Animal feed demand still sluggish while malting starts strongly: Grain market daily

Thursday, 28 September 2023

Market commentary

- Paris wheat futures for Dec-23 gained €0.75/t yesterday to close at €241.00/t, as the market considers exports from the Black Sea. Egypt bought 170 Kt of European wheat, including 120 Kt of Romanian and 50Kt of Bulgarian wheat, in a tender yesterday. Although European wheat was the most competitive yesterday, Russian wheat is reported to be more competitive away from official tenders. This, and a fall in Chicago wheat futures, limited gains.

- Nov-23 UK feed wheat futures fell £0.75/t to £192.00/t, likely linked to sterling lifting against the euro. Yesterday £1 was worth €1.1519, up from the four and a half months low of €1.1492 on Tuesday (European Central Bank).

- Paris rapeseed futures for Nov-23 rose €11.50/t to €452.25/t, buoyed by a rise in Canada’s Winnipeg canola futures.

- Farmers in England grew 210.6 Kha of field beans in 2023, data from Defra showed this morning. This is 1.2% larger than 2022 and the largest area in electronic records back to 1983. The area of peas for dry harvesting also expanded 6.5% year-on-year to 60.3 Kha but is still smaller than 2021 (60.4 Kha). It’s also worth noting there’s a relatively wide confidence interval for peas (+/- 9.0 Kha), meaning there is more uncertainty over the figure.

Animal feed demand still sluggish while malting starts strongly

Demand for grains from the compound animal feed sector, including Integrated Poultry Units (IPUs), started this season (2023/24) sluggishly, just as it ended last season.

However, more barley was used to make compound feed in July and August than the same period last season. Meanwhile, demand for barley from brewers, maltsters, and distillers (BMDs) has started the season strongly. Depending on the UK crop size, if these trends continue, they could squeeze the UK’s barley availability for export.

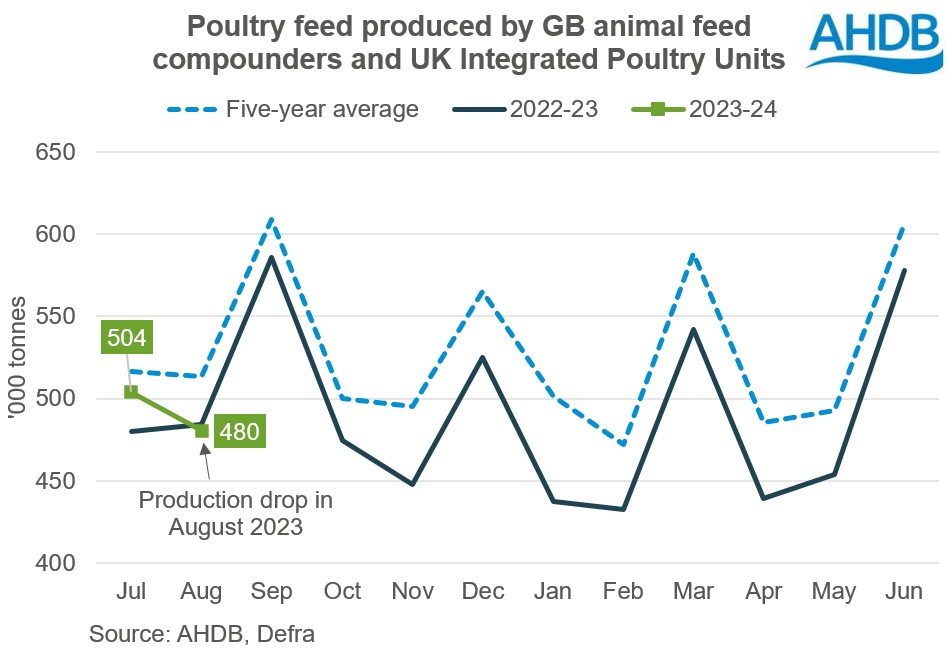

Poultry pecking down animal feed demand

The total amount of animal feed produced by GB compounders and IPUs across the UK in August was the lowest since 2015.

The total for the season so far (July and August) is comparable to the first two months of last season (2022/23). But we’ll need to monitor to see if the trend of lower demand continues, and the total falls below last season.

Pulling down the total in August 2023 particularly, is a drop in the production of poultry feed, which dropped to a ten-year low for the month. Defra reports that UK turkey poult placing in August were the lowest for the month since at least the mid-1990s. In addition, layer chick placings slipped back below the five-year average in July and August. View more on this data on Defra’s website here.

Production of pig feed also remains well below last season so far, which in unsurprising given the pig herd is the smallest in over a decade. There is potential for some gradual recovery in pig numbers if margins remain positive, though this will partly depend on how grain and oilseed prices evolve.

