Tight wheat balance to limit the downward pull from maize? Grain market daily

Thursday, 20 July 2023

Market commentary

- UK feed wheat futures (Nov-23) climbed £13.30/t yesterday, to close at £212.15/t. The Nov-24 contract gained £10.90/t over the same period, ending the session at £213.95/t.

- Global wheat futures have continued to climb over the last few days following escalations in the Black Sea region after Russia withdrew from the Black Sea Initiative deal. No ships have left Ukrainian ports since the deal expired on Monday, and last night saw a third straight night of bombardments of Ukrainian ports. Russia has also issued a new threat against vessels heading for Ukraine, suggesting Moscow might attack ships imminently (Refinitiv).

- Paris rapeseed (Nov-23) gained €26.25/t yesterday, closing at €508.25/t. The Nov-24 contract closed at €498.25/t, up €23.00/t over the session.

- Support in US soyabean markets filtered through into rapeseed futures yesterday. Concerns rose over the condition of the US crop due to forecast hot and dry weather in the Midwest.

Tight wheat balance to limit the downward pull from maize?

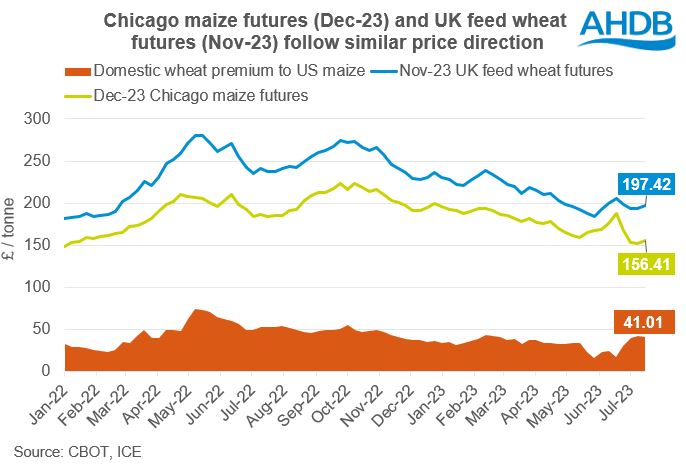

As is well known, animal feed producers around the world can adjust their use of maize and wheat depending on price competitiveness that season, with one grain substituting another to a certain point. Because of this, UK feed wheat futures (Nov-23) and Chicago maize futures (Dec-23) follow similar price directions.

Over the last year and a half, the UK futures premium over Chicago maize (Dec-23) has most of the time stayed at £30-50/tonne. However, over the last couple of months, premiums have been less stable. The UK wheat futures premium dropped down to £16.78/t at the end of May, likely due to adverse weather in the US raising concerns over the maize crop. The premium then rose to £41.01/t last week. The recent rise in premiums is likely the result of a tighter-looking global wheat balance but a heavier-than-expected maize balance this season.

Where next for prices?

To know what we can expect from prices moving forward, it’s key to look at the global maize and wheat supply and demand picture.

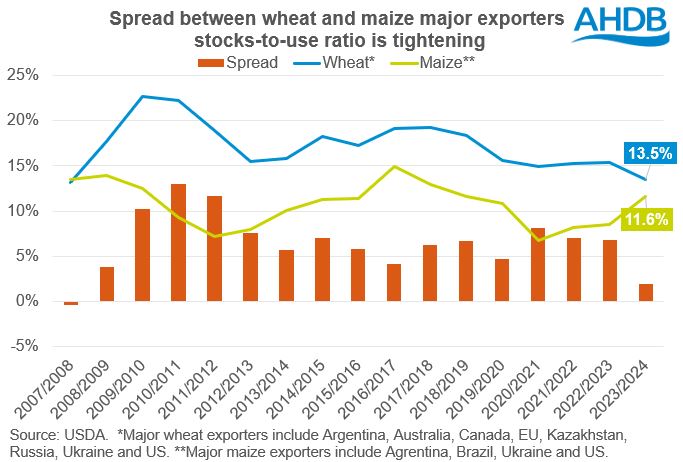

The stocks-to-use ratio of the world’s major exporters of maize or wheat is calculated by dividing estimated ending stocks by estimated consumption in these countries and their exports. This calculation gives us an idea of how much grain could be available to the global market.

In the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE), the maize balance was estimated heavier than analysts had expected. A combination of the third-largest US maize area since 1944 and improving US crop conditions over the last few weeks led to increased supply expectations. Argentina and Brazil are also due large maize crops in the 2023/24 season, offsetting the below-average EU maize crop.

A larger US wheat crop is expected to be offset by smaller crops in the EU-27, Canada, and Argentina this season. As a result, global wheat production was cut in the latest WASDE. Stocks held in major exporting nations are expected to reach their lowest level in recent years, potentially limiting any major pressure from maize markets.

Conclusion

To conclude, as it stands, this season is expected to bring a historically tight wheat balance, but a heavier-than-average maize balance. Long term, ultimately UK feed wheat futures will be influenced by US maize futures to an extent, as maize is a large part of global grain supply and demand. But the global tightness of wheat supply will likely limit the downward pressure expected in maize markets, and the premium over maize futures could strengthen.

Short term, as maize in the US and EU is in its critical growth stage, adverse weather could bring some short-term support to maize markets. This could filter into wheat prices, though it’s important to note that wheat prices are being driven largely by Black Sea supply concerns currently.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.