What can we expect from tomorrow’s WASDE? Grain market daily

Tuesday, 11 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £193.75/t yesterday, unchanged from Friday’s close. The Nov-24 contract gained £0.25/t over the session, closing at £196.85/t.

- While grain markets stabilised yesterday, uncertainty over the future of the Black Sea export initiative continues. Moscow still says it sees no grounds to extend it beyond 17 July (Refinitiv).

- Paris rapeseed futures (Nov-23) gained €11.00/t yesterday, ending the session at €459.25/t. The Nov-24 contract closed at €459.75/t, up €10.25/t from the previous session.

- Rapeseed prices climbed along with the wider vegetable oil complex on the back of a jump in Malaysian palm oil futures due to smaller than expected stocks, and a surge in July exports.

What can we expect from tomorrow’s WASDE?

As has been well reported, US weather and its impact on maize and soyabean conditions remain a key driver in global grain and oilseed markets.

Tomorrow, the USDA will release its July World Agricultural Supply and Demand Estimates (WASDE), giving us more insight into what we can expect from harvest 2023. So, what adjustments can we expect from tomorrow’s report? And what impact might that have on prices?

Maize

As mentioned in our 4 July analysis, some key US maize-producing states have been experiencing extreme drought conditions. While recent rains have reduced the extremity of the drought in certain areas over the last couple of weeks, as of 04 July parts of Nebraska (a key maize-producing state) were still in ‘exceptional drought’. In total, 67% of the US maize crop area is reportedly affected by drought.

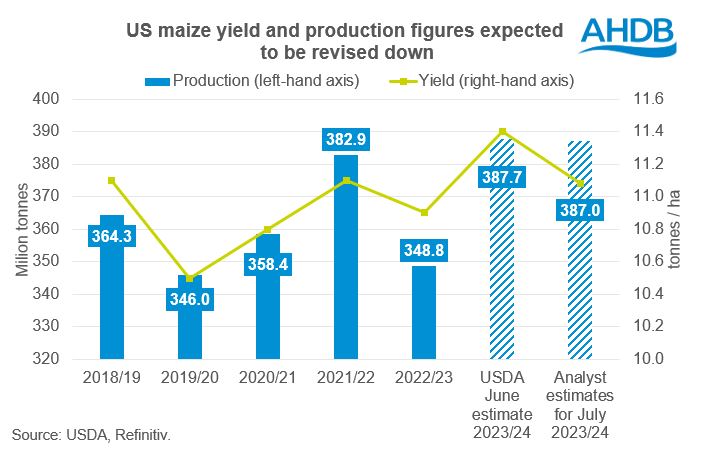

This adverse weather has raised doubts over US maize yield potential, with crop condition scores remaining historically low. According to a Refinitiv pre-report poll, on average, analysts are expecting the USDA to peg its maize yield for the 2023/24 season at 11.08 t/ha. This is down from the current estimate of 11.4 t/ha. If realised, this would still be well above the five-year average yield of 10.9 t/ha.

Taking into account the large maize acreage in the USA this year, analysts' US maize production estimates are averaging around 387 Mt. Again, this is well above the five-year average of 360.1 Mt.

Soyabeans

Much like maize, the US soyabean crop has also suffered with drought conditions, with 60% of the crop area affected by drought as of 04 July. Yesterday, the USDA released its weekly crop progress report. In the report, 51% of US soyabeans were rated good/excellent. This is up slightly (1 percentage point (pp)) on the week, but still significantly lower than 62% at the same point last year.

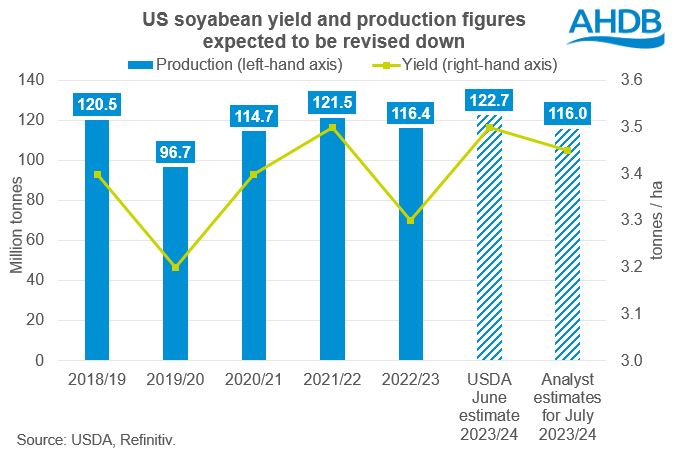

According to Refinitiv’s poll, on average, analysts are expecting the US soyabean yield to be revised to 3.45 t/ha in tomorrow’s WASDE, down from the current estimate of 3.5 t/ha. This would remain above the five-year average of 3.4 t/ha. Given the unexpected reduction in US soyabean acreage to 33.8 Mha (down 5% on the year), it’s expected that production will also be cut to around 116 Mt. Again, this would be above the five-year average of just under 114 Mt.

What could this mean for prices?

To conclude, it is already expected that both maize and soyabean yield/production figures will be revised down in tomorrow’s report. So, much of the impact has likely been factored into prices already. However, should we see some bolder revisions (i.e., greater reductions due to the extreme drought conditions) or if the recent wet weather leads to less of a drop than expected due to improved crop conditions, we could see a change in market sentiment.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.