Where now for rapeseed prices? Grain market daily

Tuesday, 26 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £193.90/t, gaining £4.50/t on Friday’s close. New crop futures (Nov-24) closed at £202.90/t, gaining £2.90/t over the same period

- The UK market gained due to strength in both Paris and Chicago wheat futures. This comes from concerns over Southern Hemisphere wheat crops, as hot and dry weather impacts both Australia and Argentina. There are expectations that Australian wheat production could be revised down further as the month of September is crucial for development

- Paris rapeseed futures (Nov-23) closed yesterday at €440.75/t, down €0.50/t on Friday, following the pressure in Winnipeg canola futures and Chicago soybean oil. On the other hand, Chicago soyabean futures gained as traders adjusted positions before the US quarterly grains stocks data (out this Friday 29 September). Plus, some rains across the US Midwest slowed harvest in some areas

Where now for rapeseed prices?

For a while in the AHDB market reports, we have been marginally bearish longer-term on rapeseed prices, with the market subsiding since the start of 2023. Looking forward, there are big influences that could continue to weigh on rapeseed prices into 2024.

What’s happened to rapeseed prices?

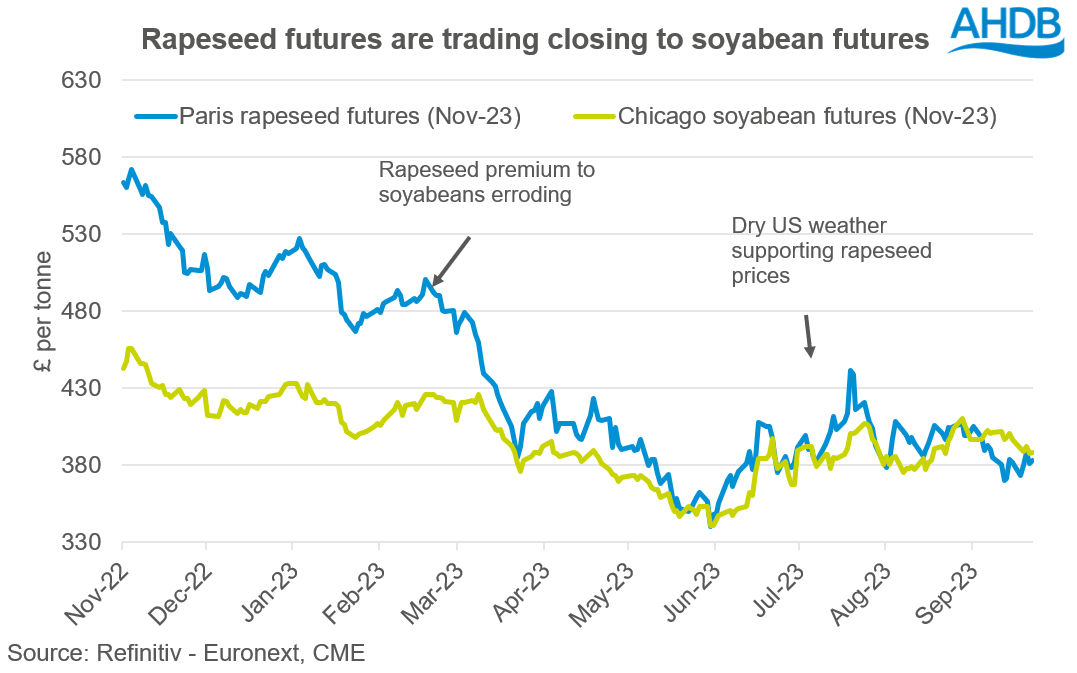

Since the start of 2023, Paris rapeseed futures (Nov-23) have dropped over 25%. Delivered rapeseed prices (into Erith, Nov-23) were quoted at £371.00/t last Friday. This is down significantly from the start of January when this price was (into Erith, Nov-23) quoted at £522.50/t.

At the start of the year, rapeseed’s premium over Chicago soyabean futures eroded rapidly. This was due to fundamentals such as large stocks in the EU, combined with large crops expected from Ukraine, the EU and Canada weighing on the market. Rapeseed futures are trading at near parity to Chicago soyabean futures now.

