Arable Market Report - 30 May 2023

Tuesday, 30 May 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

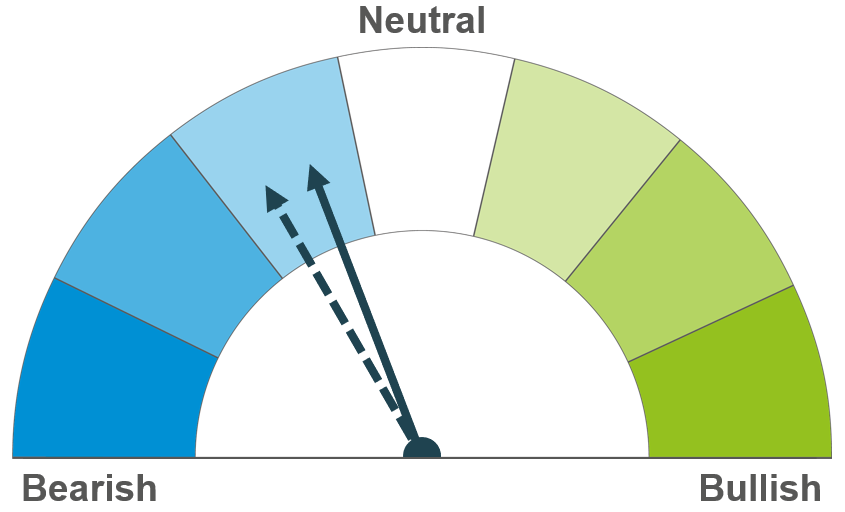

Although wheat supplies look tighter next season, total grain supplies still look heavy, which is bearish for wheat. Many Northern Hemisphere wheat crops are in their key yield-forming stages and until crops are harvested, there remains risk.

Expectations for global maize supplies in the months ahead remain high. But this is uncertain until the crops, especially in the US, are through the key yield-forming stages. Market sentiment could shift if there is a threat to these yields or if the Black Sea Initiative is not renewed.

Global barley prices continue to follow movements in the wider grain complex. Forecasts of larger feed grain supplies for the new season keep sentiment bearish. As at 25 May, new crop feed barley (delivered E.Anglia, Hvst-23) was £23.50/t below feed wheat.

Global grain markets

Global grain futures

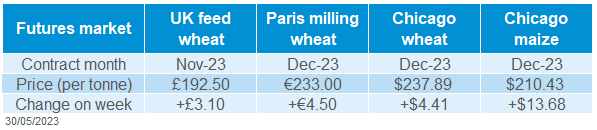

Grain prices ended higher last week, with the main gains recorded on Friday. Chicago maize futures rose the most due to dry weather concerns in the US, with wheat prices up by lesser amounts.

Speculative traders remained short of Chicago maize and Chicago wheat futures last Tuesday (23 May) according to the CFTC. Repositioning ahead of the three-day weekend in the US and parts of Europe reportedly contributed to prices rising.

A large proportion of the US maize crop is now planted thanks to dry weather in the US Midwest. If the dryness continues, it could pose a risk to crop development, but rain is forecast. The USDA will issue its first assessment of the condition of the crop tonight. High US maize condition scores could reiterate the bearish tone in markets. Lower scores could mean doubts about the crop’s potential and offer some support to prices. Weather in July and August is the main make/break point for the crop, while it’s silking.

Harvesting of the Safrinha Brazilian maize crop is now underway (AgRural). Expectations for the crop are high and local forecasters have recently increased their forecasts. This crop reaching market could bring more pressure on prices.

Russian wheat export prices declined again last week (IKAR, via Refinitiv) due to forecasts of a large Russian crop this coming harvest. This is acting as a weight on global wheat markets.

Crop conditions in most major European grain exporters continue to be positive according to the EU Commission. But, due to drought Spain, Portugal, and parts of North Africa will have higher import needs in 2023/24.

Also, there now are doubts that the Black Sea Initiative (Ukrainian export corridor) will continue beyond 17 July following Russian statements. As we’ve covered before, disruption to the deal can support prices as it reduces market access to Ukrainian supplies.

