Analyst insight: The cost of drying grain for harvest 2023

Thursday, 3 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £195.85/t, gaining £0.20/t from Tuesday’s close. New crop futures (Nov-24) closed at £198.25/t, up £0.25/t over the same period. UK wheat prices were supported slightly by sterling weakening, ahead of the Bank of England's interest rate revision today. The UK's interest rate has risen by 0.25% − from 5% to 5.25% − the highest rate since April 2008.

- While UK markets were relatively stable, global grain prices dropped yesterday, with both the Chicago and Paris wheat markets ending down. This is despite reports of Russia attacking Ukraine’s main inland port across the Danube River from Romania yesterday. Markets were initially supported, but gains subsided as the market assessed the potential impact of the attack, against the backdrop of strong Russian exports and rumours of Russia considering re-igniting the Black Sea Initiative.

- Paris rapeseed futures (Nov-23) closed yesterday at €444.50/t, gaining €3.75/t from Tuesday’s close. Rapeseed followed gains in palm oil, which ended higher due to a weaker Malaysian Ringgit. However, the Chicago soyabean market ended down, with forecasts of cool wet weather across key growing regions in the USA pressuring prices.

- This morning, AHDB published the latest GB animal feed and UK human and industrial cereal usage statistics for the month of June 2023. This means there is now a full season overview of production and usage for the 2022/23 marketing year (Jul-Jun). GB compound animal feed production for 2022/23 is estimated at 11.16 Mt, down 5.7% year-on-year. Total wheat usage by UK flour millers (inc. bioethanol and starch) for 2022/23 is at 6.13 Mt, up 2.1% year-on-year. Full information can be found in the links above.

The cost of drying grain for harvest 2023

While harvest 2023 is underway, it has been hindered in most regions by wet weather, with progress falling behind the previous five-year average. However, windows of dry weather have enabled farmers in some regions to make a reasonable start to winter barley and oilseed rape harvest.

With the recent rains, some grain will likely need drying to meet the correct specification to market. For feed wheat to meet specification in the UK it needs to be at c.15% moisture. With energy prices now much lower than this time last year, that cost will be significantly reduced, but will still be a cost that will impact gross margins of arable crops. Especially given last year's crops needed little to no drying and cereal prices this year have come down considerably, while input costs for the 2023 crops remained relatively high.

What is your moisture percentage?

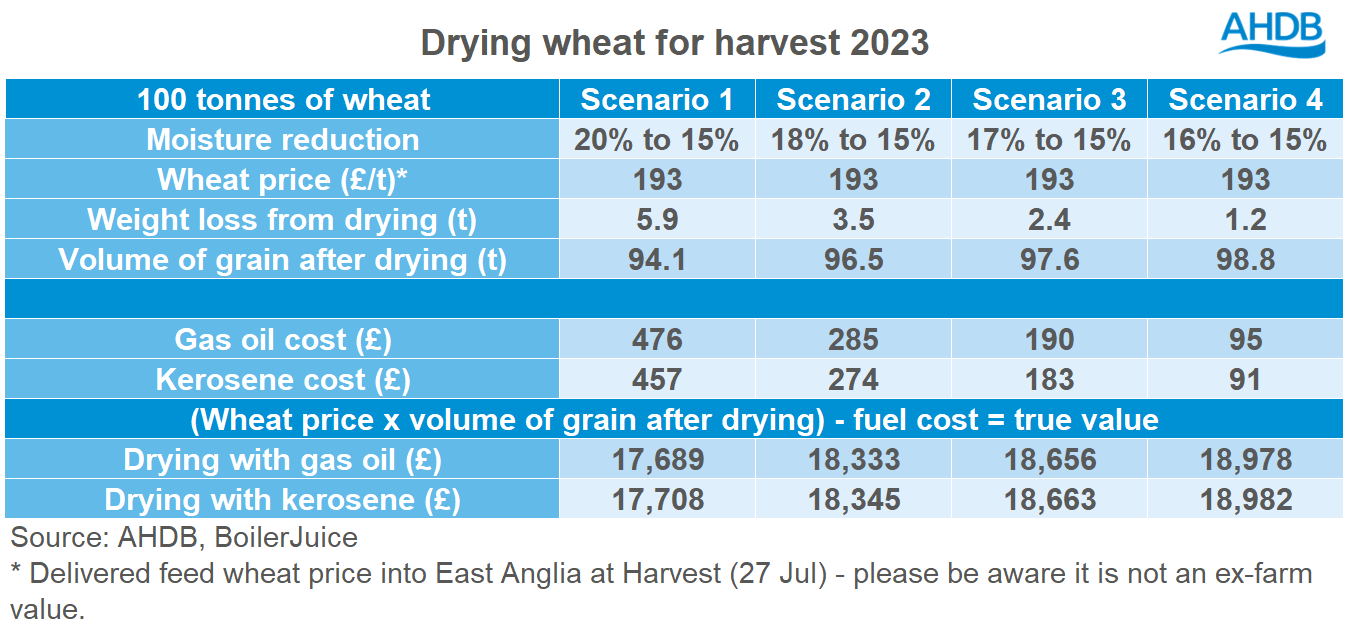

This analysis is going to focus on the cost of drying 100 t of feed wheat using a continuous flow drying system from different moisture levels to 15%, using gas oil and kerosene, which will also take into account the tonnage lost from drying the crop. The wheat price used is the latest delivered feed wheat price into East Anglia for Harvest of £193.00/t (as at 27 July).

The grain drying calculator developed by AHDB assumes that gas oil (red diesel) usage is 1.20 L of fuel per tonne of grain dried by 1%. While kerosene is slightly less efficient at 1.32 L. The fuel price data has been sourced from Boiler Juice and is as at 2 August.

For all scenarios shown above, drying using kerosene (albeit less efficient) is more cost effective at the moment. Furthermore, it’s not surprising that the less drying that is required, the less costs there are, increasing the true value of the grain.

The stark contrast between Scenario 1 and 4 needs to be noted. In Scenario 1, nearly five times more tonnage is lost when drying to 15%, compared to Scenario 4. This means that over five times more fuel is needed to dry the grain, increasing costs, and decreasing the true value of the original ‘100 t of grain’.

Between Scenario 1 and 4 there is a 7% difference in the end value of the grain when marketed at 15% moisture.

Conclusion

Ultimately, we cannot help the weather this harvest, and if it rains, it rains. However, what this analysis does show is that if there is chance to wait for your grain to naturally dry somewhat in the field, it may pay dividend in the end and lower input costs. Likewise, if you do use a continuous flow drying system or mobile dryers, it may be worth looking at the fuel you use to power them, with kerosene, currently working out cheaper than gas oil/red diesel.

Regular harvest progression and updates will be posted on the AHDB harvest progress page.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.