Arable Market Report - 03 July 2023

Monday, 3 July 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

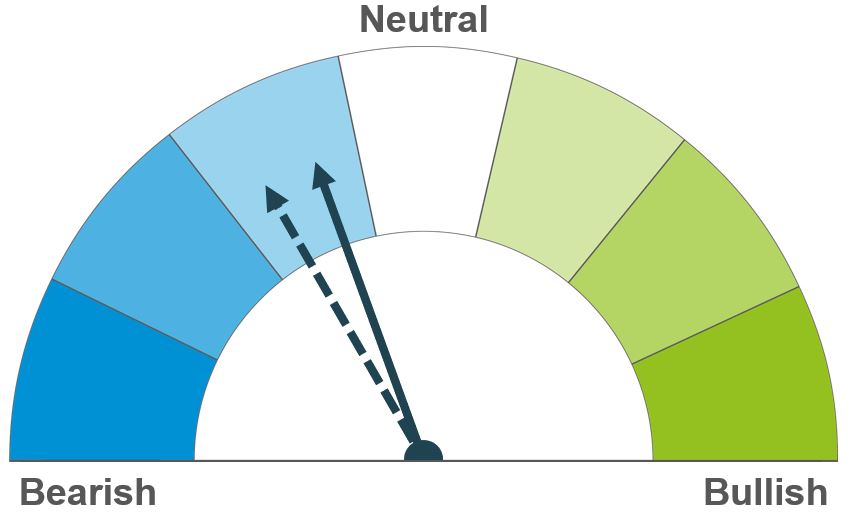

Grains

Wheat

Maize

Barley

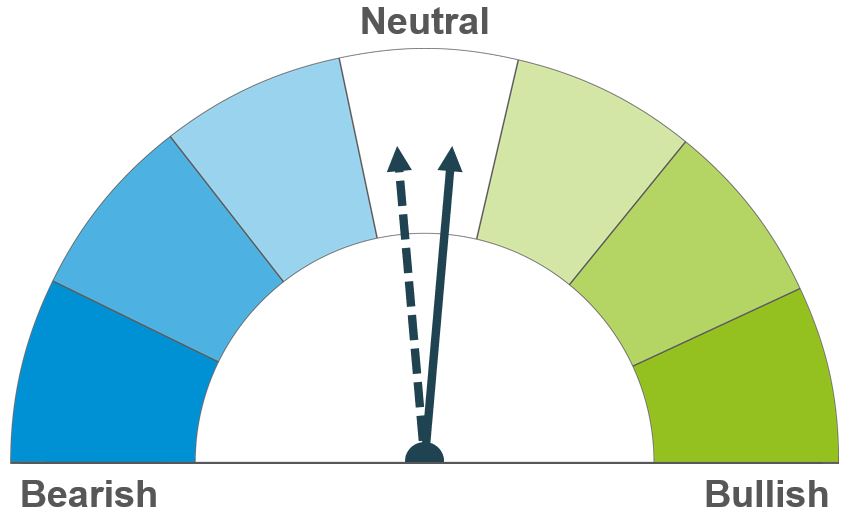

Uncertainty over the future of Black Sea grain exports is still in focus, with the expiration date fast approaching. US and European weather also remain watchpoints over the coming weeks, likely keeping prices volatile.

Welcomed rain and large acreages in the US Midwest have calmed market sentiment for now. As with wheat, weather is still something to watch as concerns remain over yield potential.

The European barley outlook looks to be tightening due to adverse weather. Though ultimately barley price direction will still depend on the wider grains complex.

Global grain markets

Global grain futures

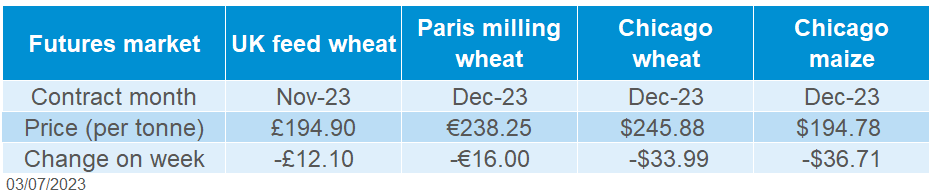

After rallying at the end of the previous week, global grain futures were overall pressured last week (Friday to Friday). Chicago wheat and maize futures (Dec-23) were down 12.1% and 15.9% respectively over the week. This downwards pressure was largely due to welcomed rains across key producing regions in the US, as well as easing tensions in the Black Sea region. Though markets remained reactive to any news on the future of the Black Sea Initiative.

Northern Hemisphere weather is still in focus as harvest progresses in parts of Europe and the US, and spring crops in certain areas struggle with drought conditions. Key maize producing regions in the US including Illinois, Iowa and Nebraska received much needed rain last week. Looking ahead, there is up to 1.5 inches of rain due in parts of those regions at the end of this week which could help improve maize conditions. While US maize yields are a watchpoint, the USDA published their acreage report on Friday, showing a 6% rise in the maize area year-on-year. This area represents the third highest planted acreage in the US since 1944. The USDA also released their quarterly stocks data on Friday. US maize stocks were slightly lower than analysts had expected, total stocks as at 01 June totalled 104.3 Mt, up 6% from the same point last year.

