Tight outlook for EU barley next season? Grain market daily

Friday, 30 June 2023

Market commentary

- UK feed wheat futures (Nov-23) were up slightly yesterday (£0.30/t), ending the session at £196.75/t. New crop futures (Nov-24) closed at £202.50/t, up £0.50/t over the same period.

- Domestic wheat futures followed Paris wheat futures up as adverse weather in Europe means further reductions to wheat production prospects. FranceAgriMer reported this morning that 81% of the French soft wheat crop was in good/excellent condition, compared to 83% the previous week.

- Paris rapeseed futures (Nov-23) were up €4.00/t yesterday, closing at €442.00/t. The Nov-24 contract closed at €447.75/t, up €3.75/t over the session.

- Old crop rapeseed prices followed Chicago soyabeans up yesterday ahead of the USDA’s key acreage and quarterly stocks data due out later today. But gains were capped by storms across the US Midwest bringing needed rains.

- Earlier today, we released analysis providing insights into the UK Government’s Green Finance Strategy.

Tight outlook for EU barley next season?

While EU wheat stocks are expected to remain relatively high next season, the outlook for barley looks to be tightening. With the EU barley harvest now well underway, what can we expect from the 2023 crop? And what could this mean for domestic prices?

Dry weather impacting production

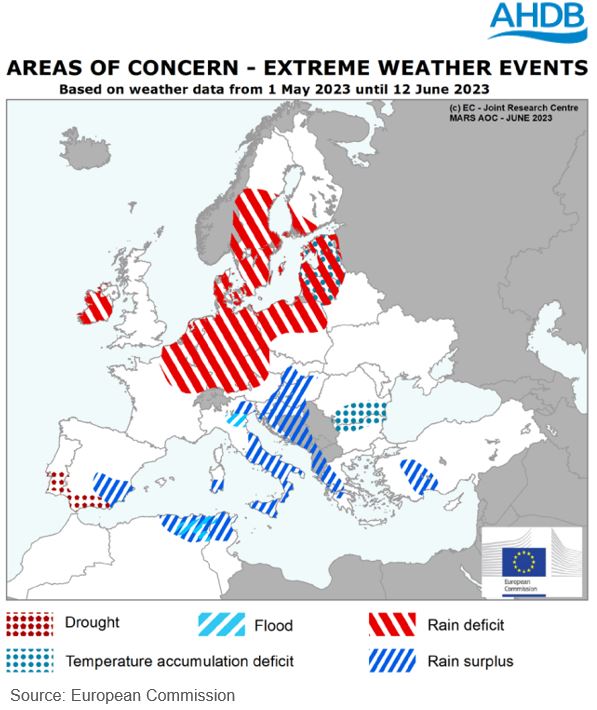

Much like the UK, the end of May and the beginning of June saw hot and dry weather with minimal rain across parts of Europe.

As mentioned in a previous analysis, the barley crop in Spain is particularly poor this season. While there has been heavy rain in key barley producing regions of Spain over the past month, it is too late to save yields and could have worsened quality further.

Denmark, Sweden, and the Baltic countries have also been affected by drought conditions. According to RMI analytics, spring barley crops are particularly vulnerable to the hot and dry weather, and yields need watching as harvest progresses.

In the Brewing Raw Material Journal last week, RMI analytics pegged EU-27 and UK barley production for the 2023/24 season at 56.0 Mt. If realised, this would be down 4.7% from the estimated 58.8 Mt produced in 2022. Largely due to the decreased EU supply outlook and the reduced import opportunities (due to a smaller Ukrainian crop), EU and UK combined barley ending stocks were forecast at 5.2 Mt, down 25.7% from the 2022/23 estimate. If realised, this would be significantly below the five-year average (Stratégie Grains).

What could this mean for UK barley prices?

Global barley prices will continue to track the wider grains complex. But, we could see the discount of barley to wheat reduce if the EU barley supply and demand balance is as tight as expected.

UK barley exports to the EU have been relatively strong for most of 2022/23, and there is the potential for firm exports in 2023/24 too.

This will of course depend on how competitive UK barley is on the global market and the size of our domestic crop. In the most recent crop development report, while winter barley was in better condition than at the same point last year, spring barley was rated at 53% good/excellent condition, compared to 77% last season. With the total UK barley area estimated down slightly (2%) and poorer conditions, we might not have as much surplus available for export that we’ve had this season.

Conclusion

To conclude, the EU barley outlook for the 2023/24 season looks to be tightening, and with harvest progressing, in some areas it is too late for rains to improve quality and yield. As a result, barley prices could see some support, though the overall direction will still be driven by the wider grains complex. UK barley export potential will remain a watchpoint over the next few weeks as we gain more information on our domestic crop.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.