Since rapeseed’s premium has eroded, rapeseeds price direction has largely been driven by Chicago soyabeans and caught up in the North American weather market. US weather, at times, was hot and dry leading to soyabean yield cuts, which supported prices, filtering into rapeseed prices too.

What could happen to rapeseed prices?

We know that the rapeseed market is largely well-supplied for the 2023/24 marketing year; this is despite the recent cuts to the Canadian and EU crops. The USDA forecast global ending stocks at 6.1 Mt, down from 7.5 Mt last year, but way above 2021/22 when ending stocks dropped to 4.6Mt.

Rapeseed futures appear to have hit a floor, after falling to meet soyabean futures, as the graph shows above. Global stocks for 2023/24 of rapeseed are not small enough to cause a huge premium to soyabeans. Therefore, this indicates that soyabeans are probably going to drive domestic rapeseed prices for this marketing year.

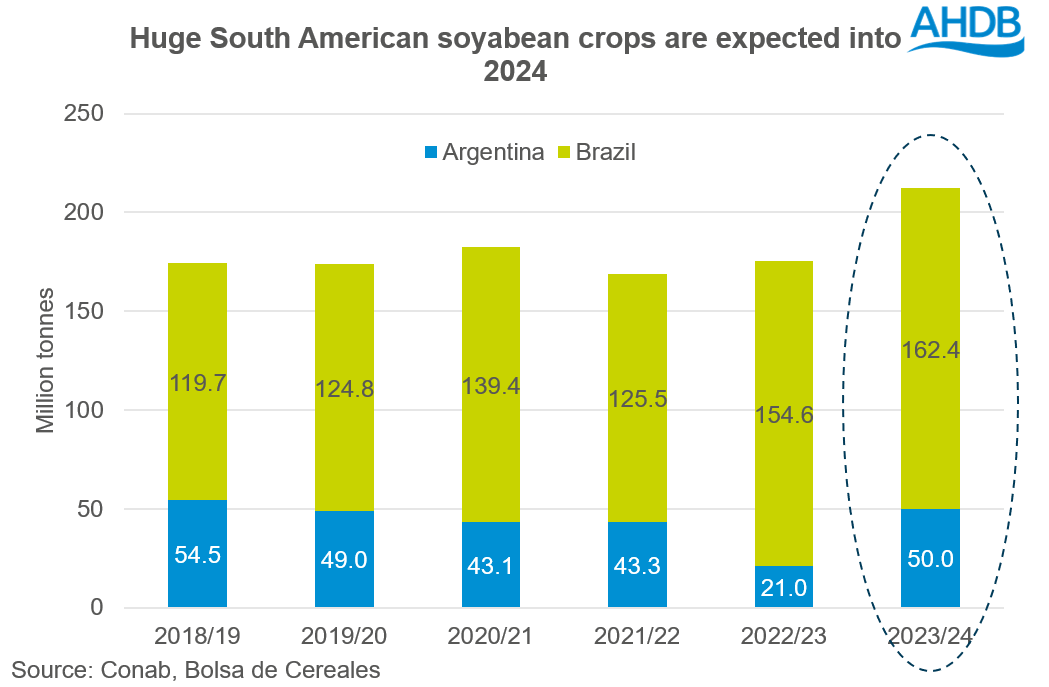

There are expectations that pressure could occur in the soyabean market going into the start of 2024. South American soyabean production could really weigh on the oilseed complex.

Currently a record soyabean crop is predicted for Brazil of 162.4 Mt (Conab). According to Ag Rural, 1.9% of the Brazilian soyabean crop is now planted, the quickest pace in 5 years. Argentinian production is expected to rebound to 50.0 Mt, up from the disastrous drought-hit crop last year of 21.0 Mt.

Also, there is a 95% chance of an El Nino weather event continuing into 2024 (NOAA), which in large will bring warm and wet conditions to productive growing regions of these two countries. As long as the rain is not excessive, this could really bolster South American soyabean production.

Although this part of the world is over 5,000 miles from the fields of Suffolk, in reality it will really impact rapeseed prices going into 2024.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.