Cuts to EU production: Grain market daily

Thursday, 10 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £200.25/t, down £1.95/t from Tuesday’s close. Nov-24 futures fell just £0.55/t over the same period, to close at £204.00/t.

- Domestic futures followed losses on the Chicago and Paris wheat markets yesterday, pressured by competitive Russian wheat and India releasing wheat stocks. On Tuesday, Egypt’s state buyer GASC purchased 235 Kt of Russian wheat, despite the increase in freight costs from the region over the week. Yesterday, India announced it would release up to 5 Mt of wheat from stocks to curb price rises.

- Continuous rain caused by the back end of the Typhoon Doksuri has impacted 258 Kha of the sown area in China's largest maize producing province Heilongjiang, according to state broadcaster CCTV (Refinitiv).

- Paris rapeseed futures (Nov-23) yesterday closed at €458.25/t, down €5.50/t from the previous day’s close. Despite some gains seen for Chicago soyabean futures, the Paris contract followed pressure for Winnipeg canola futures (Nov-23).

- Today’s price action will likely be dominated by positioning ahead of the USDA publishing its latest World Agricultural Supply and Demand Estimates (WASDE) tomorrow.

Cuts to EU production

Weather continues to be the focus across the UK and EU. Domestically, rains have delayed harvest for many, though this week we are finally seeing some sunshine.

From the catchy rain so far, at the forefront of minds is the quality of grain domestically, how much milling vs feed wheat will likely be available and what that might mean for domestic prices.

We are hearing anecdotal reports of sooty head mould and germinating ears to name a few challenges for crops waiting to be cut, with moistures and drying costs again at the forefront of minds.

Our next GB harvest report is provisionally scheduled for release tomorrow, which will give us more insight into harvest progress, yield and initial quality.

The EU too is in focus. Yesterday, FranceAgriMer said rain delays to the end of the soft wheat harvest in France may affect milling quality. However, crops gathered before the wet spell were generally showing satisfactory results.

With drought and heatwaves earlier in the summer, followed by heavy rain across northern Europe, concerns have grown over yield prospects and quality leading to trimmed yield potential.

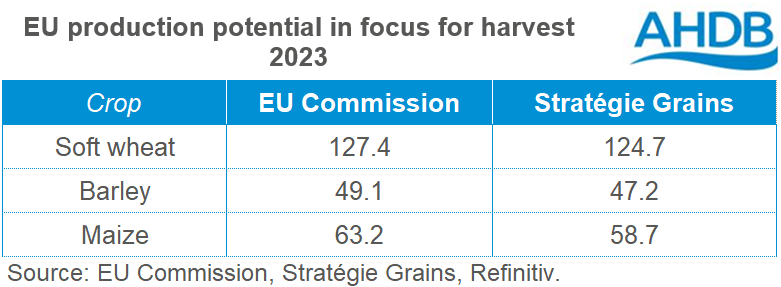

Yesterday, consultancy Stratégie Grains pulled back their EU production forecasts for both wheat and maize (Refinitiv). EU soft wheat production for 2023/24 is now forecast at 124.7Mt, down 1.5 Mt from last month’s forecast and has now fallen lower than last season.

Maize production is forecast to be 2.1 Mt lower than last month’s estimate, at 58.7 Mt. Growing conditions through July, especially in southern EU countries, have been hot and dry.

The outlook for EU barley production is significantly lower year-on-year (-4Mt) but saw a marginal increase (+0.1Mt) from last month’s forecast. A tight EU barley balance is still expected for this season.

Two weeks ago (27 July) the European Commission published its latest projections for harvest 2023 for the bloc. The Commission have soft wheat production currently forecast at 127.4Mt, maize at 63.2Mt and barley at 49.1Mt, for EU-27.

Stratégie Grains latest estimates now sit considerably below the European Commission’s latest estimates. Could we see any change in tomorrow’s USDA report and the next MARS report due later this month? Something to watch, for price direction not just on the continent, but here in the UK too.

What does this mean for price direction?

Wheat supply on the continent looks to be more finely balanced than previously expected, considering these crop cuts, though not as tight as the barley balance.

With large carry-in stocks from 2022/23 (partly due to high volumes of imported Ukrainian wheat), EU wheat stocks still feel in the comfortable zone. Though focus, as mentioned earlier, is on how much of the crop will meet milling quality.

Globally, the potential of smaller EU wheat supplies is significant considering the tightening of stocks in major exporters this season. However, it’s important to note that Russian grain, especially, continues to be competitive on the global market, which could cap gains for EU values and, in turn, UK price movements.

For now, weather watching continues and what impact this season’s conditions have had on yields and quality.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.