- Home

- News

- Domestic milling wheat premiums remain strong despite declining global wheat prices: Grain market daily

Domestic milling wheat premiums remain strong despite declining global wheat prices: Grain market daily

Thursday, 11 May 2023

Market commentary

- UK feed wheat futures (May-23) closed at £182.50/t yesterday, down £1.50/t from Tuesday’s close. The Nov-23 contract was down £1.00/t over the same period, ending the session at £195.75/t.

- European markets are still awaiting news regarding talks over the Black Sea Initiative. The Kremlin declined to comment yesterday on how talks were progressing.

- Nov-23 Paris rapeseed futures gained €1.50/t over yesterday’s session, closing at €442.25/t.

- Chicago soyabean futures (May-23) closed at $527.77/t yesterday, down $5.60/t over the session. New crop futures (Nov-23) lost $1.37/t over the same period, closing at $459.53/t.

- US soyabean futures continue to fall as favourable weather has seen plantings in the US rapidly progress.

Domestic milling wheat premiums remain strong despite declining global wheat prices

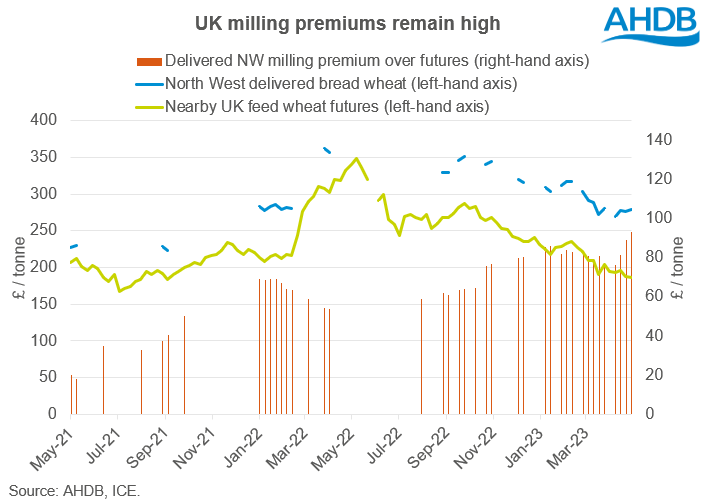

Following their peak around this time last season, while volatile, global wheat markets have largely been in decline. Domestic wheat prices have closely tracked global market movements, and UK feed wheat futures are now back at pre-war levels. However, domestic milling wheat prices have not fallen at the same rate, and premiums remain firm. So, why are premiums so high? And are they likely to remain at this level heading into the new season?

Why are premiums so high?

As at 4 May, bread wheat into the North West for spot delivery was quoted at £279.00/t, a £93.00/t premium over nearby UK feed wheat futures. For comparison, as at 13 April last season, the premium was £56.50/t, which is still considered a large premium.

As has been well reported, we had a large UK wheat crop in 2022 at 15.5Mt. However, due to a combination of some reduced fertiliser applications last season (due to the high cost), and limited uptake of nitrogen (due to the dry hot weather in the spring/summer), availability of high protein full specification milling wheat has been in shorter supply than expected in 2022/23.

What might impact premiums moving forward?

Earlier in the season, it was thought that the cost-of-living crisis and recessionary fears may impact demand for milling wheat this season, counteracting some losses in availability. To gauge flour production by millers, we can take ‘other flour’ (which includes production by starch and bioethanol industries) from ‘total flour produced’ from the UK flour millers data. The data shows that this season to date (Jul-Apr), total flour production (excl. ‘other flour’) is at 2.8Mt, down slightly (0.4%) on the year, partly due to higher extraction rates, due to good specific weights, as well as the impact of changing consumer habits due to the rise in cost of living. The latter has been particularly prominent from February to April, where usage has been declining at a greater rate on year earlier levels. This is something to watch over the next couple of months.

Due to the size of the domestic wheat crop, despite lower-than-average protein levels, we have still seen an increase in the proportion of home-grown wheat used this season, with imported wheat at a significantly higher cost earlier in the season.

In terms of what else may impact high premiums looking ahead, there is anticipation as we approach harvest as to how much milling wheat will become available in the new season. AHDB’s Early Bird survey released in December suggests that we will see a 1% increase in wheat area on the year, though high input costs and adverse weather could impact quality. According to the latest AHDB crop development report published at the beginning of the month, generally crops are faring well, though the recent rainfall has led to delays in spring plantings and fertiliser and crop protection applications, which could impact milling quality.

While fertiliser prices have been declining as of late, UK produced AN averaged £737.00/t between May and June last year when most farmers would have bought fertiliser, according to the AHDB fertiliser prices. For context, UK produced AN in 2021 averaged £290.50/t over the same period. This could mean that certain growers may apply less fertiliser or decide to grow feed wheat as an alternative way of managing costs, supporting high premiums.

On the other hand, it’s important to look at the cost of imported milling wheat. As at Tuesday 9 May, imported delivered German milling wheat was estimated at £271.81/t. This was slightly cheaper than UK milling wheat delivered into the North West, and could mean if imported prices continue to decline, UK premiums will be pressured.

Ultimately, we will know more about price direction when we know how much milling wheat has been planted this season, something to look out for in AHDB’s Planting and Variety Survey due out in July. However, the weather over the next few weeks will be an important factor to watch as farmers make their final nitrogen applications, and we go through a key development stage for the crop. Though it poses the question, that if there is potential for premiums to come down, could it be worth marketing more milling wheat while premiums are so high?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.