Arable Market Report - 24 July 2023

Monday, 24 July 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

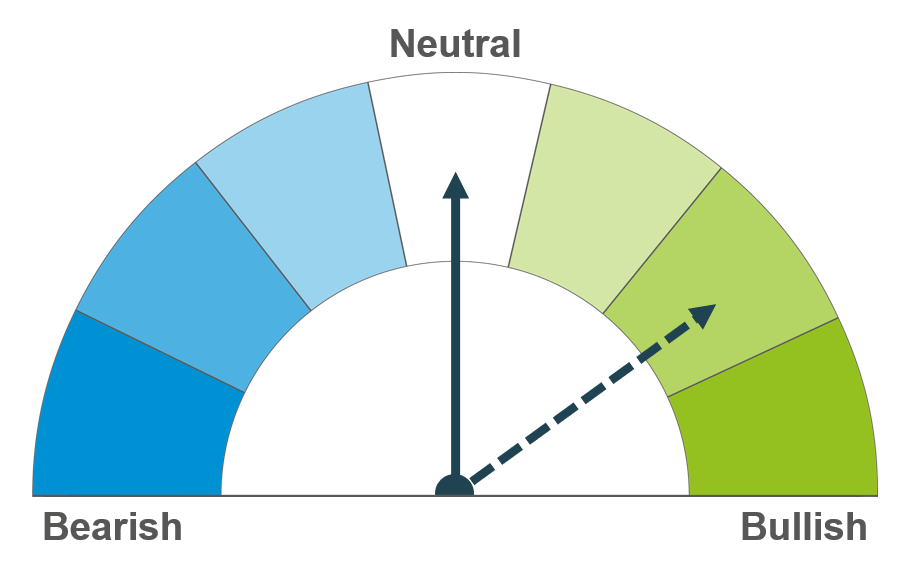

Grains

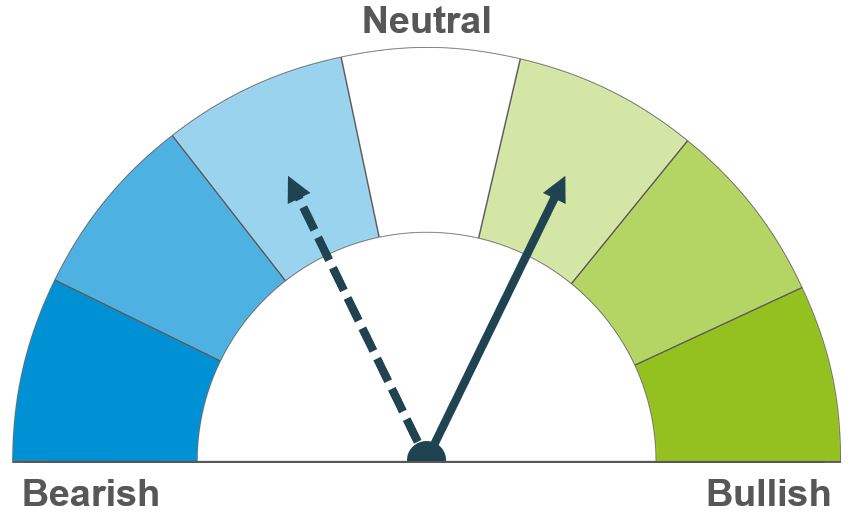

Wheat

Air strikes on the Danube river port cast renewed doubts over exports from Ukraine. Prices are likely to stay volatile in the short term. Maize supply and demand will be important for the longer-term outlook for wheat.

Maize

Forecasts of hotter weather in the US and the situation in Ukraine are currently supporting prices. The size of the US maize crop is important to total grain supplies in 2023/24; if a large crop is confirmed, it could dampen the outlook longer-term.

Barley

The tightness in global barley supplies will shape barley’s price in relation to other grains. But the overall price direction will still depend on total global grain supplies and access to those supplies.

