EU yields trimmed and quality in focus: Grain market daily

Wednesday, 26 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £214.00/t, down £2.00/t from Monday’s close. Nov-24 futures also fell £2.00/t yesterday, to close at £212.50/t.

- Global wheat markets were mixed yesterday, with Chicago markets feeling support still but Paris markets seeing a small fall. After large gains seen in these markets on Monday, profit-taking probably added pressure to contracts yesterday.

- Market focus remains on Russian strikes on Ukrainian grain facilities on the Danube after the expiry of the Black Sea Initiative.

- Paris rapeseed futures (Nov-23) closed yesterday at €478.50/t, down €8.50/t over yesterday’s session. This followed wider losses for Chicago soyabeans futures and Malaysian palm oil.

- Yesterday, CF Fertilisers announced a proposal to permanently close the ammonia plant at its Billingham site. CF Fertilisers states it intends to continue to produce ammonium nitrate (AN) fertiliser and nitric acid at the Billingham site using imported ammonia, as it has for the last 10 months following the decision to temporarily idle the plant in August 2022. This is reportedly due to high projected natural gas prices compared to other countries and carbon costs. The company reports that they believe there is ample global availability of ammonia for import.

EU yields trimmed and quality in focus

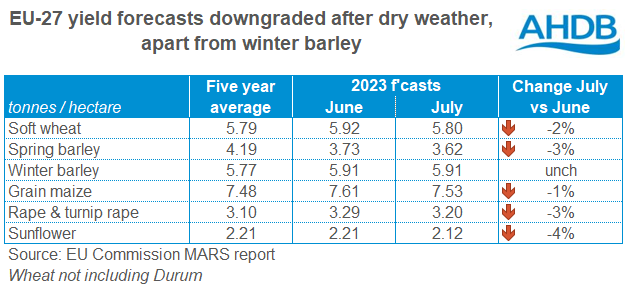

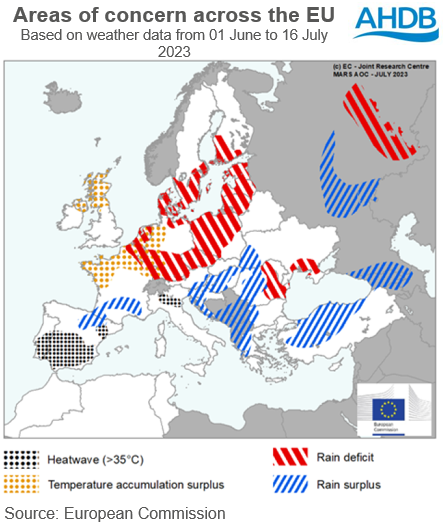

The European Commission trimmed yield forecasts for all cereal and oilseed crops, except winter barley, in their July MARS report released on Monday. This follows drier-than-usual conditions in larger parts of western, central, and northern Europe, as well as in eastern Romania.

For many crops, though, yield forecasts remain above the 5-year average. However, this is notably not the case for spring barley and sunflower yield forecasts, the most impacted by recent cuts. A downgrade in sunflower yield prospects for the key producer, Romania, was a key reason for this. For spring barley, the report details substantial downward revisions for Denmark, Sweden, Finland and the Baltic Sea.

Intense heatwaves have been seen across southern Portugal and Spain, as well as northern Italy. According to the European Commission, this triggered a risk of heat-induced sterility for flowering summer crops, with potentially irreversible impacts on yields.

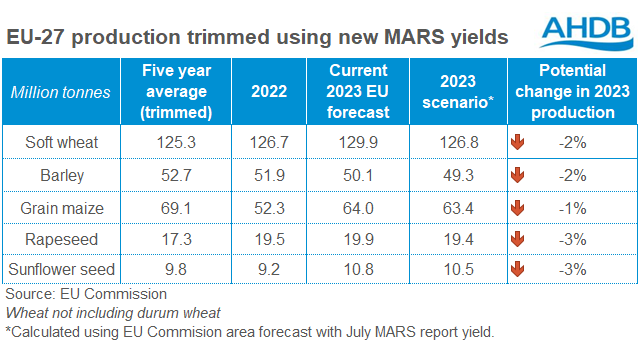

So, what could these yield changes mean for harvest 2023 production forecasts? We can apply the new MARS forecast from July 2023 with EU Commission area forecasts to understand what we might expect.

Rain in focus for quality

Rain has been delaying harvest and causing potential impacts on grain quality in parts of Bulgaria and Romania, Slovenia, Croatia and Hungary; something to monitor as more information is reported from harvest.

The European Commission have also flagged questions around wetter-than-usual conditions in European areas of Russia, and the impact on crop quality. Though above-average yields are still expected, the rainfall surplus is expected to have deteriorated grain quality according to the report. Harvest of winter cereals is ongoing, after starting in the second half of June. Patches of rain look to continue this week.

What does this mean for prices?

Well, particularly with export uncertainty surrounding Ukrainian grain, reliance on other major global exporters for global supply becomes increasingly in focus. This is particularly true for wheat, with stocks in global major exporters tight, though wheat stocks this season on the continent are still expected to be ample. But if quality issues are confirmed as EU harvests progress, we could see a widening of the gap between feed quality prices and other grades. Something to follow closely.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.