The last few weeks have seen minimal rainfall in northern Europe in particular, and as a result, cereal crop production prospects were revised down by the EU Commission last week. The EU-27 soft wheat production forecast for harvest 2023 now sits at 129.9 Mt. While this is down on the month, if realised, it would be up 2.5% on the year. The 2023 EU-27 barley harvest is currently pegged at 50.1 Mt, down 3.6% from the harvest 2022 estimate. Read more about the EU’s 2023/24 barley outlook in Friday’s grain market daily.

Last week, Russia said that they see no reason to extend the Black Sea Initiative (export deal) beyond 17 July (Refinitiv). However, this morning it was reported by the Financial Times that the EU is considering a proposal for the Russian Agricultural Bank to set up a subsidiary to reconnect to the global financial network. This would enable the bank to handle payments related to grain exports, facilitating the grain deal. As we approach the expiration date of the deal, any news on the future of the deal will likely impact grain market price movement.

UK focus

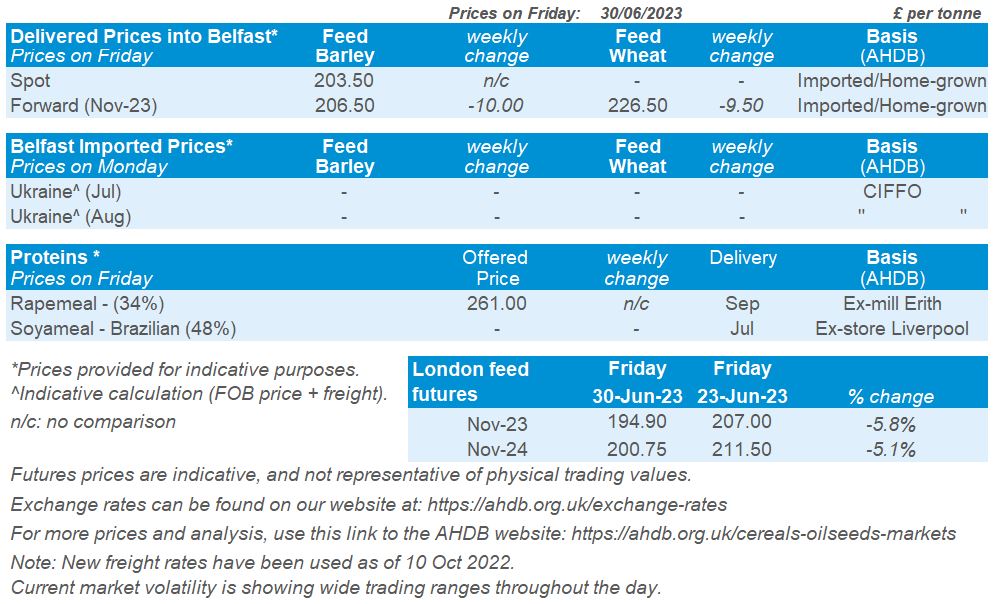

Delivered cereals

Domestic wheat futures followed the global price movement down last week. The Nov-23 UK feed wheat futures contract lost £12.10/t over the week, closing at £194.90/t on Friday. The Nov-24 contract was down £10.75/t over the same period, closing at £200.75/t.

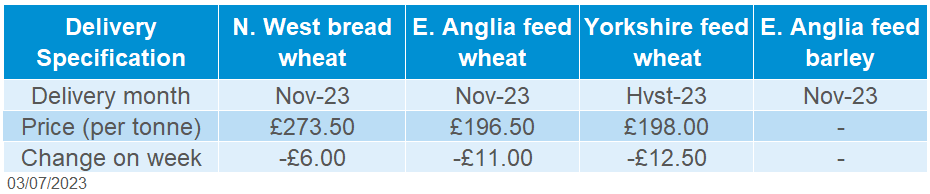

Delivered prices tracked futures prices down last week (Thursday to Thursday). Feed wheat delivered into East Anglia for November delivery was quoted at £196.50/t, down £11.00/t over the week. Delivered bread wheat into the North West for the same month was quoted at £273.50/t, down £6.00/t on the week.

On Thursday, AHDB published updated UK human and industrial cereal usage and GB animal feed production figures. Data showed that total flour production by flour millers from July-May was up 2.8% compared to the same period a year earlier. Barley and wheat usage by the brewing, malting and distilling sector was up 5.2% and 6.3% over the same period respectively.

After significant declines earlier in the season, in May, total GB animal feed and integrated poultry unit (IPU) feed production was only 0.5% below May 2022 at 992 Kt due to higher ruminant feed output. This is the smallest year on year drop this season.

