El Niño could have implications for Brazilian maize: Grain market daily

Tuesday, 31 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £187.10/t, down £0.10/t on Friday’s close. New crop futures (Nov-24) closed at £204.55/t, up £1.35/t over the same period.

- Broadly both Chicago and Paris wheat markets were pressured yesterday. The market didn’t move that much as traders assessed Ukrainian shipments. The new Black Sea export corridor has led to a sharp increase in rail wagons heading to the ports of Odesa (Refinitiv).

- Paris rapeseed futures (Nov-23) closed yesterday at €398.75/t, down €4.50/t on Friday’s close. New crop futures (Nov-24) closed at €447.50/t, down €5.50/t over the same period.

- Rapeseed was pressured with Chicago soyabeans as there was welcomed rains in Argentina over the weekend. Further to that, Brazil’s 2023/24 soyabean plantings are estimated at 40% complete (to 26 Oct), up 10% from the previous week. Sowing still lags last year when it was estimated at 46% at this point (AgRural).

El Niño could have implications for Brazilian maize

As US harvests are progressing quickly, focus for plugging the supply gap turns to South America for the start of 2024. At the minute Brazilian soyabean plantings are lagging from the dryness in the Northern part of the country, from the El Niño weather event.

The National Oceanic and Atmospheric Administration (NOAA) estimate that there is an 80% chance of this El Niño weather event continuing until May 2024. So looking forward, this weather event could impact potential supplies that are expected to come to the market in 2024, such as the second Brazilian maize crop.

Over the past few months from a maize perspective, the longer-term outlook has been bearish on the anticipation that Brazil is expected to produce 119.4 Mt of maize this cropping cycle (2023/24). However, 76% of this crop hasn’t been planted yet, it will be going into the seed beds that the current soyabean crop is going into.

So, is there a correlation on a national scale between El Niño weather events and second crop maize yields in Brazil? Could this current weather event, which is expected to continue, compromise the global supply of grain at the start of 2024?

El Niño could possibly impact maize yields

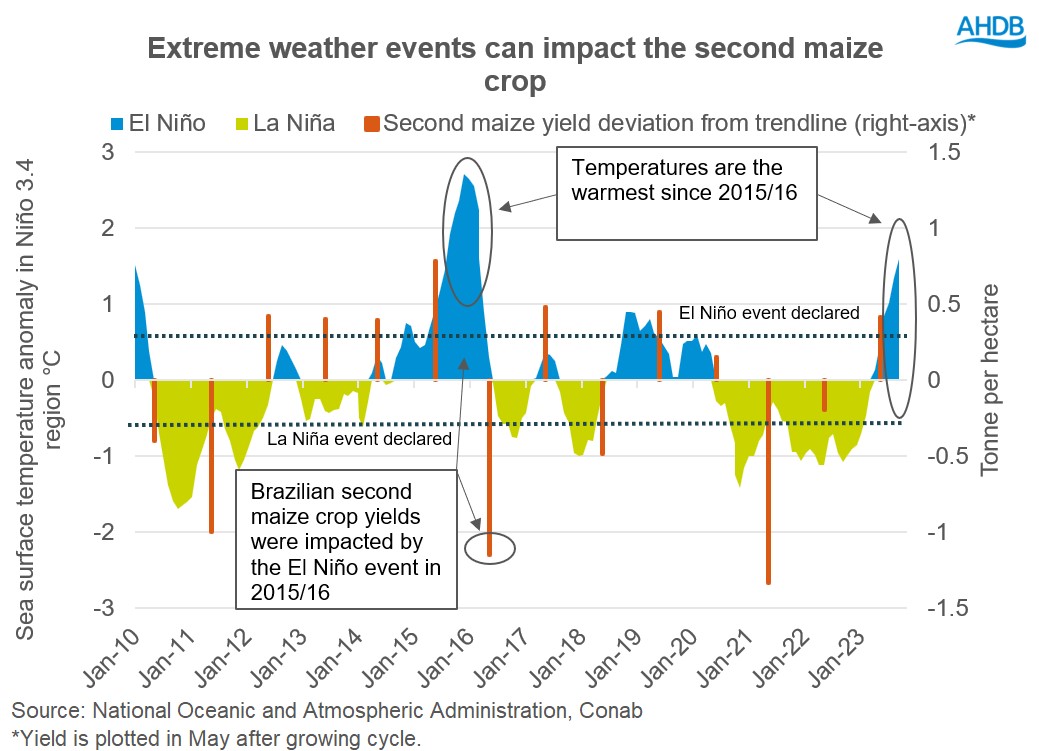

Although there is not an absolute correlation between La Niña / El Niño weather events with second maize crop yields in Brazil, there is to some extent a link to how extreme the event is. This is ultimately determined by sea surface temperature (SST) anomalies in the Niño 3.4 region in the South Pacific.

In the graph above, historic La Niña and El Niño weather events are shown alongside the Brazilian second maize crop yields deviation from trends.

Now, SST anomalies are the warmest since the 2015/16 cropping cycle. In the 2015/16 cycle, SST anomalies peaked at +2.71°C (Nov 2015), with an extreme El Niño weather event declared. Brazilian second maize crop production was down 25% on the year for this season, as yields suffered from the dry weather.

However, there has been other El Niño weather events such as 2018/19, where yields were not impacted, but granted temperatures anomalies were not as extreme.

Right now, the latest data (Sep 2023) from NOAA is reporting that SST anomalies are +1.59°C. For comparison, in the same month in the 2015/16 cycle, temperatures were at +2.20°C.

The development of this El Niño event is a critical watchpoint for markets because this Brazilian Safrinha crop (second crop) is expected to be 91.2 Mt, accounting for 76% of total Brazilian maize production (Conab). The second crop is usually exported to the global market, therefore often plugging the supply gap before the US crop at the end of 2024.

Currently, we know that the SST has been rising, bringing into focus what impact the El Niño could create. A significant production cut to this crop could ultimately change the balance of global S&D and potentially change the sentiment of the long-term view on maize markets and wider grain markets, though it is arguably still too early to tell. Though this remains something to watch as currently anticipated larger maize supplies, such as this Brazilian crop coming to market, sets a more bearish sentiment longer term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.