UK focus

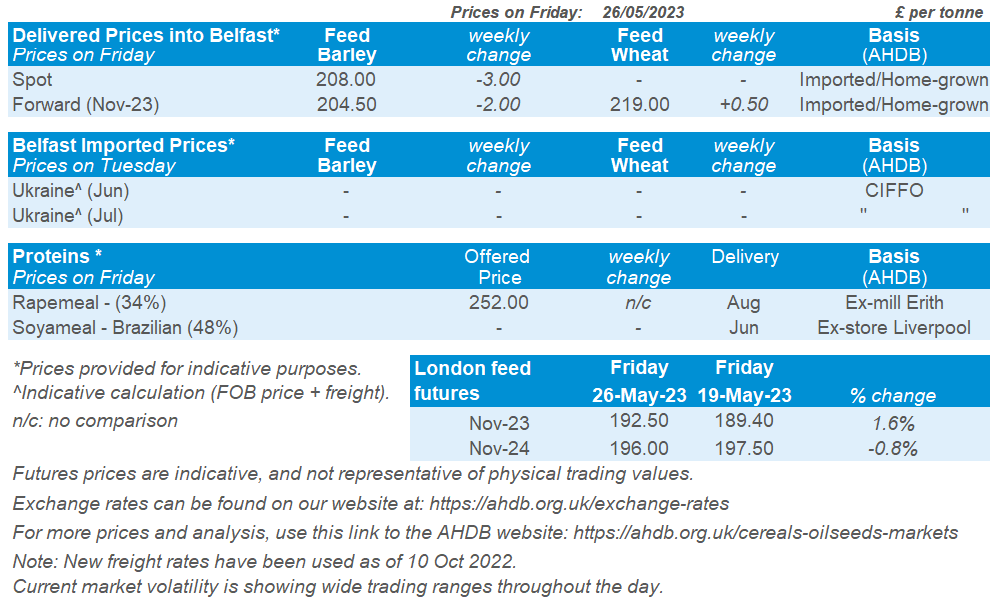

Delivered cereals

New crop UK feed wheat futures gained last week, due to global markets rising on Friday. The Nov-23 contract gained £3.10/t to close at £192.50/t on Friday.

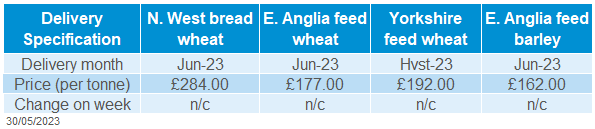

The gap between feed wheat and feed barley prices is wider for next season. In the latest AHDB delivered prices (as at Thursday), feed barley for harvest delivery (East Anglia) was reported at a £23.50/t discount to feed wheat. This compares to a £15.00/t discount currently for old crop June 2023 delivery.

North-West bread wheat for June delivery was quoted at £284.00/t on 25 May, with no comparison to the previous week.

AHDB published updated UK supply and demand forecasts last week. Commercial wheat ending stocks remain high at 2.44 Mt, up 32% on the year. With another good crop likely on the way, this could mean heavy domestic supplies in 2023/24. The potential for demand to also remain lacklustre suggests that high exports will again be needed next season.

For barley, a higher export forecast offsets lower demand. This means end of season stocks will slip below the five-year average. Stronger exports are also forecast for oats, now at the highest level for 20 years. But these only partly offset a trimmed demand forecast to leave oat stocks slightly higher than was forecast in March.

Oilseeds

Rapeseed

Soyabeans

EU rapeseed crop in general is faring well with a large production expected. Longer-term Canadian weather is the focus as plantings progress and come to an end.

Focus is currently on the US soyabean plantings, which is bolstering expectations of record production for 2023/24. Record output will have the ability to keep weighing on the oilseed complex.

Global oilseed markets

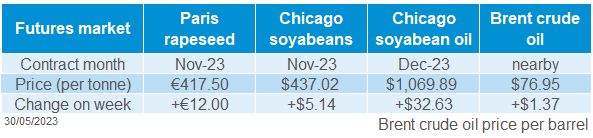

Global oilseed futures

A choppy week for Chicago soyabean futures (Nov-23) with the contract supported at the start of last week from a round of bargain buying. From this point there was pressured throughout the week. The pace of U.S. soyabean plantings accelerated, bolstering expectations for a good harvest this Autumn. Further to that, pressure came from a strengthening dollar, and lower than anticipated demand from China. However, soyabeans firmed on Friday as optimism over negotiations to raise the U.S. debt ceiling lifted commodity and equity markets. The Nov-23 contract closed at $437.02/t on Friday, up 1.2% across the week.

US weekly export sales of old crop soyabeans were 115 Kt (to week ending May 18), at the low end of trade expectations. New-crop sales were at 1.1 Kt over the same period, way under trade expectations of 100 Kt – 676 Kt.

In other news, there was support across the week for Malaysian palm oil from a weaker Malaysian Ringgit and forecasts of an El Niño weather pattern hitting production. According to the Malaysian Palm Oil Board, crude palm oil production could drop 1-3 Mt next year due to the El Niño weather pattern. This is a critical watchpoint for oilseed markets at the end of 2023.

There was support across the week for nearby Brent crude oil futures, with the contract gaining 1.8%. Further gains yesterday took the contract to $77.07/barrel. Support comes as U.S. officials were close to striking a debt-ceiling deal. This weekend OPEC+ will hold a meeting to discuss oil output. There is uncertainty over whether the cartel will increase their output due to the recent and longer-term pressure on crude oil prices. This will be a watchpoint for driving overall sentiment toward crude oil, which will filter into oilseed prices.

This week’s focus is on U.S. soyabean plantings with a planting update released this evening. Over the next seven days widespread rains are forecast over the U.S. Midwest. This would be ideal for the newly sown soyabeans, with soyabeans planting over 70% complete (to 21 May 2023) in nearly half the top growing states.

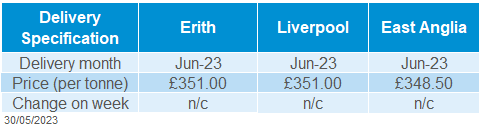

Rapeseed focus

UK delivered oilseed prices

Rapeseed prices were supported by crude oil and palm oil prices last week. Paris rapeseed futures closed Friday at €417.50/t, gaining €12.00/t across the week. Delivered rapeseed (into Erith, Jun-23) was quoted at £351.00/t, with no comparison on the week.

Germany’s association of farm cooperative forecast the 2023 winter rapeseed crop similar to last year at 4.28 Mt, with figures increasing on the April forecast (4.25 Mt) after the crop benefited from good weather.

EU weather is still a critical watchpoint as we approach harvest. However, as Canada finishes up canola plantings focus will shift towards their crop development, due to the sizeable crop expected.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.