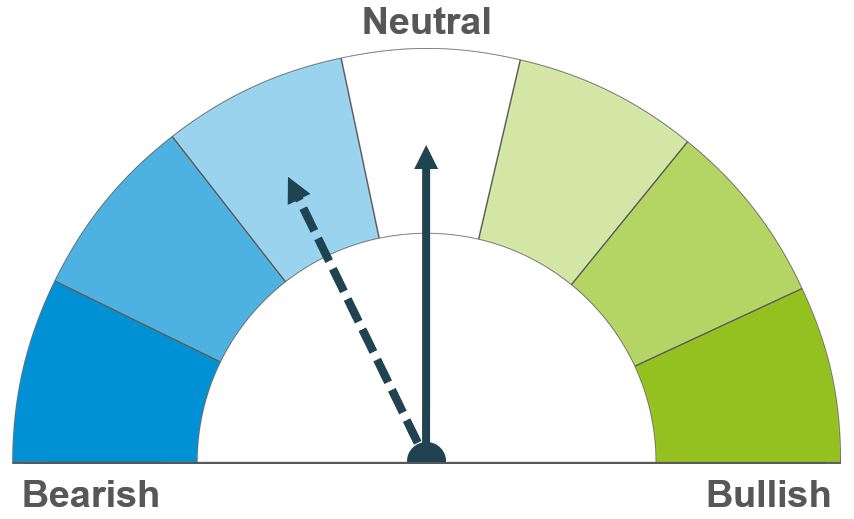

Oilseeds

Rapeseed

Soyabeans

Short-term pressure is possible with EU-27 rapeseed harvest set to begin. Longer-term globally rapeseed markets are expected to be well-supplied.

US weather is in focus to revive the drought impacted soyabean crop. Long-term, large South American crops are expected going into 2024 which will pressure the market.

Global oilseed markets

Global oilseed futures

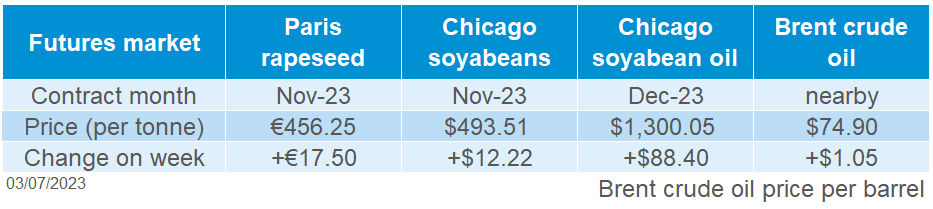

A mixed week for Chicago soyabeans with the market initially supported from US crop conditions data. In the middle of the week wetter forecasts in the US Midwest pressured the market. However, the market surged on Friday after the release of the USDA US acreage and stocks data which meant that Chicago soyabean futures (Nov-23) ended up 2.5% across the week, closing at $493.51/t.

US soyabean crop conditions (week ending 25 June) were estimated at 51% good-to-excellent, down from 54% the week before. This data was in line with analyst estimates; however, conditions fell to the lowest since 1988. An update is expected to be released this evening. Over the last 7-days, there has been rains over the US Midwest, which pressured the market. However, this was limited in some areas and more rains are required to improve conditions. Much of the US Midwest is forecast rains over the next 7 days.

On Friday, Chicago soyabean futures (Nov-23) were supported 6.1% across the day from the USDA acreage and stocks data. The US soyabean planted area for 2023 is estimated at 33.8 Mha, down 5% from last year. This is down 1.6 Mha from the March plantings prospective report. In the USDA stocks data, total US soyabeans stored on 01 June totalled 21.7 Mt, down 18% from a year ago. This was below most of the trade estimates. Both updates were supportive towards the market, which also fed into soyabean oil markets too.

However, what’s critical to note in the oilseed market, is that if supply concerns from the US do ease over the coming weeks, traders focus will return to uncertain demand for US origin soyabeans given the stiff competition from Brazilian origin. According to the oilseed group Abiove, last Tuesday they are estimating the Brazilian soyabean crop at 156 Mt, up 1 Mt from the month before. Further to that, exports are revised up to 97 Mt from 95.7 Mt.

Rapeseed focus

UK delivered oilseed prices

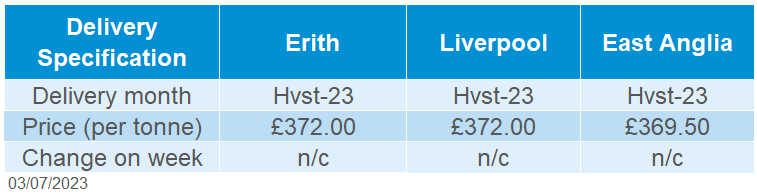

Support in soyabeans fed into the rapeseed market. Paris rapeseed futures (Nov-23) closed Friday at €456.25/t, gaining €17.50/t across the week. Most of these gains were seen on Friday. Domestic delivered rapeseed (into Erith, Hvst-23) was quoted at £372.00/t on Friday, with no comparison on the week.

Stratégie Grains now estimate the EU-27 rapeseed crop at 19.8 Mt down 600 Kt from last month’s forecast, in their latest oilseed report. Citing that persistent dry weather in Northern EU countries had impacted the rapeseed yield potential.

Data released from Statistics Canada last week shows that farmers planted 8.9 Mha of canola for harvest 2023. This is 3% more than last year and above trade expectations (Refinitiv).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.