What does better China-Australia relations mean for UK barley? Grain market daily

Wednesday, 16 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £186.20/t yesterday, down £5.20/t from Monday’s close. Nov-24 futures fell £3.70/t over the same period, to close yesterday at £194.30/t.

- Domestic futures followed pressure on Chicago and Paris wheat markets yesterday, on wider commodity losses from concerns with China’s economy, and improved US crop conditions.

- Paris rapeseed futures (Nov-23) closed yesterday at €453.25/t, up €6.00/t from Monday’s close. Support came from the wider vegetable oil picture yesterday. Malaysian palm oil futures (Nov delivery) gained yesterday due to strong exports so far this month, a weaker ringgit and production worries after a hot and dry weather forecast.

- Domestic inflation looks to be slowing using the latest ONS data, mostly due to falling gas and electricity prices. The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose 6.4% in the 12 months to July 2023, down from 7.3% in June. CPI rose by 6.8% in the 12 months to July 2023, down from 7.9% in June.

What does better China-Australia relations mean for UK barley?

Recently, China announced they were lifting the 80.5% anti-dumping and countervailing duties on Australian barley. This duty had been in place since May 2020, effectively blocking Australian barley exports to China. Now duties have been lifted and the companies CBH Grain and LDC’s Emerald Grain Australia have been re-registered to export.

In response, barley prices in the north of Australia lifted $20/t, according to Australian news reporter Grain Central. We are also seeing reports this week that at least four cargoes of Australian barley for shipment from September–October have been booked already. According to Bloomberg, Australian barley is very competitively priced for animal feed compared to domestic Chinese maize.

So, what does this mean for French barley and the EU balance?

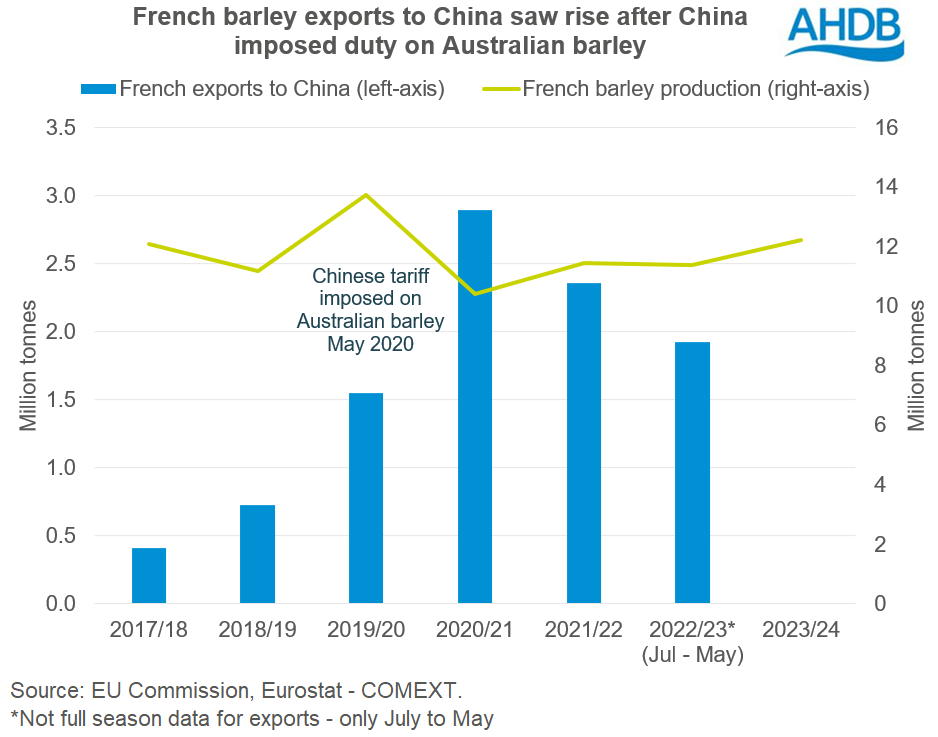

French barley exports gained from the dispute in 2020, seeing a pickup in volumes exported to China after the duty came in. As China books cargoes from Australia, we could see French origin lose out. This depends on China’s appetite for barley, but Australia is geographically well-placed to be a competitive origin to meet Chinese demand.

What will this mean for French barley this season? The French barley crop for harvest 2023 is forecast up 7% year-on-year to 12.2 Mt by the EU Commission. However, the overall EU barley balance is expected to be tight this season with EU-27 production currently forecast down 2.8 Mt on the year, to 49.1 Mt. Consultancy Stratégie Grains pegs total barley production as low as 47.2 Mt (Refinitiv). Sharp reductions are forecast for the barley crops in Spain and Denmark especially, on dry conditions earlier in the season. Spain, like last year, has seen hot and dry conditions; this has led to successive cuts to their grain crops for 2023.

With a tight barley balance on the continent, French barley will not need to look too far for demand, providing they are competitively priced to other origins like Black Sea barley. Though what does this mean for UK export potential to the EU?

UK barley exports boosted to Spain last season – where next?

Last season (2022/23), we saw UK barley exports boosted to the EU and Spain specifically, following a smaller Spanish barley harvest in 2022. HMRC have recently published full datasets for last season’s trade data (July 2022 – June 2023), with barley exports totalling 1.116 Mt; this is up 46% on the year. Of this, 99% headed to the EU and 44% to Spain. My colleague Olivia will be exploring full season export and import numbers in more detail tomorrow.

Looking to this season, another decent barley crop is due in the UK. The total UK barley area for harvest 2023 is estimated at 1,154 Kha, up 5% on the year according to the Planting and Variety Survey. Yields look positive in initial GB harvest reports, on a par with the five-year average. Quality remains in focus considering the rain that has been hampering harvest progress.

Despite potentially more French barley looking for a home this season, with the tight barley balance in the EU and an even smaller Spanish barley crop, UK barley exports have the potential to remain strong into the EU this season – this is providing UK origin remains priced competitively.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.