Grain prices fall after USDA raises US crop forecasts: Grain market daily

Thursday, 13 July 2023

Market commentary

- UK feed wheat futures (Nov-23) dropped £3.90/t yesterday to close at £191.50/t, the lowest price since 7 June. Prices fell under pressure from the US markets, following the release of the July World Agricultural Supply and Demand Estimates (WASDE) by the USDA – see below.

- In contrast, Nov-23 Paris rapeseed futures rose €4.75/t to €471.00/t. Rapeseed prices found support from worries about dryness in Canada and higher crude oil prices. Nearby Brent crude oil gained $0.71/barrel to settle at $80.11/barrel.

- Reports suggest the UN asked Russia to extend the Black Sea Initiative (grain export corridor) last night (Refinitiv). In return, the UN is reportedly offering the Russian agricultural bank access to the SWIFT international payment system. The current deal expires on 17 July and so far, there is little sign of an extension. UkrAgroConsult reports that just under half of Ukraine’s total grain exports in 2022/23 were through the export corridor. However, the volume exported outside the corridor has increased in recent months.

Grain prices fall after USDA raises US crop forecasts

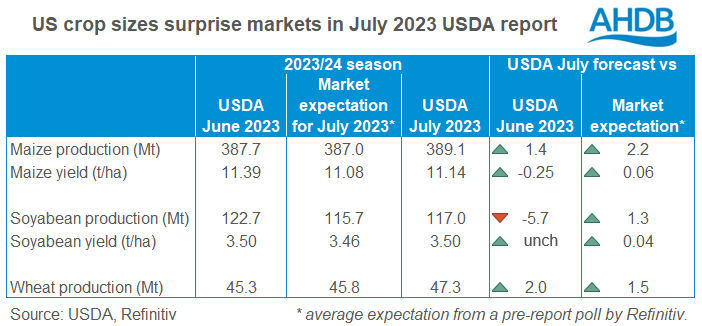

Futures prices for both wheat and maize fell yesterday after the release of the latest World Agricultural Supply and Demand Estimates (WASDE) by the USDA. The USDA unexpectedly increased its forecasts for the US wheat and maize crops. Chicago maize futures (Dec-23) and Chicago wheat (Dec-23) both fell 4% on the day yesterday.

A poll by Refinitiv before the report was released showed the industry expected a smaller maize crop, with yields falling enough to offset a larger planted area. Planted area data, out on 30 June, showed farmers planted more maize and less soyabeans than was previously forecast.

While the USDA did reduce the US maize yield, it was less than the market expected. Rain and cooler weather arrived just in time according to the report, citing the significance of July weather to the crop’s yield. This smaller cut to yields, combined with the larger planted area (published on 30 June), means the US maize crop forecast is now 1.4 Mt larger than last month.

The US wheat crop estimate also exceeded industry expectations. Drought has impacted the 2023 crop but the USDA increased yields, citing better-than-expected yields to date in Kansas. At 47.3 Mt, the crop is 2.0 Mt larger than forecast last month and is above even the highest industry prediction.

The global grain impact

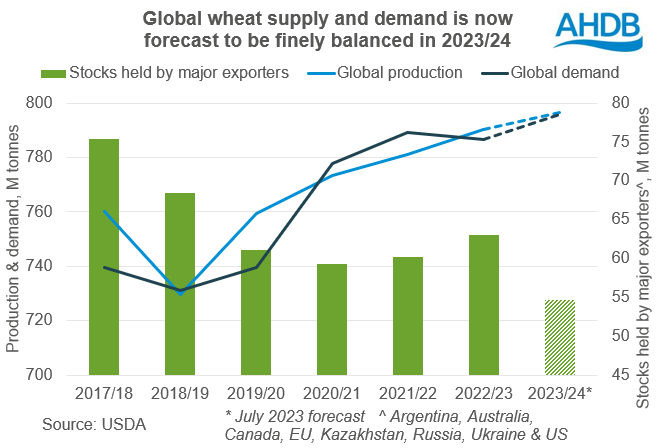

The main global changes are for wheat. The larger US crop is offset by smaller crops in the EU-27, Canada, and Argentina. As a result, global production is cut by 3.5 Mt and is now only just (0.9 Mt) above forecasted global demand. Furthermore, stocks held in major exporting nations are now projected to fall 8.3 Mt on the year to just 54.7 Mt at the end of 2023/24. This would be the lowest level since 2012/13.

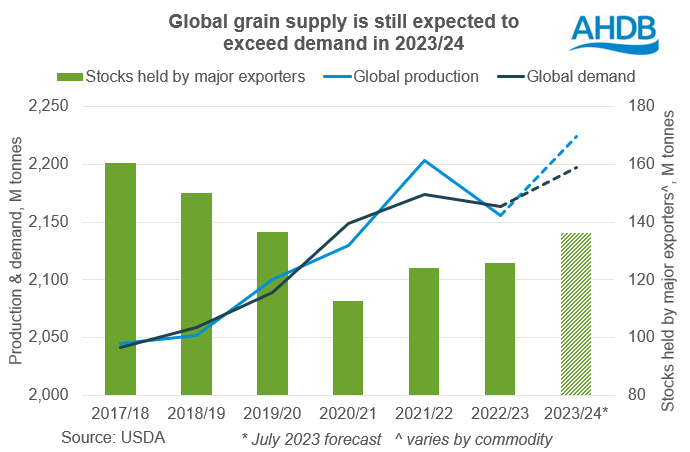

However, because the US maize crop is now larger than the June forecast, the changes at the total grain level globally are small. Total global grain production is still expected to exceed demand by 26.5 Mt. This is down from the 32.9 Mt forecast in June, but it is still a large surplus.

These are not the final crop numbers, and we will still need to watch the weather forecasts over the weeks to come. That said, the large total grain stock forecast seems likely to bring a more bearish tone back to markets in the months to come. Yet, wheat prices may resist this tone a little more than maize as the global wheat market tightens.

Soyabean supplies still look comfortable

The USDA cut the US soyabean crop by less than expected. The crop is forecast 5.7 Mt lower than last month due to the smaller planted area (published on 30 June), but the market expected a 6.7 Mt cut. The USDA left its yield projection unchanged at 3.5 t/ha, a record level. Meanwhile, the USDA expects the smaller soyabean crop to result in sharply lower exports, meaning the impact is largely mitigated.

With small adjustments elsewhere, the global 2023/24 end-of-season soyabean stock forecast is down 2.4 Mt from the June report. However, this would be still the highest stock level since 2019/20.

This brings a more bearish tone back to soyabean, and so oilseed, markets. Yesterday, Chicago soyabean futures (Dec-23) fell 2% on the day. But August weather will make or break the US crop so again we’ll need to continue to watch this space.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.