Global grain markets

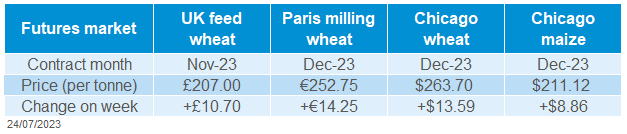

Global grain futures

Grain prices rose sharply last week as the world reacted to Russia pulling out of the Black Sea Initiative. Prices edged down at the end of the week due to profit-taking by speculative traders but were still the highest for over a month.

Paris wheat futures (Dec-23) opened higher again this morning (24 July) and at 13:00 was trading close to €264.00/t. Over the weekend, Russia accused a ship that had docked in Ukraine in May under the Black Sea Initiative of carrying military cargo. There has also been a further expansion of Russian air strikes. This morning, Refinitiv reported that grain storage warehouses were hit overnight in the port of Reni on the Danube river. Port and food storage infrastructure has also been damaged in Odesa and Chornomorsk in the past week.

Ukraine has been increasing shipments through the Danube in recent months. So, the widening of air strikes poses renewed questions about access to Ukrainian grain.

The International Grains Council (IGC) increased its forecast of the global grain crop last week by 5 Mt, mainly due to a larger US maize area. Despite this, the IGC still expects global grain ending stocks to contract year on year due to deficits in the wheat and barley markets. The IGC forecasts global wheat carryover stocks to fall by 20 Mt over 2023/24, while barley stocks drop to the lowest level in nearly three decades.

Maize crops both in the US and Europe are in still their critical stage of development, known as ‘silking’. So, markets remain nervous about crop potential. Higher temperatures are forecast for much of the US maize growing area this week, which could hamper yield development. There is also concern about the impact the current hot, dry weather in southern Europe may be having on summer crops, especially maize.

Harvest is progressing in Europe. The French and German winter barley harvests are almost complete. Plus, wheat harvesting in France is in the latter stages, with 58% cut by 17 July (FranceAgriMer)

