Potential for firm barley exports into the EU next season? Grain market daily

Wednesday, 31 May 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £185.40/t yesterday, down £7.10/t from Friday’s close. The Nov-24 contract was down £4.60/t over the same period, ending the session at £191.40/t.

- The European Commission raised its 2023/24 EU soft wheat crop forecast yesterday to 131.5 Mt, up from 130.2 Mt last month. If realised it would also be well above the 125.7 Mt harvested in 2022.

- The Nov-23 Paris rapeseed futures contract closed at €394.00/t yesterday, down €17.00/t over the session. The Nov-24 contract closed at €399.50/t, down €18.25/t over the same period.

- The European Commission increased its 2023/24 EU rapeseed production forecast yesterday, now at 20.2 Mt. This is up from 20.0 Mt a month earlier and 19.5 Mt in 2022/23.

Potential for firm barley exports into the EU next season?

In AHDB’s latest supply and demand estimates released last Thursday, barley exports for the 2022/23 season are pegged at 1.15 Mt, up 50% on the year. According to HMRC UK trade data, this season to date, exports into the EU have been relatively strong compared to the previous season. So, as we are now approaching harvest, can we expect this pace to continue into the new season?

The picture this season

According to UK trade data, from July to March this marketing year, the UK had exported 871.85 Kt of barley to the EU, up 60.3% from the same point last year. According to the EU Commission, as at 29 May, the EU had imported 1.05 Mt of UK barley this season, making up 54.9% of total EU barley imports.

As mentioned in a previous analysis, the main reason for the increase in barley exports to the continent is increased demand from Spain. So far this season, of the 1.91 Mt of barley imported by the EU, 938.81 Kt (49.1%) went to Spain.

What is the outlook for next season?

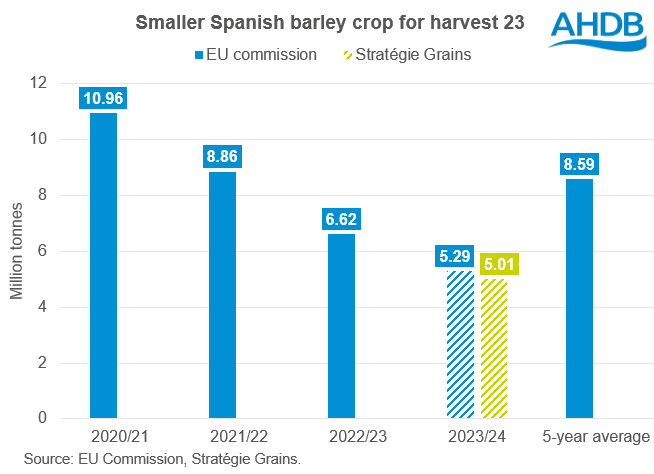

Increased demand from Spain was due to the country having a much smaller than average barley crop this season (harvest 22) at 6.62 Mt (EU commission). The EU barley balance for the 2023/24 marketing year will begin with much lower carry-in stocks than wheat, and the current drought in Spain is expected to impact European supplies (Stratégie Grains).

Looking at the upcoming harvest, the EU Commission is currently forecasting the 2023 crop at 5.29 Mt, down 38.5% on the five-year average. Stratégie grains has forecast the crop even lower, at 5.01 Mt.

In the latest MARS report released last week, it was noted that prolonged drought conditions in the Iberian Peninsula region have severely impacted winter crop yields. Though it was also added that the actual impact of the drought might be reflected more in areas sown and harvested, than in the yields. In central and southern regions, some of the winter crops have already been harvested as fodder, or, if too small to harvest, given to animals for grazing.

With demand looking strong, another aspect to look at is price competitiveness. Feed barley off the East Coast (FOB) for August delivery was quoted at £168.50/t yesterday. This price will need to remain competitive if exports are to remain firm next season. We are currently seeing the barley discount to wheat grow for new crop, as outlined in yesterday’s market report.

Price competitiveness could also be pressured by a looming deal between Australia and China. The Australian trade minister said on Monday that he expects China to remove its 80% tariffs on Australian barley exports within the next few weeks (Bloomberg). If this is the case, much of the French barley destined for the Chinese market will now become available in the EU, and prices will have to adjust accordingly. Something to watch out for over the next few weeks.

Conclusion

To conclude, it looks to be another small Spanish barley crop next season. With another reasonable UK barley crop expected, this opens up potential demand for UK exports. However, price competitivity will be key to firm exports, and availability of French barley will be an important watchpoint.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.