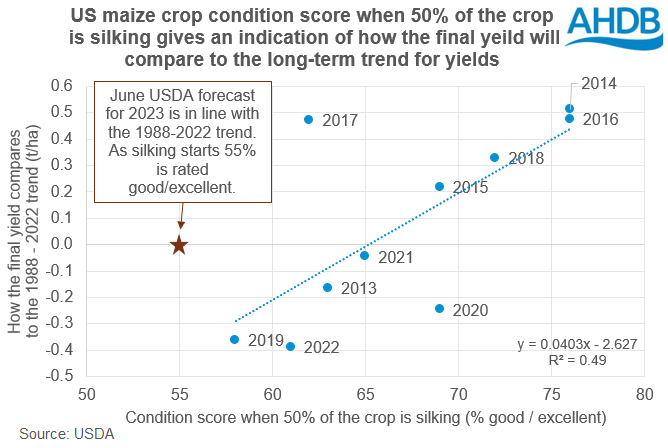

There’s a good link between US crop conditions at silking (maize’s reproductive phase) and how the final yield compares to the long-term yield trend. We need to look at how each year’s yield compares to the long-term trend, as US maize yields are generally rising.

We can assess crop conditions by looking at the proportion rated good/excellent. Better crop conditions at silking usually mean yields close to or above the long-term trend. Vice versa, poorer crop conditions typically mean a final yield below the long-term trend.

Currently the USDA forecasts 2023 the US maize yield close to the long-term (1988-2022) trend at 11.4t/ha. The USDA usually uses the long-term trend to forecast yields until around August, occasionally they do adjust it sooner.

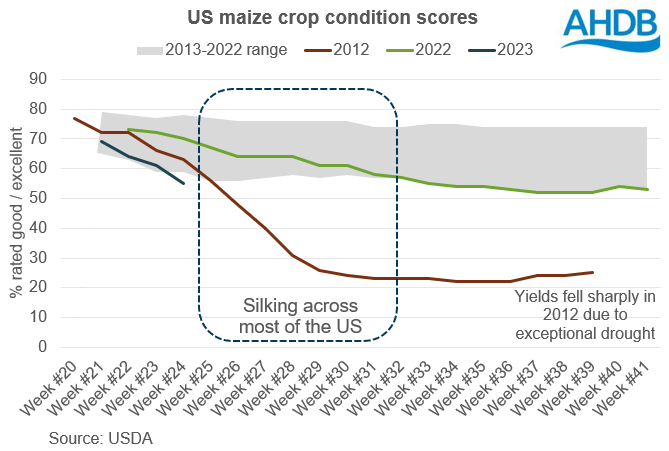

Crop conditions drop as silking begins

As of 18 June, the USDA reported that 55% of the US maize crop was in good/ excellent condition. This was down 6 percentage points (pp) from the previous week and the lowest score for this stage in the season in recent years (see below). Chicago maize prices jumped up after this data was released on Tuesday night.

Crops are already silking in the southern states including Texas. The USDA plans to release its nationwide assessment of how much of the crop is silking on Monday night (26 June).

Yield likely to fall below trend

Using the top graph, we can look at what could happen if 55% of the crop continued to be rated good/excellent when half the US crop was silking. It implies a final yield of around 0.4 t/ha below the trend yield or 11.0 t/ha. This ‘could’ remove close to 14.0 Mt from the US crop, though this assumes the US harvested area stays as currently forecast at just over 34.0 Mha. But bear in mind weather that reduces yields can also reduce the harvested area, so, the actual impact could be greater. You can see more about what different yield falls could mean for the US crop here.

Earlier this month the USDA forecast the global grain surplus at 33 Mt. So, a 14 Mt cut to the US maize crop could reduce the global grain surplus by over 40% – if nothing else changed. Markets are already reacting to the possibility.

Where now?

US drought conditions have intensified again over the past week. Just 7% of the Midwest is now free from abnormally dry conditions or drought, down from 11% a week earlier. So, it seems unlikely that crop conditions will improve in Monday night’s crop progress report. If condition scores fall further, it brings the possibility of a larger yield drop and larger squeeze on global supplies.

A little caution is needed, as years like 2017 do happen. In 2017, the crop experienced particularly cool conditions and timely rain during grain fill. Condition scores rose during grain fill and the yield was better than expected.

This doesn’t seem likely currently for 2023. The forecasts show more warm weather, though more rainfall, which would be welcomed by crops for the weeks ahead. We’ll need to continue to watch the weather.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.