UK focus

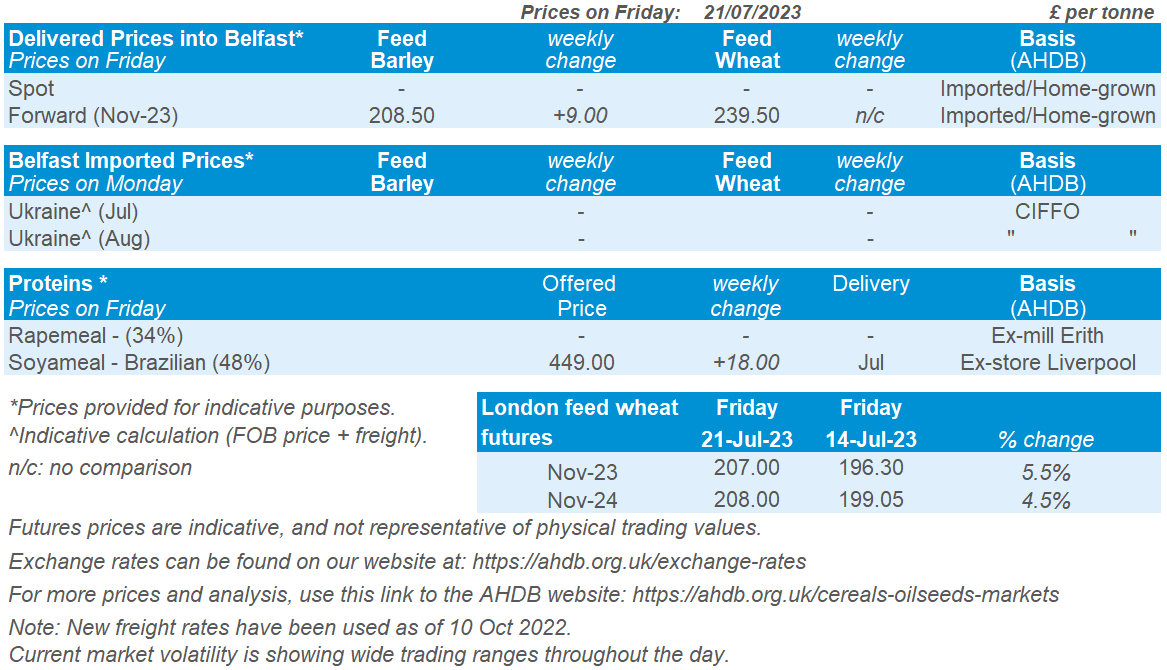

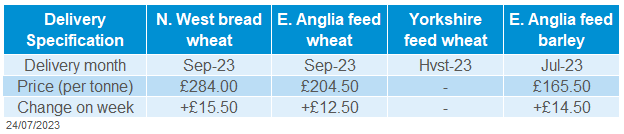

Delivered cereals

UK prices rose last week following the global trend after the Black Sea Initiative ended. The Nov-23 UK feed wheat futures contract settled at £212.15/t on Wednesday at its highest level since 19 April. The contract then dropped back slightly to end the week at £207.00/t.

UK feed wheat for delivery to East Anglia in September was £204.50/t as of Thursday, up £12.50/t from 13 July. Bread wheat for delivery to the North West in September was £284.00/t, up £15.50/t on the week.

Statistics from Defra show that in June 2023 UK placings of broiler chicks (+2.5%), layer chicks (+28%), and turkey poults (+4.8%) were all higher than June 2022. This could mean higher feed demand in the short term. But the number of eggs set (indicating future placings) for layers and turkey poults was still lower than in June 2022.

The results of AHDB’s Planting and Variety Survey are provisionally due to be out on Thursday (27 July), with highlights in Grain market daily and the full results on our website.

The wet weather continues to cause challenges for harvesting. AHDB’s harvest toolkit includes a wealth of information on straw, good sampling practice, grain storage, contract tips and much more. Our first GB harvest progress report of the year will give an assessment as of 25 July. Look out for highlights in next week’s Market Report.