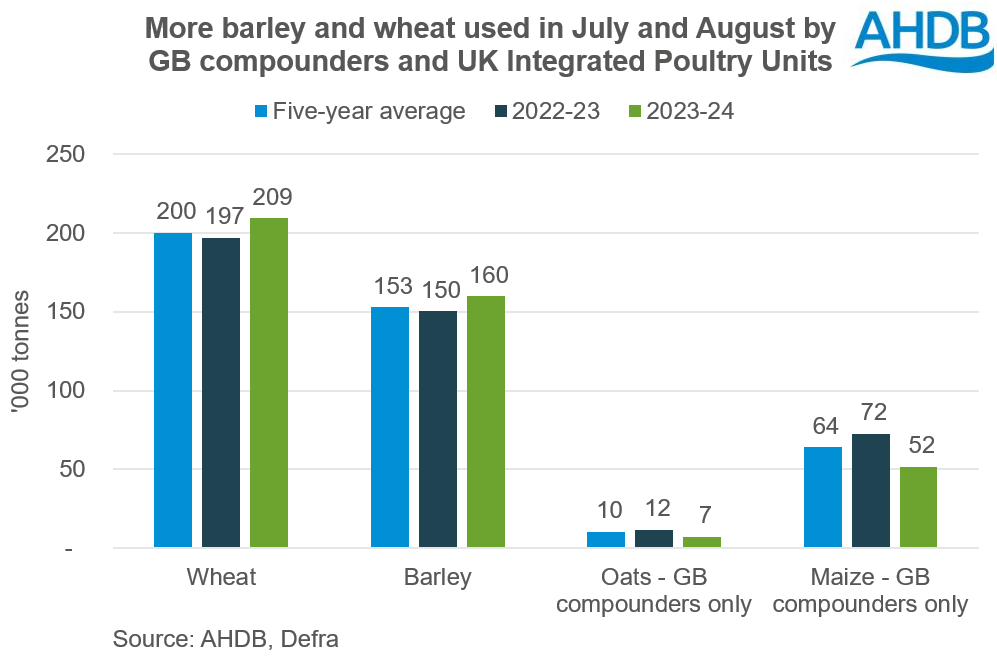

Barley feed demand up so far

Animal feed makes up 54% of total grain demand in the UK (five-season average) so the trends have a big impact on average UK supply and demand.

So far this season (July and August), barley is accounting for a bigger proportion of the grain being used to make animal feed (combined GB compounders and IPUs). This continues the pattern from the end of last season (2022/23) and may reflect the timing of the 2023 harvest.

Wheat inclusions started strongly in July but eased back a bit in August, while oat usage by GB compounders is sharply down again year-on-year, from the highs in 2021/22.

A key area to watch is maize. In July and August GB compounders used less maize than in the first two months of the 2022/23 season, however could this change? The world is forecast to harvest a very large maize crop this season. Once 2023 maize crops become available for export, could more find its way into UK rations?

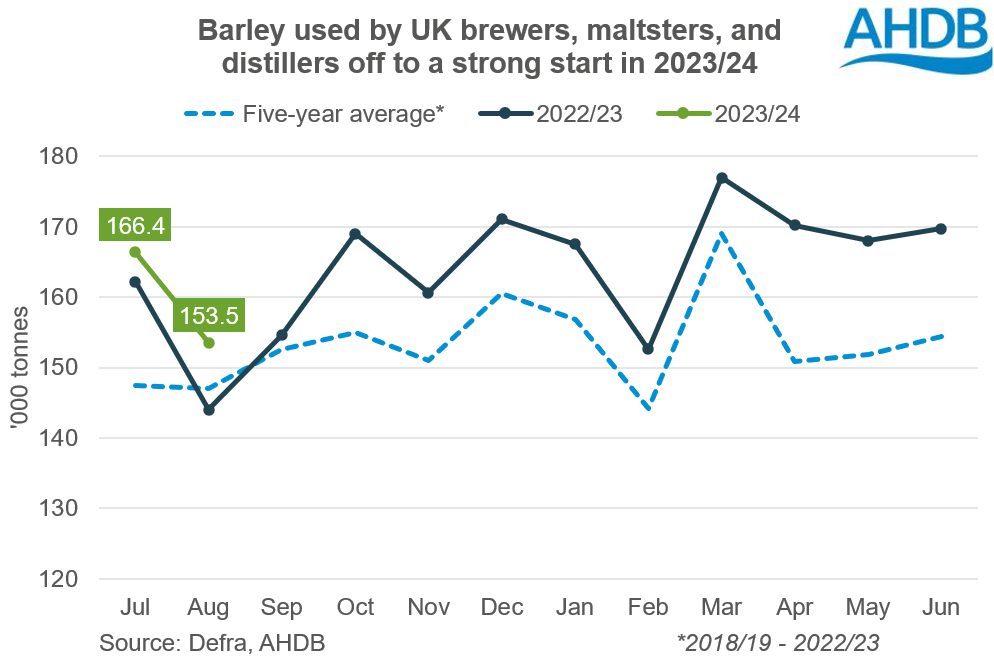

Strong start to season for malting demand

Demand for malting barley started this season strongly, even more so that last season’s strong usage levels. The amount of barley used by BMDs was up 7% year-on-year in August and 4% above the five-year average for the month.

In 2022/23 the total amount of barley used by the human and industrial sectors totalled 1.98 Mt, the highest in our electronic records back to 1999/00. While there’s still a long way to go, if the strong start to demand by BMDs continues, it raises the prospect of could demand surpass 2022/23? Supporting this prospects is that capacity increases are now online. However, the rise in spot malting barley prices due to the wet harvests across Europe and tight global barley supplies means it’s not certain.

Less home-grown wheat milled in August

Total usage of wheat by UK flour millers (including for starch and bioethanol production) dropped 22 Kt between July and August to 507 Kt. The August total is still above last year and the five-year average for August, but to a lesser extent than in July.

Most of the monthly decline is home-grown wheat, which is not surprising given the later harvest this year. We’ll need to see if the trend continues now that harvest is all-but concluded and as imports of wheat slowed in July.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.