Nitrogen fertiliser prices up in July – is there more to come? Grain market daily

Tuesday, 15 August 2023

Market commentary

- UK feed wheat futures (Nov-23) fell £4.05/t yesterday to £191.40/t, the lowest price since 07 June.

- Global wheat markets came under pressure from larger Russian crop forecasts. IKAR increased its wheat crop forecast from 88.0 Mt to 89.5 Mt. The USDA currently estimates the crop at 85.0 Mt, though the USDA excludes Crimea from its forecast. The market largely ignored the latest developments in the war; Russia fired ‘warning shots’ at a grain vessel reportedly headed for Ukraine (Refinitiv).

- Paris rapeseed futures (Nov-23) fell €9.00/t yesterday to close at €447.25/t. This contrasted with gains in Chicago soyabean futures and Winnipeg canola futures due to more US soyabean export sales and fund buying.

- The USDA reported bigger improvements in US maize and soyabean crop ratings than the market expected last night. The USDA rated 59% of the US maize crop as in good/excellent condition as of 13 August, up 2 percentage points (pp) from 6 August. The soyabean rating rose 4 pp (6 -13 August) to 59% good/excellent.

- Brazil had harvested 72% of its second (safrinha) maize crop by 12 August, Conab said last night, up from 64% a week earlier.

Nitrogen fertiliser prices up in July – is there more to come?

Spot prices for nitrogen fertiliser rose in July, according to the latest GB fertiliser prices. UK produced ammonium nitrate (AN, 34.5% N) averaged £353/t in July for spot delivery, up £9/t from June. Meanwhile, the price for granular urea rose £46/t over the same period to £397/t.

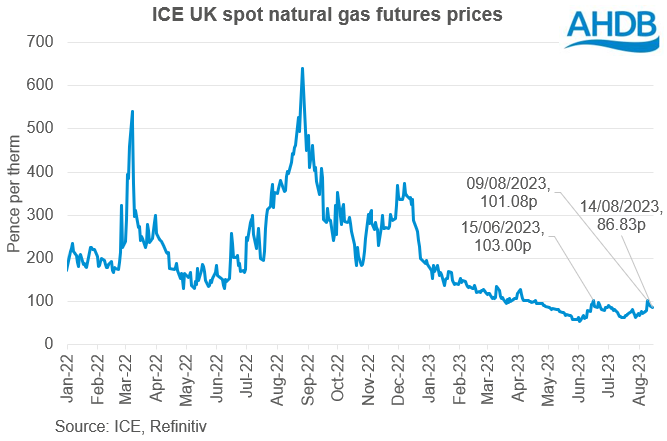

Natural gas prices rose in June as temperatures climbed (increasing the need for air conditioning) at the same time there were supply outages in Norway. There was a further increase last week due to a potential strike at the Liquified Natural Gas (LNG) plants in Australia. Europe now needs to compete for LNG cargoes to compensate for lower Russian gas imports.

UK natural gas prices have eased back slightly since, but are still trading close to 90 pence per therm. This is a long way down from last year’s peaks but above the recent lows of late May and early June.

Also, the EU Commission reintroduced tariffs on imports of urea and ammonia from several origins in June. The tariffs were suspended in December after prices spiked in 2022. Higher gas prices, along with the reintroduction of tariffs, a weaker pound against the US dollar, and lower Egyptian urea output, have filtered through to push up UK nitrogen fertiliser prices.

Is there more to come?

Forward natural gas prices are higher than current levels, partly as autumn and winter mean higher demand. European natural gas stores are filling up, but the region’s dependence on LNG will continue and gas prices remain vulnerable to further supply shocks.

Natural gas makes up around 60−80% of nitrogen fertiliser production costs in Europe. So, any rise in natural gas prices is likely to filter through to UK nitrogen fertiliser prices.

Another factor to watch is the sterling to US dollar exchange rate. A weaker pound against the US dollar would make all imported products dearer, including nitrogen fertiliser.

More falls for phosphate and potash prices in July

Meanwhile, potash and phosphate fertiliser prices continued to fall in July. The average spot price for Muriate of Potash (MOP) fell £15/t to £416/t, the lowest price since Aug-21. The average spot price for Diammonium Phosphate (DAP) fell £40/t to £519/t, the lowest price since May-21.

Whether this trend continues into August or changes depends on global prices for potash and phosphate, plus the sterling to US dollar exchange rate. Global DAP prices have been picking up in recent weeks. If sustained, and sterling remains weaker against the US dollar, this could translate into higher UK prices going forward.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.