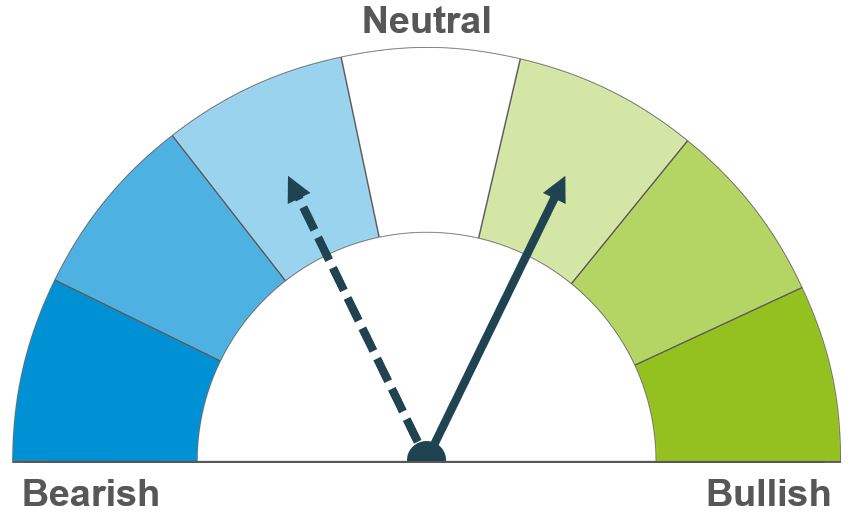

Oilseeds

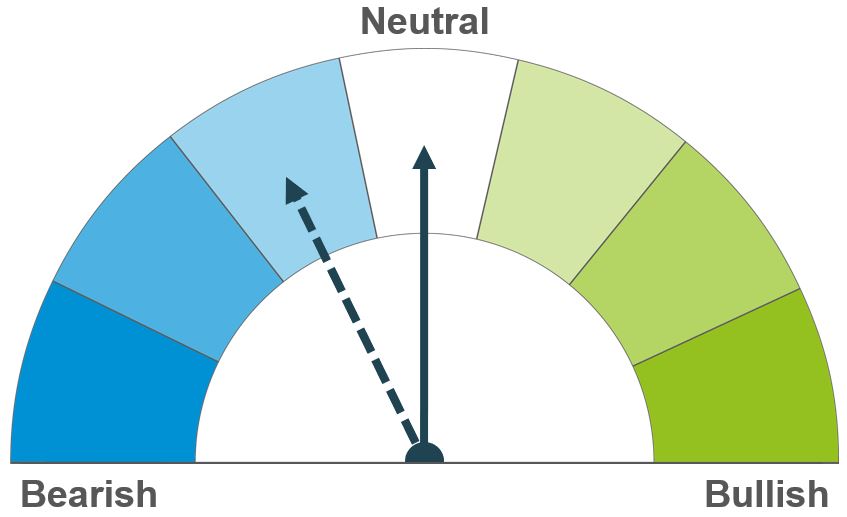

Rapeseed

Black Sea exports remain in focus, considering recent news surrounding the Danube region (see grains). Weather also remains a watchpoint across the EU for harvest, and Canada for ongoing dry conditions. Longer-term, global rapeseed markets, and the EU specifically, look to be well-supplied this season.

Soyabeans

US weather remains in focus short-term, supporting price levels, but how much is already factored in? Longer-term, a large Brazilian new crop will likely weigh on the global market.

Global oilseed markets

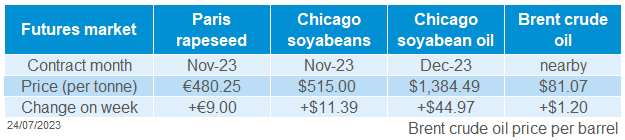

Global oilseed futures

Last week, Chicago soyabean futures (Nov-23) felt overall support. Prices climbed through the start of last week, buoyed by dry US weather concerns and wider market volatility surrounding the Black Sea Initiative. Nov-23 closed on Wednesday at the highest point on the contract since late December. However, prices dropped back a little on Thursday and Friday, with some profit-taking.

US Midwest weather remains a key supportive factor in the market. 50% of US soyabean crops are still in drought conditions (to 18 July) and 20% are now at pod set (to 16 July). So, the weather over the coming weeks remains crucial and continues to support soyabean and soyabean oil markets. This week, up to one inch is due in scattered areas across parts of the Midwest, with occasional forecasts of two inches of rain (World Ag Weather). However, overall, the outlook for much of the region remains dry, and warmer than average.

Demand also remains a watchpoint in the market. In the US, the Environmental Protection Agency has finalised the blending volumes of biofuels required by US oil refiners over the next three years. But the total volume less than the initial proposals. In June, China's soyabean imports from Brazil increased 31.6% from a year earlier, as reported on Thursday.

The impact of Russia withdrawing from the Black Sea Initiative, damage to Ukrainian ports, and the intensifying of the war in Ukraine remains important in oilseed markets too. Malaysian palm oil futures (October delivery) closed on Thursday at the highest point since March. Prices were supported by strong July exports and Russia’s withdrawal from the Black Sea Initiative, heightening concerns over vegetable oil supply.

Rapeseed focus

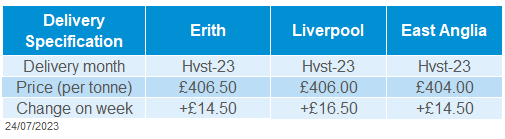

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed on Friday at €480.25/t, up €9.00/t over the week. Prices reached €508.25/t at Wednesday’s close, the highest close since early March, gaining with Chicago soyabeans and wider vegetable oils. Prices then fell back on profit-taking on Friday, with soyabeans.

On Friday, rapeseed delivered into Erith for harvest delivery was quoted at £406.50/t, up £14.50/t over the week. With prices taken around midday on Friday, prices show the rise seen last week in Paris rapeseed futures, though before the full extent of Friday’s pressure.

The results of AHDB’s Planting and Variety Survey are provisionally set to be out on Thursday (27 July), find the full results on our website once published.

With rain ongoing, where has domestic harvest started and what are initial thoughts on quality? Look out for our first GB harvest progress update in next week’s Market Report.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.