Lower-quality domestic crops increase cereals imports this season: Grain market daily

Tuesday, 28 November 2023

Market commentary

- UK feed wheat futures (May-24) closed at £193.70/t yesterday, down £1.55/t from Friday’s close. The Nov-24 contract lost £0.60/t over the same period, ending the session at £205.30/t

- Domestic wheat futures followed global wheat markets down yesterday on the back of better-than-expected US wheat crop conditions. Yesterday, the USDA rated 50% of the US wheat crop in good–excellent condition, up two percentage points (pp) on the week, and a greater improvement than expected by analysts. This is the last US-wide condition report of the year; the reports resume on 1 April 2024

- Paris rapeseed futures (May-24) rose €3.25/t yesterday, closing at €446.00/t. The Nov-24 contract closed at €452.50/t, up €3.00/t over the session

- Paris rapeseed futures followed movement in the wider oilseeds complex yesterday, as markets continue to react to planting progression of soya beans in Brazil. AgRural said yesterday that soya bean plantings in the country reached 74% of the expected planted area, making it the slowest progress for the period in eight years

Lower-quality domestic crops increase cereals imports this season

Today, AHDB published the first official UK supply and demand estimates for wheat, barley, oats and maize for the 2023/24 season.

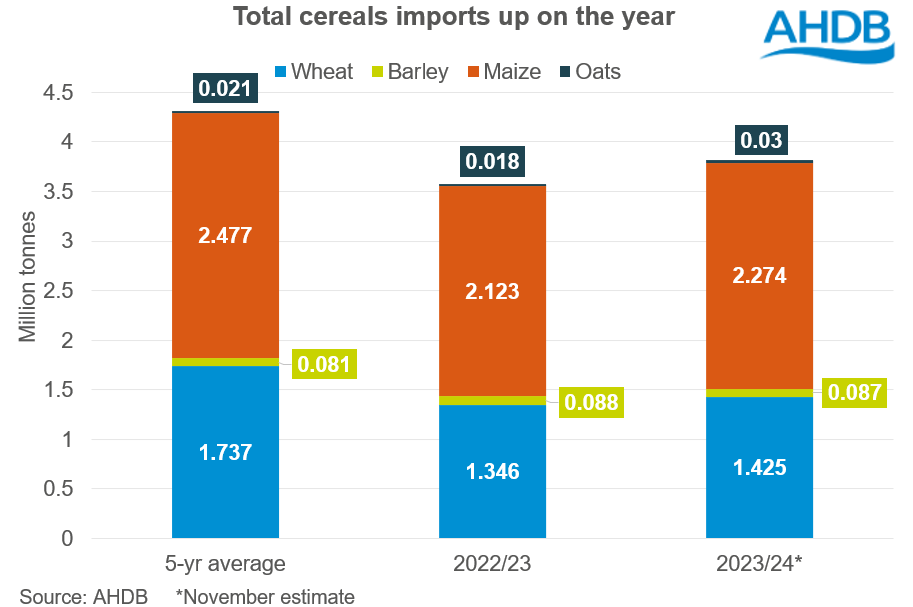

For wheat, the estimates show that a smaller crop outweighs heavier carry-in stocks and increased imports. Combined with a rise in domestic consumption, this leaves a tighter balance this season. For barley, despite a small fall in domestic consumption, lower availability again leads to a tighter-than-average balance. Maize imports are expected to reach 2.274 Mt in 2023/24, due to increased usage in animal feed production as a result of its relative price to domestic grains. Finally, an estimated smaller oat crop leaves a tight-looking balance this season.

Rising imports of high-quality grain

A key takeaway from this month’s estimates is a rise in wheat, maize and oat imports from last season. For wheat and oats, this is largely due to the lower quality of the domestic crops harvested in 2023, resulting in the need to import higher-quality grain for milling purposes.

Full-season wheat imports are now estimated at 1.425 Mt, up 6% (79 Kt) from the 2022/23 season. Home-grown wheat is expected to account for around 86% of human and industrial consumption this season, compared with 88% last season. This season to date (Jul–Sep), wheat imports (incl. durum) have totalled 404.2 Kt, up 13.4% on the year. It’s thought that imports will remain relatively firm throughout the season, with German milling wheat pricing competitively against domestic wheat in northern regions. Moreover, should concerns over harvest 2024 crops worsen, we could see millers looking at 2024/25 supplies and potentially importing even more high-quality wheat ahead of time.

For oats, full-season imports are estimated at 30 Kt, up 71% (12 Kt) from year-earlier levels. Much like wheat, the proportion of human and industrial consumption accounted for by home-grown oats is down to 95%, from 96% in 2022/23. So far this season (Jul–Sep), oat imports have totalled 3.3 Kt, up 18.1% from the same period last season. While demand for oat products is expected to be lacklustre globally, the poor quality of this season’s domestic crop has led to increased hulling losses, meaning increased demand for milling oats and a need for more imports.

Read the further analysis and the full set of 2023/24 estimates.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.